By Jaime Otero

International markets are the new battleground in the streaming wars and as competition has grown in European SVOD markets, specifically France, Italy, Germany, Spain and the U.K. – producing homegrown European content has been a key factor to success. Further, more of these original and local hits are finding global audiences than ever before.

Popular series that have become worldwide sensations include Lupin, Call My Agent!, La Casa De Papel, Elite, Gomorrah, Dark, and Sex Education being just a few of the many hits hailing from these markets.

Across France, Italy, Germany, Spain and the UK (FIGS-UK), there are an average of more than 30 SVOD services per country with each averaging over 70,000 titles according to figures from BB, one of Whip Media’s data partners. Further, the average number of SVOD subscriptions per person in FIGS and the U.K is three or less, while in the US it is closer to five, according to Whip Media data, indicating that there may be an opportunity to add two services to a European’s portfolio as SVOD consumption patterns mature in Europe.

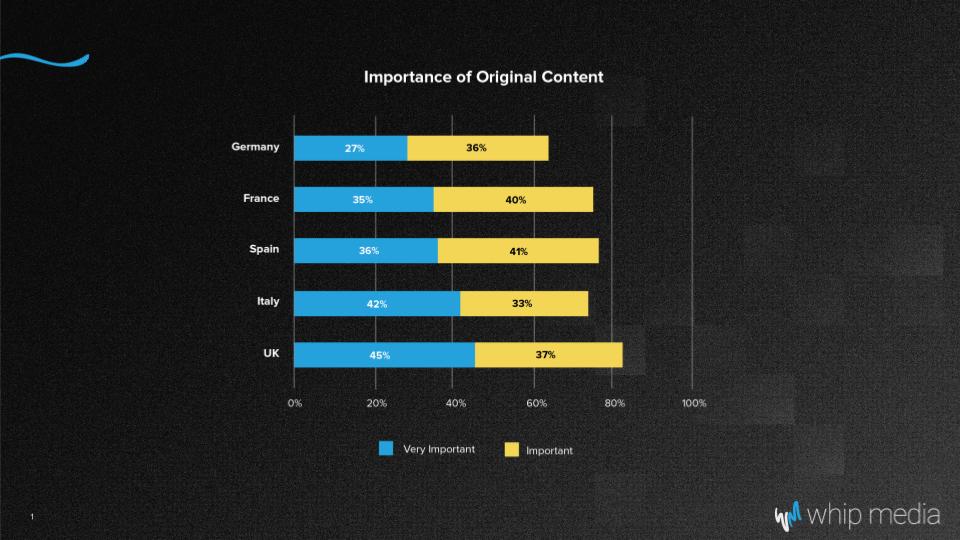

As global streamers and local broadcasters compete in these key European markets, how important are original and local TV series and movies? When it comes to European viewers, that depends on who you’re asking. By comparing the FIGS markets, survey data compiled by Whip Media indicates there’s a wide range of attitudes.

More than 60% of German viewers said original content was “important” or “very important”; in Italy, Spain and France, that percentage jumped to more than 70% of viewers and more than 80% for the UK.

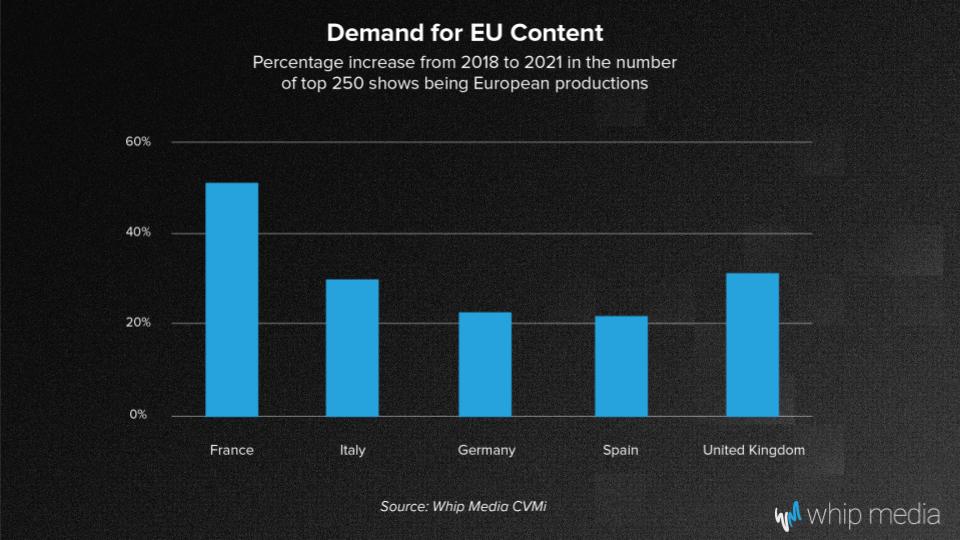

There’s been a clear surge in demand for European content among FIGS-UK viewers over the last few years. In France, for example, 47 of the most-viewed 250 shows of 2021, according to Whip Media’s data, were European series — an increase of 52% from just 2018. That trend was consistent across all FIGS-UK markets, too. In Italy, there was a 27.5% increase during that time; in Germany it was a 23% increase; in Spain it was a 22% increase; and in the UK it was a 31% jump compared to 2018.

In regards to genre among the most viewed series, dramas and reality competition shows are among the most popular. But new formats are emerging as well. One of the most popular shows in Italy in the past year was Tear Along the Dotted Line, an adult animated series written and directed by the Italian cartoonist Zerocalcare.

The Impact of Regulations

In addition to content consumption trends, European regulations play a role in the originals strategy of streaming services. The European Union’s Audiovisual Media Services Directive, calls for streaming services to offer a 30% quota of European content to its subscribers within the E.U.

A Whip Media survey found more than half of French viewers and 69% of Spanish viewers favor the 30% policy or a higher minimum, compared to only 48% and 28% of viewers in Italy and Germany, respectively. As local production ramps up to comply with the AVMSD, the market will become even more competitive.

One thing is for certain: in the crowded European market, streamers and content creators will need to continue prioritizing regional production. As competition intensifies, possessing data on what types of films and TV series will find audiences provides a huge advantage.

Jaime Otero is VP Business Development and Content Strategy at Whip Media. He leads the global expansion of the Whip Media Exchange, the company’s data-driven content planning hub and marketplace for film and TV licensing. Whip Media is exhibiting at MIPTV at booth R7.L3 in the Riviera Hall.