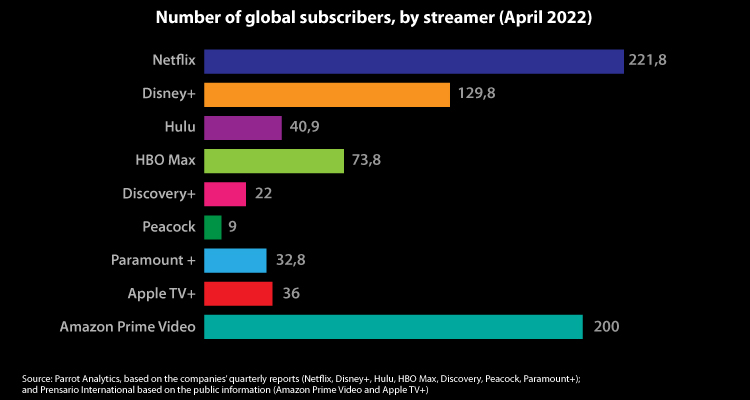

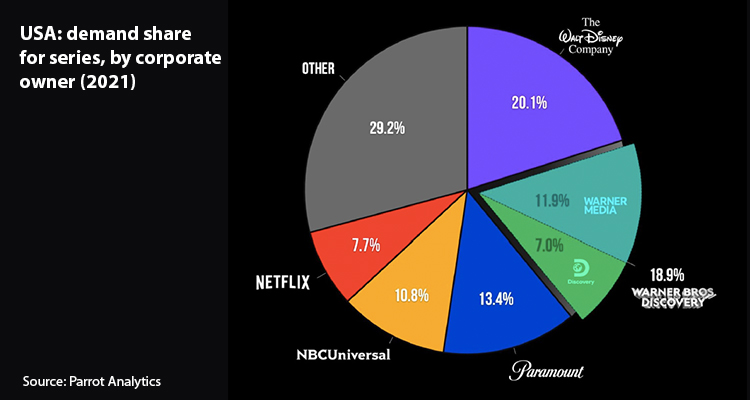

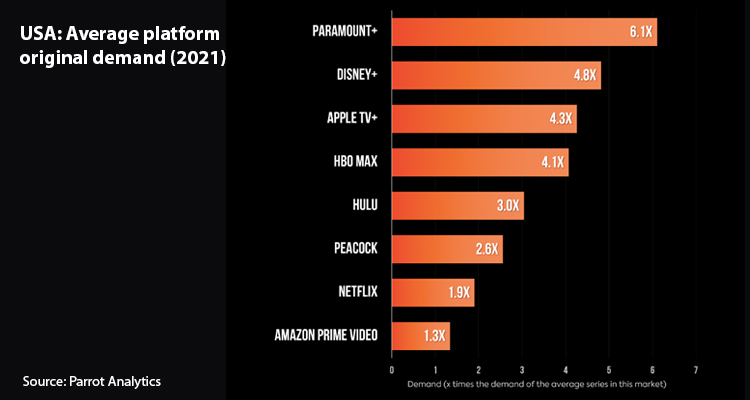

Parrot Analytics has analyzed the flagship streaming platforms from the top six media companies which control over 70% of all US demand for TV content: The Walt Disney Company (Disney+ & Hulu), Paramount (Paramount+), WarnerMedia (HBO Max), NBCUniversal (Peacock), Netflix and Discovery (Discovery+). The report also considered AppleTV+ and Amazon Prime Video, whose parent companies do not break out subscriber or revenue numbers, but their audience demand share success and awards deserve recognition.

Combining subscriber and revenue data from corporate earnings reports with the exclusive demand data and vision, Parrot Analytics has revealed the connections between audience demand and financial performance on its Q4 2021 streaming report (*).

