The 2021 edition of ATF offered a varied number of local and regional testimonials of the media and entertainment business across the APAC. Among them, stood streamers and producers. Let’s take a deep look on what’s hot and what’s coming next.

Great sensations have left the first part of the ATF edition, which started in December 2021 and whose platform ATF Online + continues until June 2022. Prensario gathered the top testimonials from key players from different segments and territories about their feelings and future plan.

Buyers, producers and distributors from the APAC region answered about their 2021 outcome, the pandemic and post-pandemic trends and what’s next in their pipeline in terms of contents and business expansion. Even though the Covid-19 did not stop, most of them believe 2022 will be better in many aspects, while they highlighted the learnings of the past years.

Streamers

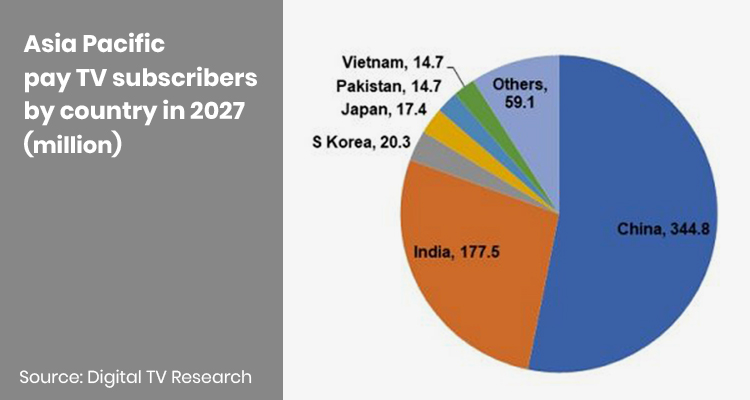

Asia is seeing the entry of new players in the OTT segment, as well as the consolidation of Asian platforms that are expanding their footprint internationally. This phenomenon is making the region more attractive than ever.

One of those new entrants is Taiwan+, a free English-language streaming service launched in August. Joanne Tsai, CEO: ‘It’s a very new service, and we haven’t done something like this before because it’s all in English. So, we need a lot of international talent. The government has backed Taiwan + with USD 28 Million in funding’.

Another is Indonesian’ Migo. Taking advantage of the growing market by its large mobile-first population, the operatorhas set its sights in this territory. Barret Comiskey, founder and CEO: ‘We are not an OTT player, but rather, we are a distributor, akin to an MVPD (Multichannel Video Programming Distributor) with direct consumer relationships and their own distributor infrastructure’.

‘I have observed that new entrants to the market have come in three tiers: global, regional and local’, added Kaichen Li, head of WeTV & iFlix, Tencent. The executive remarked that the global pandemic affected his content strategy, as many titles presented delays and explained the three phases of his strategy: ‘First, we intend to have the best Chinese IP to overseas audience, localize them, and make sure that they are available for viewing at the same time as Chinese audience. On the second phase, we are partnering with primary content providers in territories like Malaysia, Thailand, Philippines, and Indonesia. And as for third phase, we are creating a slate of WeTV Original content to differentiate it from free-to-air platforms’.

Continuing with stablished streaming-business units, Anna Pak Burdi, head of business development at iQiyi International: ‘We are past our stage of improving our platform. Now we are growing as a service in terms of content and this is thanks to a distribution strategy with telcos, because basically we have to get our content to complicated places in Asia. We must think about the variety of access that the audience has in Asia, such as currency exchange, credit card payments, internet access, so the best thing is to partner with strategic companies to simplify these processes’.

From the same company, Kuek Yu-Chuang, VP of International Business, added: ‘As the biggest advocates of Asian entertainment, iQiyi will continue to play our role in enhancing the Asian entertainment ecosystem, in addition to our already announced original productions from South Korea and the Philippines, we expect these six original series from Malaysia and Thailand to become globally recognized and loved in 2022’.

Anson Tan, Country Head at Viu Singapore: Tan highlighted Viu‘s hybrid model, and its availability in 16 global markets: ‘Alliances are fundamental for us. We have an aggressive plan of partnerships with local companies and local telcos to be able to distribute the platform in more regions of Asia. We put a priority on supporting business partners’ key performance indexes. Given that most telcos have invested heavily in the deployment of 4G and 5G networks, Viu aims to drive engagement that can translate into data usage for our telco partners. In terms of content, we also collaborated with partners on local content production. In 2020, the platform co-produced and jointly launched two originals with Thailand-based telco PCL. The originals were made available on both Viu and AIS platforms at the same time’.

Lee Tae-Hyun, CEO of the Korean streaming powerhouse Wavve underlined the evolution of the company and the Korean content globally, as well as opportunities and challenges for the coming years. ‘There is a rebirth of content in Asia. We are experiencing a unique moment into Korean content. When I started in this company, in terms of the local market, Netflix was at its growth point, and taking as a reference to that big one, we started operating on the first platform called Pooq, before Wavve, and also many other companies were making efforts. of content for streamers’.

The executive also referred to the players that are joining the Asian market: ‘I think the industry grows when there are more players. That is why we do not consider the rest as competition. Each one offers the best and it will be up to the audience to decide what they want to see and we prepare a programming strategy based on this’.

Regarding Wavve‘s scale in the local and international market, he concluded: ‘Our shareholder is our content provider at the same time. For terrestrial broadcasters such as KBS, MBC, and SBS, the content of these broadcasters is piled up one after another like daily, weekly or monthly, then basically a strong library has been built, and the goal would be to build up a little more special edgy content in the library another than those already in the local market’.

Amazon Prime Video plans to make great efforts in the South East Asian market, according to Erika North, director of local originals, APAC, Amazon Studios, who highlighted that it is looking for local language projects to increase its catalog in these markets.

