After the outbreak of COVID-19 in 2020 and its impact on some sectors of advertising such as offline, the sector has begun to show notable improvements. The consulting firm Zenith forecasts that by the end of this year, global advertising spending will grow by 8.0%, a lower rate respect the previous report by the firm, which predicted 9.1% for this year, but if it doubts more hopeful.

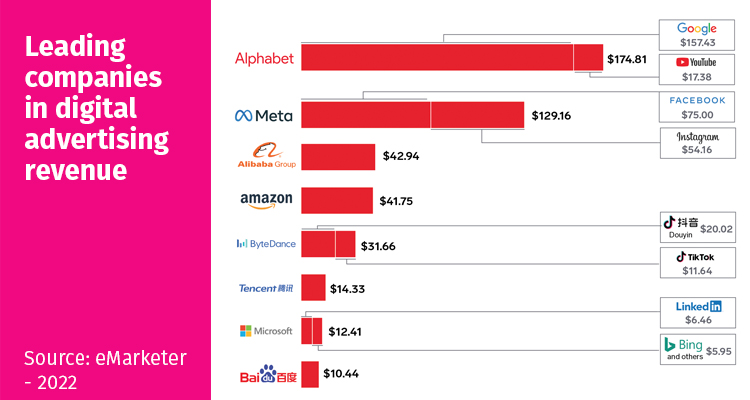

The drivers of this figure are results of purely digital strategies, due to cuts in areas such as print, TV or OOH, which have been consistent in all productive sectors of advertising. According to Garther, consumer brands, financial services companies and health care appear to have been less affected by the pandemic, according to an annual report. But above all, they emphasizes that purely digital companies are the ones that are making the greatest investment in advertising.

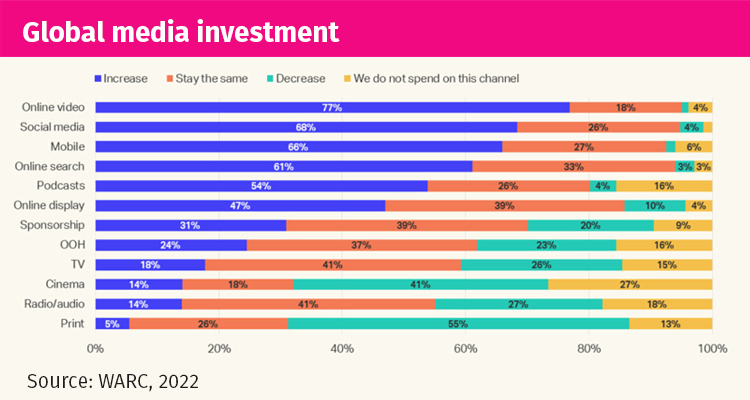

WARC also presented its global report on media investment in 2022 and is headed by online video, social media, mobile advertising, and online searches, sectors that have reflected an increase in their advertising investments, which range between 60% and 70%.

In this report, Prensario presents the most current data on the segment of prudentiality, the items that stand out and some of the trends that will govern the following months.

Good prospects by region

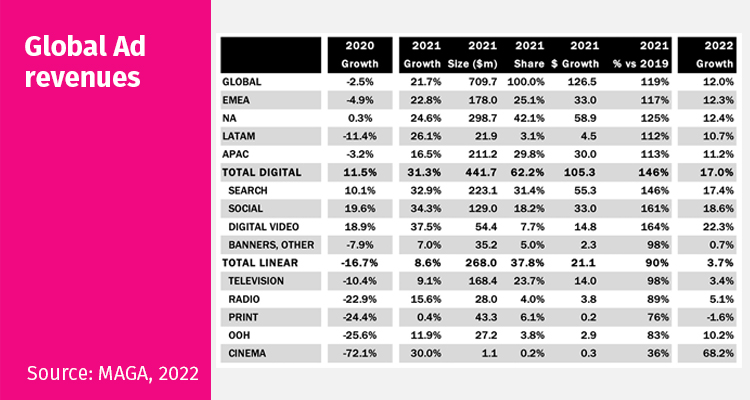

The market experienced a healthy growth in 2021, with a strong emphasis on the digital segment, although traditional formats also recovered, growing by 9%, after a 17% decline in 2020 due to covid.

But it was digital advertising that was the big winner last year, showing 31% growth.

The market seems to maintain this growth. According to the consulting firm MAGMA, advertising investment will grow in 70 markets monitored by this consultancy company, which recorded above-average growth, including the US (+25%), the UK (+34%), Brazil (+30%), Canada (+27%) and Australia (+23%), while China (+17%) and India (+14%) experienced below-average growth.

As a whole, Zenith forecasts global ad spend to rise by $58 billion by the end of this year, to a total of $781 billion, up slightly from the end of 2021 of $723 billion. This rise to more than a year after the pandemic is due to the rapid digital transformation that various sectors of the global economy are facing.

A large part of these numbers come from the USA, which is forecast to expand by US$33.0 billion in 2022, and which will represent about 57% of the global figure. Meanwhile, one of the markets that Zenith highlighted in its annual report is India, a country that will lead growth in advertising with an expansion of 21% by the end of this year, driven by advertising around its presidential elections and by the resumption of the festivals canceled due to the Coronavirus health crisis.

On the other hand, the firm assures that the serious situation between Russia and Ukraine will affect its closest trading partners and will cause a 26% decrease in advertising investment in the CEE: ‘Advertising investment has remained on track despite the macroeconomic obstacles that emerged this year. High inflation, concentrated in basic products such as heating, gasoline and food, is forcing consumers to prioritize their spending, particularly the least advantaged, and has caused a drop in consumer confidence. But for now, consumer spending continues to grow as consumers demonstrate their huge appetite for the travel and entertainment experiences they were denied during the pandemic’.

Preference for digital consumption

Additionally, GroupM reported in its recent annual report that it forecasts ad revenue from pure digital platforms to grow 11.5% in 2022, down from 32% growth in 2021. Digital advertising on those platforms will account for 67% of total industry revenue this year, excluding political advertising in the US.

Along these same lines, Zenith also agrees, asserting that sustained growth this year and the forecast for the next is based on demand from advertisers, driven largely by inflation in the media, particularly television, where supply Viewership is flattening out as viewers switch to alternatives like AVOD services.

At this point, GroupM forecasts TV advertising to grow slightly 4.4% in 2022, driven by ad-supported streaming services like Paramount Global-owned Pluto and Fox Corp.-owned Tubi, which are attracting much of the revenue audiences in the USA.

Finally, Zenith expects online video ad spend to rise from US$62bn in 2021 to US$95bn in 2024: ‘The introduction of cheaper ad-supported tiers by SVOD services like Netflix and Disney+ will drive further growth by providing new high-quality environments for brand communication. Mixed video-on-demand models that combine subscriptions with advertising will also help online video audiences continue to grow around the world by recruiting consumers who are unwilling or unable to pay for the growing list of subscription-only services’, reports.