This fall Europe will witness a new hinge point in the streaming business with new players, majors and independent, coming to the region. Apart from HBO Max disembark in two steps (see the interview in this Prensario Zone edition), Disney+, Netflix, AmazonPrime Video and ViacomCBS’s Pluto TV and Paramount+ are expanding all across the continent with new services and Original programming.

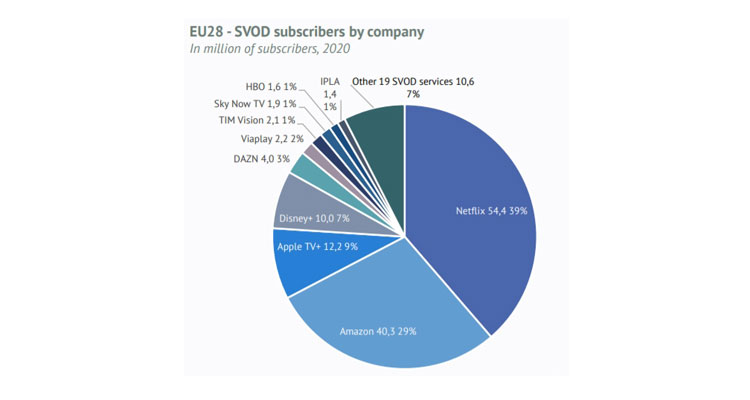

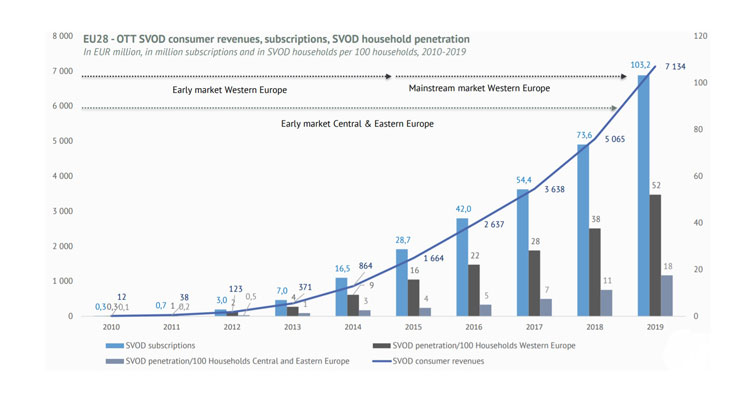

Europe continues to grow its subscriber and consumer base for SVOD platforms.According to Statista, the region has around 141 million SVOD subscribers, with a daily average of 91 minutes of viewing on a platform, with Netflix standing out as the platform with the highest penetration.

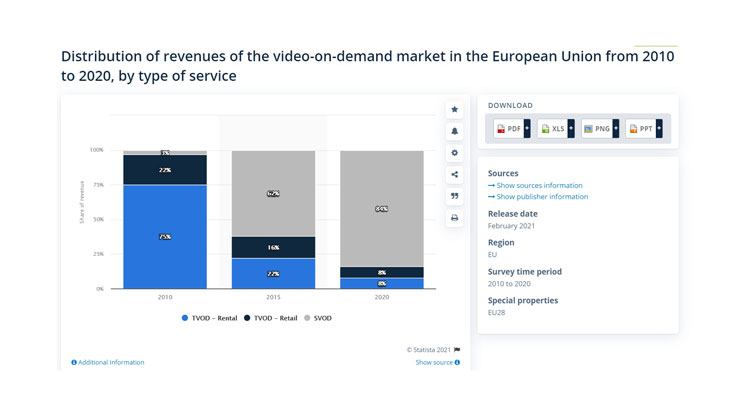

Revenues in the VOD segments in Europe have grown considerably, specifically around €11 billion from 2011 to 2021, thanks to the success of subscription services. Also, according to Statista, the market share of subscription video-on demand in the EU stood at 3% in 2010, and increased over 80% a decade later.

This rapid growth was driven by the appearance of the Coronavirus at the beginning of 2020, an event that forced many to shelter in their homes and even to acquire multiple services from different providers at the same time, so the big players began to allocate large resources to the production, promotion and diversification of content.

