The gaming industry is experiencing a radical transformation, where related companies and sponsors have understood this and have started to increase their budgets in this sector. 2021 was a year marked by large revenues in the sector, according to a recent report by the consulting firm Newzoo, globally the segment received USD 175.8Bn, highlighting the APAC market as the one with the highest income, with USD 88.2Bn, 50% of the global number. Prensario reviews in this special report the main segment insights, new trends, and how media companies begin to join the creation of content oriented to eSports.

Global market

Part of this income is driven by the adoption of the use of the mobile as the main device in a large part of these territories, according to the Newzoo study, highlighting China, a market that capitalized USD 45.6 billion in games revenues, owing to the region’s massively mobile-first games market that was less impacted by COVID-19.

He also mentioned that North America was affected during the pandemic, due to its greater emphasis on the console, but even so, it is still the second largest region of 2021, with gaming revenue of USD 42.6 billion, down -7.2%. compared to 2019, (mainly from the United States).

Just like North America, Europe was impacted by the Coronavirus crisis, where its revenues declining -5.6% between 2020 and 2021 with 31.5Bn. And although global rates are well above emerging markets such as LatAm and MENA, 7.2Bn and 6.3Bn respectively (4% globally each one), the consulting firm assured that their overall revenue shares will increase toward 2024 (slightly shrinking both North America and China’s shares).

Regarding the videogame players base, Newzoo highlighted that globally there will be close to 3.0 billion players in 2021. Being an up +5.3% year on year since 2020, due by online users boosted by a better internet infrastructure, and affordable smartphones and mobile internet data plans, especially in emerged markets like MENA and LatAm, which showed an increased 10.1% and 6.2% respectively.

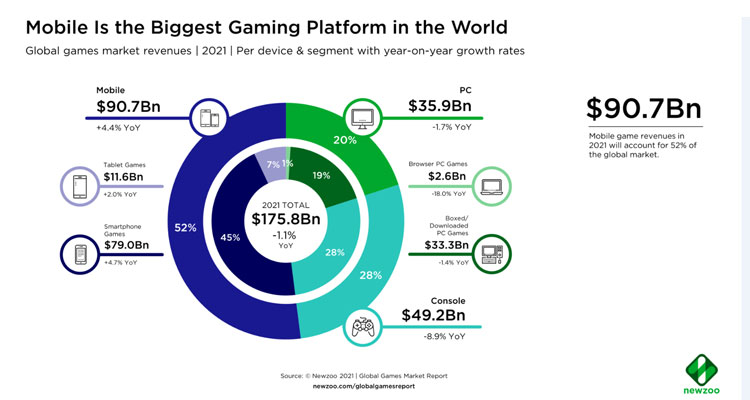

While the gaming segment markets is dominated by Smartphone games with 79Bn, followed by console games (49.2Bn), downloaded/boxed PC Games (33.3Bn), Tablet games (11.6Bn), and Browser PC Games (2.6Bn). The consultancy explained that the pandemic has had an impact on game development and publishing in terms of delays, which are affecting revenues across the segment in 2021, principally on the console side but also on PC. Compared to mobile, console and PC games tend to have bigger teams, higher production values, and more cross-country collaborations.

Key trends

Following the recent figures, one of the currently trends is the mobile as a principal device. Newzoo commented on the report that gaming companies are using this for brand identify for merger and acquisition activity, where biggest names including Tencent, Embracer Group, Microsoft and Sony, continue its steps of consolidation. Various companies take advantage of alliance with consolidate brands to enter in the gaming market. To that end, M&A and investment is a more efficient and less risky way for publishers to bolster their content offerings, enter new genres and markets, and facilitate growth. For many game publishers, brand identity is at the core of their M&A strategy.

One of the biggest examples is the investment made by Epic Games for USD 1 billion, where acquired 5 companies, which raised the value Fortnite and the Unreal game engine used in production by many games and even Hollywood studios, at USD 28.7 billion.