Netflix

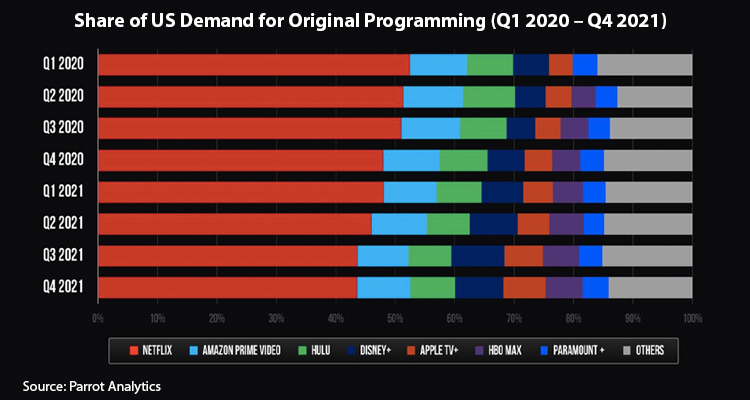

Nothing summarizes the state of the streaming industry quite like a look at digital original demand share over the last two years. From Q2 2020 to Q4 2021, Netflix’s share dropped from 51.4% to 43.6%, while Apple TV+, Disney+, and HBO Max combined grew from 13.5% to 21.4%, meaning those three services account for virtually all of Netflix’s losses over the last two years.

Despite hitting record low demand share for original content with US and global audiences once again, Netflix did slow its losses from previous quarters in 2021, helped by non-English language hits Squid Game and La Casa De Papel. However, the streaming giant’s steady loss in market share finally caught up with it, as it reported slowing subscriber growth and a disappointing outlook, leading to Netflix’s stock dropping as much as 25% post-earnings.

Netflix’s Q1 2022 wishes include new seasons of the massively popular The Witcher and Cobra Kai launched by the end of the Q4, meaning they should boost demand for in Q1 2022. The streamer will hope that its measured outlook for Q1 keeps expectations low on Wall Street.

While Bridgerton S2 and the premiere of Vikings: Valhalla should be successful, Netflix has fewer blockbuster franchise releases in Q1 2022 than Q4 2021. New episodes of Stranger Things are just months away, for the first time in nearly three years. The release of S4 has been wisely split up, with one segment of episodes set to release in Q2 and the next at the beginning of Q3. Netflix needs to build out its home-grown franchises to give its subscribers a reason to keep coming back.

Disney-Hulu

Despite Disney+’s demand share for original programming dropping slightly quarter over quarter, the platform’s stellar performance in the company’s Q1 2022 speaks to the power of singular franchise installments, like Hawkeye. These are the type of series that can generate staggering levels of demand from global audiences.

The company results, however, also point to a key issue facing the platform. Smaller demand share for its catalog, and a lack of more general entertainment, can narrow the total addressable audience, giving competitors an upper hand in areas like engagement.

For Q2 2022 wishes, Parrot Analytics aims to see Disney expand upon its main franchise offerings (Star Wars, Marvel, and National Geographic) to add more general scripted and unscripted programming, alongside next day programming that often goes to Hulu.

By increasing the amount and type of content available to subscribers, and lowering the barrier of entry to access those series (like introducing an ad-supported tier, which the company just announced), Disney+ could see increased demand across the platform and continued subscriber growth.

With the investment into Hulu, including original series and shifting series from networks like FX to the streaming platform, the platform has seen quarterly increases in originals and total platform demand share. It’s also seen increased subscribers annually, which is likely helped by an increase in demand for originals and Disney’s streaming bundle.

The biggest question surrounding Hulu is how it can keep the momentum going and continue to eat into competitor’s demand through a combination of originals and the right licensing.

As Disney+ expands into more general entertainment, including hosting some series that may have appeared on Hulu previously (Black-ish, Grownish, Daredevil and Jessica Jones), how will Hulu continue to stand out and be a valuable addition to consumers’ homes? What is Hulu is a question that many have asked for years and, as the dilution between Disney+ and Hulu starts to happen a little more each quarter, it’s a question that Disney will have to sort out.

HBO Max

The total demand for HBO Max Originals grew 39.2% in 2021, nearly 4x the growth of Netflix Originals, up 10.3% over the same time. Meanwhile, the combined demand growth for both HBO and HBO Max Originals was 14.2% – showing that HBO Max has become a major growth engine for HBO branded content.

