In the last four years, more than 1,000 different VOD services have been launched worldwide. The OTT landscape is changing fast, and for the first time big players like Netflix are losing market share in key territories while smaller thematic and niche services are growing far faster. Prensario reviews the main figures, trends, and players that are part of this burgeoning digital market.

The digital business is showing new models and a bigger diversification. And this is not only brought by content, also by incomes: according to Statistafrom the total OTT revenue made last year, 51.58% comes from AVODs, 40.16% from SVOD, 5.1% from TVOD, and 3.16% from video downloads. Content segmentation blends with new and more miscellaneous business models.

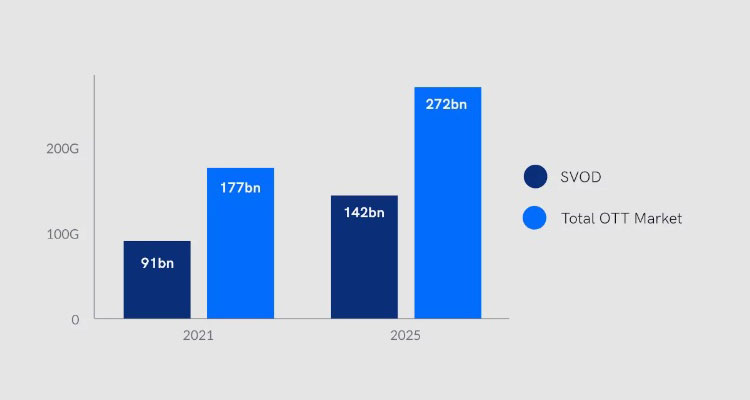

According to Allied Market Research, the OTT market will reach USD 1,039 trillion by 2027, driven by the Majors and supported by the great advances in connectivity, such as the expansion of 5G, and the access of internet to rural regions of the world.

What’s Next?

In Q1 2021, the most popular OTTTV device in the USA was Roku, with a 37% share, followed by Amazon Fire TV (22%), Samsung TV (10%), and Apple TV (6%). While, on the other hand, Netflix and Disney + dominate the SVOD market in the USA by 2021, with 30.8% and 30.7% respectively, followed by Hulu and AmazonPrime Video.

Along with these players, traditional media companies have transitioned to VOD as a new content business model. Companies such as WarnerMedia (HBO Max), Viacom (Paramount +), Discovery (Discovery +), thus redirecting their properties and content from their associated brands to these services.

But not only companies are starting to create their own OTT, but they are also developing more content especially for SVOD services, mainly linear channels, which have adopted the role of ‘TV content studios’. According to a study conducted by the consulting firm Drive, broadcasters are seeing higher income from their shows from streamers, who have positioned themselves as key distributors of these.

‘For broadcasters in the UK, new streamers, tech, business models and international markets were all opportunities that indexed extremely highly, with the new streamers being seen as an almost ubiquitous opportunity’, indicated the report.

Furthermore, in several European countries, local players manage to compete with global players offering local content: NENTGroup’s Viaplay, which offers access to live sports and which will expand in 10 additional countries by 2023 starting with Poland since last August; Cyfrowy Polsat’s IPLA in Poland, Telenet/DPG Media’s Streamz in Flemish-speaking Belgium, RTL’s Videoland in the Netherland or CME’s Voyo in CEE countries.

According to the European Audiovisual Observatory, as long as the big players continue to expand, thematic or niche VOD services will follow, supported by content aggregation services or by alliances with other companies in the sector.DocuBay, a global doc & factual OTT from IN10 Media (India); Topic, a Canadian SVOD service that offers titles and content with a journalist view, are shaping the new OTT landscape. The Boston Consulting Group said there is a ‘shifting landscape’ where during the Covid pandemic, small streamers acquired more content. In 2020 StarzPlay acquired four times more content than Netflix, according to the consultant.

One niche service which has successfully established itself in markets such as the UK, US, Australia, Italy and Belgium is international drama channel Walter Presents, which has entered new markets by partnering with local broadcasters such as Channel 4 in the UK or PBS in the USA.

Its founder, Walter Iuzzolino, commented in a recent interview with Variety that the decision to launch as a conventional AVOD service, rather than a niche paid to offer, has been crucial to its success. Relying on ad funding means Walter Presents has to be more attractive. «We wanted to be inclusive, commercial and mainstream, not elitist or overly intellectual’, Iuzzolino highlighted.

Trends

One of the main trends that will rule the OTT world is AVODas a business model for some and as the preferred one for viewers. According to OMDIA, by 2025, revenues from AVOD will exceed 80tn dollars, exceeding SVOD by more than 20%.

Drive explains that only in the UK and the USA, AVOD’s monthly active users already exceed 600 million added in multiple services. According to other sources, user behavior regarding VOD ads, compared to linear ads, ensuring that consumers are showing higher tolerance for ads and the industry is noticing it.

The consultancy company added that YouTube’s revenue has doubled in approximately two years, from USD 11 billion in 2018 to USD 19.8 billion in 2020, in turn, it assured that the display has grown 15-20%.

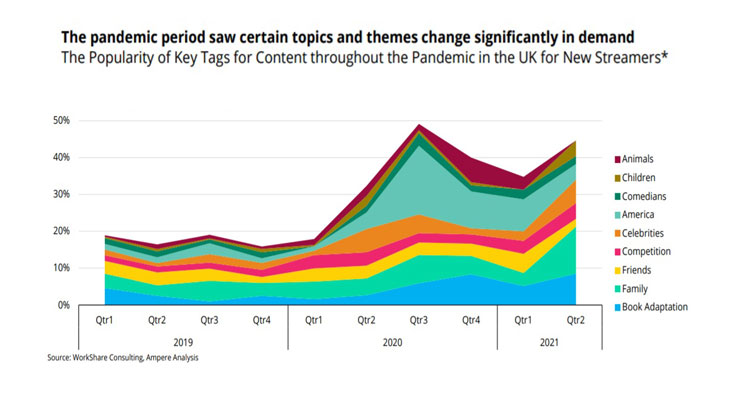

As development and acquisition trends by some players, various sources assured that Covid drove the actual trend, pushing new strategies. Drive informed that last year content spending in some European markets surpassed the USD 150 billion marks, reaching USD 155 billion by year-end. Although the large original titles draw a lot of attention to the platforms, the way of consumption, which changed with the pandemic, has driven a large investment in acquisition, reaching USD 38 million in 2021.

Another booming trend is bundle subscription. According to the consultancy, 60.1% of consumers said they were tired of the number of OTTs in the market. In response to this, companies such as Disney + have begun to offer their service with others of the same umbrella, such as Star + or ESPN.

On the other hand, telcos and pay-TV operators have begun to sign alliances with platforms, and have integrated them into their TV plans. Some cases, such as Spain, where Movistar integrates Netflix and Disney + in its Set-To-Box services.

Regarding programming trends, documentaries and factual were revalued, which represented almost 40% of commissions in VODs. This is because due to restrictions in different parts of the world, the production schemes were re-evaluated, on the other hand, the audience has developed a growing appetite for informative content. According to OMDIA, Discovery + saw a significant increase in subscribers in 2020 in the UK, of almost 191%, higher than Disney + and its local BritBox.