In terms of platforms, Netflix continues to top the list as the most used platform from the US. The service is available in 28 countries, according to data from a recent report by the European Audiovisual Observatory.In addition to this, other US services coexist, such as AmazonPrime Video (28 countries), Apple TV + (26), Disney + (13). Among the new US streamers making their debut in the European market are Paramount +, which debuted in Denmark, Norway, Sweden, and Finland last year, and which recently signed a distribution alliance with Sky platforms for 2022. As well as the OTT Discovery+, which has already begun to arrive in Nordic countries, Italy, and Spain.

However, in this region, other players also coexist in the SVOD segment, which competed against the international ones. According to the European Audiovisual Observatory, there are 460 SVOD services which operate in different languages, pan-European territories, and with content such as film curation (Filmin or MUBI), or sports (DANZ or Eurosport Player).

As for the region, UK stands out for being one of the territories where more SVOD services operate, with 113 established, followed by Ireland (53), Netherlands (40), Spain (38), France (37), Germany (20), Sweden (20) and Czech Republic (16).

Among the regional services, Nordic Entertainment Group (NENT) Viaplaystands out, which continues to expand its footprint, and has ensured that by 2023 the service will be available in more than 10 international markets, with Poland being the latest in August (see interview in this Prensario Zone edition). According to company data, in the second quarter of 2021, the platform reached more than 3.2 million users.

Also, launched in 2020, Streamz on the platform of the Belgians Telenet and DPG Media, and which currently represents 8% of the total subscribers in that region. While in France, the new France Télévisions, TF1 and M6‘s streaming platform, Salto, is already used by around 10% of consumers.

Another strong player in Europe is BBC Studios and ITV’sBritbox, which debuted in the UK at the end of 2019. According to a company statement, SVOD reached 500,000 subscribers in 2020 in the UK, and I even surpassed one million subscriptions in the USA and Canada. The service also announced that it plans to launch in 5 more countries in the coming years.

Given this level of competition, it will be difficult to see the future of screens in this territory, so only those that offer original and exclusive content, high-quality user experiences, association with prominent brands, and the use of AI to attract will stand out. subscribers and keep them long-term.

New business models

The growth of the OTT market, the new variants of the Covid, and the new consumer models are forcing us to rethink new business and production models.In a recent talk during Series Mania 2021 in Lille (France), Meghan Lyvers, SVP International Co-Production & Development at CBS Studios Europe, assured that the broadcasters’ perspective, in addition to starting to produce their own content, is to be more ‘flexible’ in the production business and agreements. de distribution said: ‘In addition to producing original stories, we are identifying stories that have cemented success and evaluating who could be the best partners to develop them with new concepts.

I think that is one of the great challenges: how to sustain the production line and the distribution line, speaking from the position of the media groups’.

There is a ‘regional’ need to promote local talents and stories. Álvaro Benitez Perea, business development at Plano a Plano (Spain), commented that his company focus is on local partners. He underlined: ‘We are currently in advanced talks to co-produce with partners in Mexico and the Middle East. «It is an interesting moment for us, because we are spreading our wings to other narratives and to other territories’.

Another trend in business is joint ventures between large media groups. A few paragraphs above we commented on BBC Studios‘ partnerships with ITV in the UK; or Telenet and DPGMedia in Belgium, which is why more and more companies are following these steps, whether to invest in streaming or content.An example of this is the recent acquisition of sports rights, with the German Bundesliga, English Premier League, or UEFA Champions League from NENT for its Viaplay platform. Its CEO, Anders Jensen, said it is ‘probably the strongest sports portfolio in the world’.

And finally, another trend that continues to rise is that of telcos as super content aggregators, where Europe seems to be carrying the flag in this business model. Companies such as Movistar, Vodafone, Orange, or Sky, continue to add exclusive distribution alliances.

An example of this is Deutsche Telecom (Germany), which have increased their ambition to be the hub for all video viewing in the home with streaming services and partners increasing, including Netflix, Amazon Prime Video, Sky, DAZN and Disney+(all available on the MagentaTV homepage). Or Movistar’s offer in Spain, which has a leading content proposition, own-content production, all football, movies and TV series from all the major studios and they recognize the need for Disney +, Netflix and others.