This is important because demand for original content is a key leading indicator of subscriber growth, suggesting that Max Originals played a primary role in getting HBO’s total subscriber count up to 73.8 million by the end of 2021.

HBO Max’s slate of original content, from And Just Like That… to The Sex Lives of College Girls to Station Eleven is helping the platform become a true ‘four quadrant’ service, which will help expand its subscriber base beyond the typically male-leaning HBO audience.

HBO Max is already building on its 2021 momentum with Peacemaker and HBO original Euphoria hovering at the top of the TV demand charts in early 2022. When it comes to on-platform demand share – which includes HBO series – HBO Max is in a solid third place, behind Hulu and Netflix.

The biggest upcoming event for the company is the impending merger between WarnerMedia and Discovery Inc, which should close in early Q2 2021. HBO Max is the undeniable crown jewel asset of the future Warner Bros Discovery conglomerate. Bundling Discovery+ and CNN+ with HBO Max, or even merging them all into HBO Max, is the best way to challenge Netflix and Disney.

Discovery+

Despite being more of a specialist service as the go-to home for snackable unscripted content, from MythBusters and Pawn Stars to My 600 Lb Life and 90 Day Fiance, Discovery’s specialty has still made it one of the top six media conglomerates by corporate demand share.

What Discovery+ lacks in original content demand, it more than makes up for with its library catalog. The company knows its audience well, and is properly leveraging its library content to service Discovery+ subscribers. 94% of demand for content on Discovery+ goes to documentary or reality programming.

In fact, Discovery+ is ahead of Disney+ in overall on-platform demand with US audiences. The problem here is the question of scale.

The highly-anticipated Warner Bros. Discovery should finally close in early Q2. The two companies’ combined would be just 1.2% points behind Disney as the biggest US media company in terms of corporate demand share. For now, CEO David Zaslav is working on getting the right lieutenants in place to figure out how to best leverage his incoming suite of assets.

The main question will be how to best package HBO Max, Discovery+ and the soon to launch CNN+. Should they get bundled together ala Disney, or placed into the same mega service with various pricing tiers? If done correctly, this new entity should be able to challenge Netflix and Disney as the de facto entertainment home for tens of millions of consumers.

Peacock

Peacock’s subscriber growth may be moving slower than some competitors, but both demand share for originals and across the entire platform show that it’s certainly trending in the right direction. Peacock saw an annual growth of 167% in originals demand share, and a nearly 10% increase in platform demand share in Q4 vs Q3.

Considering that originals are the biggest acquisition drivers, including new TV series and films, but library offerings are what keep people engaged, subscribed, and satiated throughout the rest of the year, Peacock’s growth in both areas signals the building of a fundamentally sound SVOD, that should benefit from the ending of Hulu’s partnership with NBCUniversal.

The streamer is starting to come into its own, and with an exclusivity play that will see some of its most in-demand titles, including Saturday Night Live, move from Hulu in September, NBCUniversal is demonstrating how important Peacock is to the company’s future.

The results of choosing to take content back from Hulu is months away, but when the shift happens, it’ll help illustrate whether consumers are willing to spend on another streaming for access to those series or if they will find a new favorite on a streaming service they already subscribe to.

Paramount+

Paramount+ is growing at a steady rate, leveraged by new originals like Mayor of Kingstown and 1883, franchise tentpoles like Star Trek, and a plethora of long running, adored library content.

As its demand share for both platforms and originals grow, one of the biggest issues will be what Paramount decides to do with its licensing strategy. The company can take a short term hit (quite a big one) to play entirely on exclusives in an attempt to exponentially grow Paramount+ over the next couple of years, or continue licensing its series to generate short term revenue and fund new projects.

The company has one of the biggest library offerings, but streaming is a game of balance, anticipating and meeting the needs of subscribers when it comes to exclusive offerings. The streamer has yet to prove it can be the endgame for a general global audience, but it’s still early.