In addition, Netflix recently commented that they are looks set to accelerate its move into video games field, with the hire of Mike Verdu, and veteran exec of the gaming industry. With this movement Netflix has revealed its growing interest in gaming as a way to extend the company’s franchises and further increase audience engagement behind popular IP shows as Stranger Things or Disenchantment.

eSports in growth

Different sources match that thanks to the arrival of COVID-19, the nature of eSports and all the gaming industry segments involved has changed. With people required to spend time at home during the lockdown, the pandemic led to viewing spikes across all live streaming platforms.

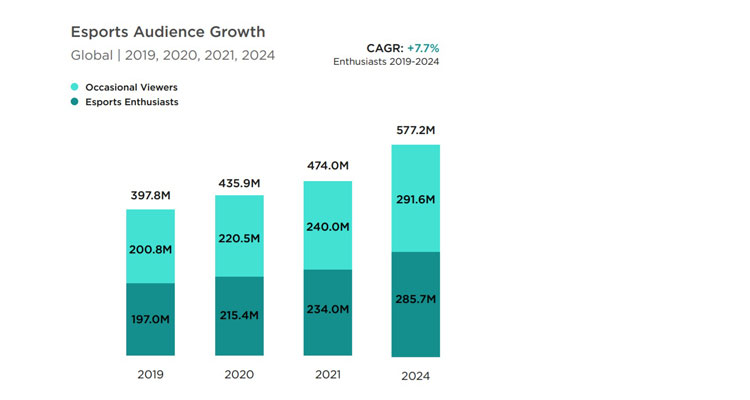

According to Newzoo, in 2019 there were 200.8 million occasional viewers and 197 million eSports enthusiasts, making the total audience 397.8 million. The year-over-year growth continued in 2020, with 220.5 million occasional viewers and 215.4 million eSports enthusiasts, a combined eSports audience of 435.9 million.

In addition, the consultancy firm expects growth to continue through 2021, with 8.7% year-on-year growth, ending the year with 240.0 million occasional viewers and 234.0 million eSports enthusiasts, a total eSports audience of 474.0 million.

Regarding regions, Jupiter Research on a recent report, highlighted that APAC region represents more than 50% of the eSports and gaming audience. Meanwhile, Latin America may also become a key region for growth, who is projected to produce over 130 million eSports and games streaming viewers by 2025.

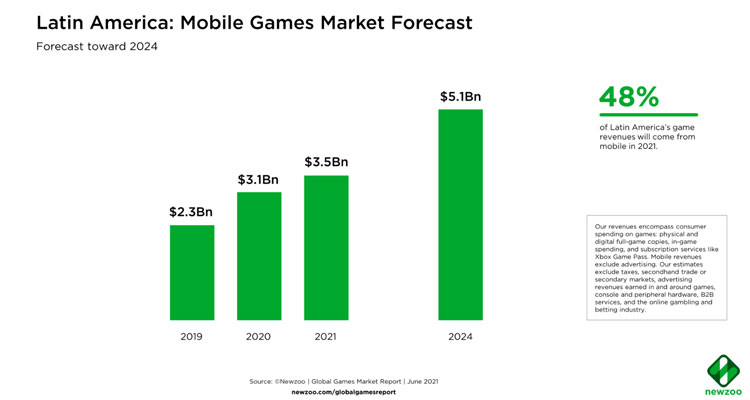

As for supporting this, Isadora dos Santos, Junior Market Analyst at Newzoo, said: The mobile games market in Latin America is vast and growing, generating USD 3.5 billion in revenues via consumer spending in 2021. The exec explain that this growth is due to Latin America is a mobile-first games market, where mobile accounts for 48% of 2021’s games market revenues in the region, and 58% of Latin America’s online population—or, 273.4 million people—play mobile games.

‘Brazil is Latin America’s largest market by both mobile game players and revenue. Its 88.4 million players will help Brazil’s mobile game market generate over USD 1 billion this year. In terms of mobile game revenues, Brazil’s lead is followed by Mexico (which will generate just under USD 900 million), Argentina, and Colombia. Mobile is also Latin America’s fastest-growing revenue segment, hitting USD 5.1 billion in 2024’, finished.