North reported that the company is doing very well in Japan, India and Australia, and that now the objective is betting on SEA territories: ‘We are open for business and, as in other parts of the region, we will partner with the best local talents to find stories, opportunities to tell those stories and amplify them among the 200 million members of Prime Video around the world’, North said.

Amazon would form a Singapore-based team for the region: ‘Content creation can take time and we are really in the first day of this process. We aim to be the true home of talent and creators in the sense that we want to ask you some of the most pertinent questions about what you haven’t had a chance to do and what Amazon can do. to provide the resources, infrastructure and distribution to expand those stories’, added the executive.

Studios: films

WarnerMedia India, SEA and Korea, and Sony Pictures Entertainment Films India, underline its co-productions plans and interest in local IP to expand their footprints in these countries. Vivek Krishnani, MD at Sony: ‘We have our eyes on the creation of Indian IPs. These can have mixed themes as well, but above all we want part of the content that we are creating for certain OTT platforms to have the ability to attract the public, not only Indian audiences, but audiences in all geographies’.

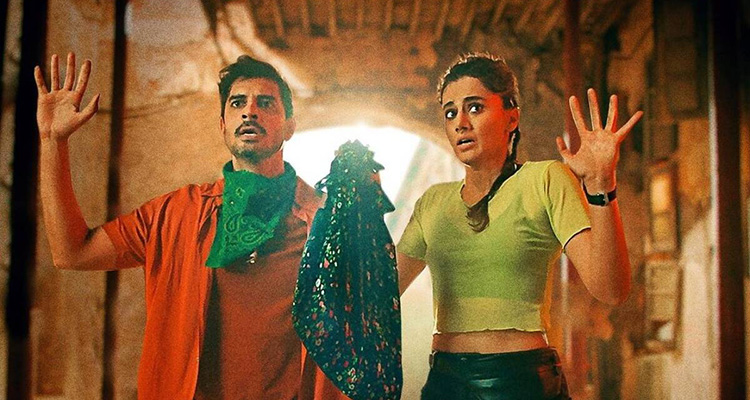

He mentioned that they will release 17 films in the next 12 months: ‘Sony is poised to capture the Indian theatrical market’. Among the titles, there are Looop Lapeta, the Indian adaptation of Run Lola Run; Helmet and Tera Kya Hoga Lovely.

Clement Schwebig, Managing Director – India, Southeast Asia, Korea at WarnerMedia, said that localization is ‘beyond just having to produce local content’: ‘Having local teams on the ground that allows the company to build a brand that is locally relevant through multiple touchpoints that offer consumer engagement beyond the content. This presents possibilities for building a fan following, as well as discoverability of the brand and content’. He also remarked that having good and precise subtitling, which is often ‘undervalued’, is also key to allowing local audiences embrace foreign content.

Producers/Buyers/Distributors

Jin Woo Hwang, President / Executive Producer at Korea’s Something Special (South Korea), underlined: ‘Even before the pandemic, it was difficult to predict the future. But the Pandemic was even far worse than anything. Neither one could see it coming, nor prevent it. Before the Pandemic, everyone was considering what would be risk-averse. Now we all know that the traditional ways need to be changed. Reviewing 2020/2021, we have learned a valuable lesson that focusing on ‘exploitation’ alone would not work anymore and we have to focus more on ‘exploration’. As for the content part, development and cooperation would be second to none’.

Indonesia is the fourth largest country in the world with one of the most dynamic and effervesce media and television industry. With 10 national TV channels and new local and international streamers operating in this key APAC market, local distributors are in a good position. But the Covid-19 affected the business: ‘The outcome of 2020/2021 was not too good but hoping 2022 will pick up. Our plan to yet look out for some new good programs as we always buy much before/ahead time as we are distributors’, describes Rani Rajesh, from Spectrum Films.

Another independent distributor in Brunei, Mariani Abdullah, acquisitions at DM Don Square Entertainment, says the company had a good 2020/2021, as it has learned to navigate and continue to work from home for the safety of everyone: ‘The technology of sending emails, WatsApp messages and calls and Zoom meetings that we had adapted made us closer with our client and distributors in the absence of film markets that we are used to more than 2 years ago’.

From Australia, Shalline Chok, VP, Sales & Acquisitions, Yoohoo Media Solutions considers pandemic has not only forced a change on to the whole media industry dilemma, ‘but it has forced a market dip into another tremendous uncertainty tremor’. She continues: ‘The whole media eco-system has taken a dive into the cloudy pond of uncertainty. The lack of government funding and advertisement revenue has leaded to this ripple effect exacerbating the shortage of new programs even further within the media industry. It was a challenge then, but a significant challenge now to maintain this balance which has leaded to our company to seek alternate strategies of opting against new programming acquisitions and focus more on reruns of existing content for the past two years’.

According to Jin Woo, the “Post Pandemic” is ‘the reality of disruption’, which are three things: ‘First, Content Globalization: content creations are no longer limited to domestic viewers. Second, Content Producers are given more leverage: we have been witnessing that the next big hit can arise from anywhere. With more opportunities for creative talents, it is important to know who is ready Third, IP or nothing: with the streaming battleground held on all sides of the world, it is much more important to acquire IP and even move faster for it’.

Abdullah remarked the future of the post pandemic business is to be ‘more authentic and relevant’: ‘Can be more competitive as ever and there are so many independent content producers and I hope we can be one of them next year. It will be a dream come true’.

‘Post pandemic will come and many broadcasters are now hungry for new fresh content due to the drought of the past two years. This has set a very positive outcome and potentially a prosperous future for the media industry and we are with a strong belief that media is in a new reborn stage. The future looks brighter, hopefully but very excitingly’, completed Chok.