Paramount 2022 wishes includes pulling some of the licenses back. Right now, Paramount’s best properties are helping Netflix, Hulu, HBO Max, and Peacock. They should be supporting Paramount+ if the core goal is to grow the streaming service as quickly as possible. Scale, scale, scale.

This, of course, may not be the core goal. It may be to grow while also maintaining excellent supporting revenue lines. If that’s the case, having clearer insight into what the new strategy is will help in evaluating what Paramount+ should be thought of today.

Amazon Prime Video

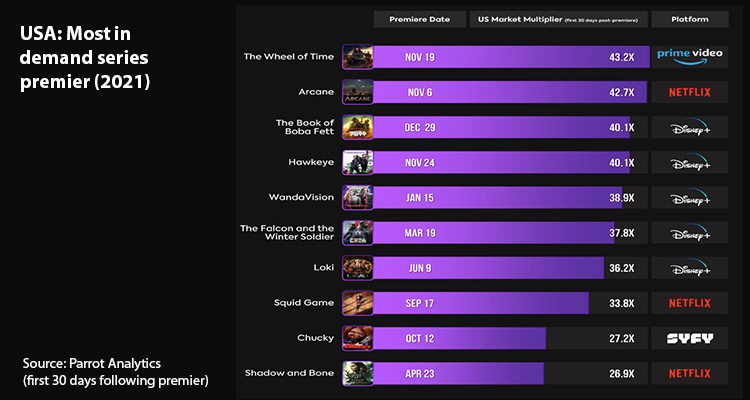

The Wheel of Time had the strongest series debut (greatest average demand in the first 30 days following the premiere) of any show in the USA across all platforms in 2021. Quickly generating massive audience demand for a brand-new series helps bring in new subscribers to a platform who previously had no reason to sign up.

It was so successful that Amazon Prime Video jumped back ahead of Disney+ for second place in US digital originals demand share in Q4. Developing a large global audience for a widely-read fantasy adaptation also bodes well for Prime Video’s biggest bet yet – its upcoming series The Lord of the Rings: The Rings of Power, debuting in September.

Over 100 million Americans got their firstlook of the series during PrimeVideo’s Super Bowl trailer debut. While this is undoubtedly oneof the most anticipated shows of the year, it won’t come outuntil September, and Prime Video subscribers will need morethan a seven-month marketing campaign to keep them engaged.

One of the platform’s biggest hits yet – The Boys – launched an animated spin-off in March, ahead of its third season in June. For now, Prime Video will hope that critical darling The Marvelous Mrs. Maisel, and newcomer series Reacher will keep subscribers happy until the summer blockbusters arrive. It has been a success for the streamer and peaked as one of the top 0.2% of all shows worldwide during its launch. It was quickly renewed for a second season.

Apple TV+

If there is one example of a single TV series making an entire streaming service relevant, it’s Ted Lasso. The Emmy winning series, which first launched in August 2020, wrapped up its sophomore season in early Q4, and drew exceptional audience demand for the full quarter – placing it in the top 0.2% of TV shows across all platforms with both US and global audiences.

Apple TV+ saw massive annual growth in original demand share – up over 50% compared to Q4 2020. It even finished ahead of HBO Max in this category. As important as Ted Lasso was in establishing Apple TV+ as a contender, it’s not the service’s only hit anymore. The series debut of Foundation and See S2 hit exceptional demand with global audiences in Q4 as well, with more modest demand in the US.

Apple TV+’s superstar-driven lineup – as highlighted by its effective “Everyone but Jon Hamm” ad campaign – will be on full display in Q1 and beyond. The Ben Stiller directed Severance features Adam Scott, Christopher Walken and Patricia Arquette, among others. On March 11, Samuel L Jackson leads The Last Days of Ptolemy Grey, and one week later Jared Leto and Anne Hathaway star in WeCrashed, highlighting the rise and fall of WeWork.

(*) To determine the number of new annual and quarterly subscribers alongside total worldwide subscribers, we’ve calculated the difference in new subscribers added for Q4 2021 (Q1 2022 for Disney) and new subscribers added in Q3 2021 to determine the increase or decrease percentage.