José MaurícioFittipaldi, Partner at CQS|FV Advogados (Brazil) and a specialist in production issues, advises large companies and international investors looking for the most competitive audiovisual destinations to generate content. Interviewedby Prensario, he described what you need to know to make the best decisions.

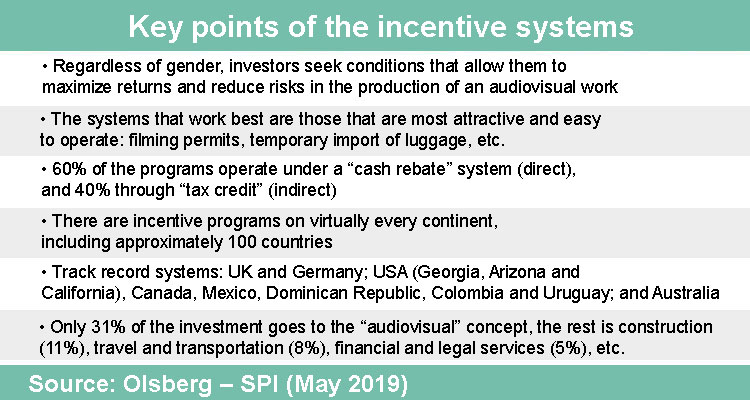

‘Audiovisual production investors are always looking for conditions that allow them to maximize the return on investment and reduce the risks when an audiovisual work is going to be produced, be it a film, a fictional series or a reality TV format. It is a risky activity due to its nature, and managing costs and returns well is essential in any part of the world’.

José MaurícioFittipaldi, Partner of CQS|FV Advogados and president of the Culture, Media & Entertainment Committee of the Ordem dos Advogados do Brasil (OAB), underlined to PrensarioInternacional the importance of global incentives for investors that promote audiovisual projects. ‘Although incentives are not the only factor, there is no doubt that their existence is a key element and, in some cases, the most relevant to make the decision’, he remarked.

Due to their nature, incentives allow producers to reduce costs and, consequently, risks: ‘The locations that offer incentives are also positioned as «film friendly» and with this they offer other advantages such as the ease of obtaining filming permits, temporary importation of baggage and other fundamental conditions for a successful production’, Fittipaldireinforced.

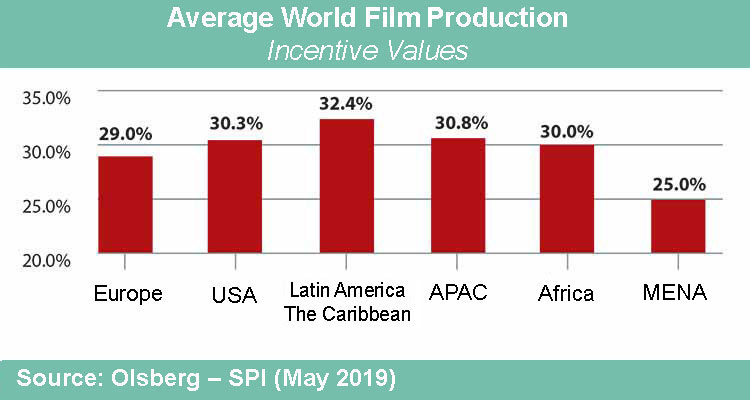

‘A recovery of 20%, 25% or 30% of the investment will always be a determining component in the decision-making process. Many countries and regions have been implementing incentive programs to be increasingly competitive in attracting investment for audiovisual productions,’ he completed.

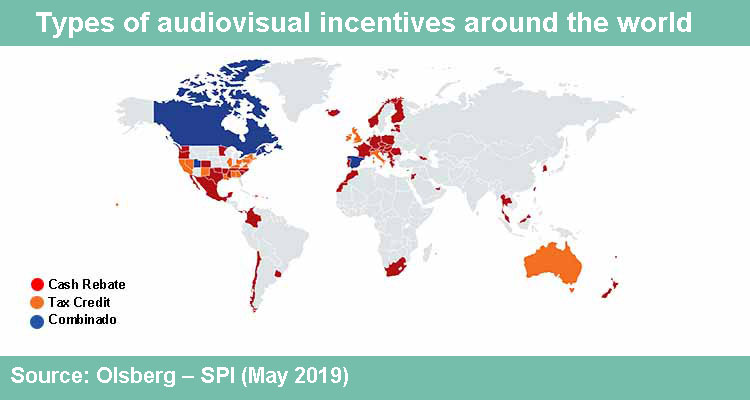

Prensarioasked about what types exist around the world: ‘In general, they are structured to allow the foreign investor a direct recovery made in a specific territory. This happens, once the requirements that have to do with the objectives of the policy established by each locality and with the definition of “eligible costs” have been observed’.

‘On average, they authorize the recovery of 30% of “eligible costs”. In other words, they make the locality promote the return or «reimbursement» of a percentage of the costs incurred, directly in money under the «cash rebate» model or through tax credits that can be converted into money, known as «tax credit”.

60% of these programs operate as “cash rebate”, and 40% operate as “tax credits”. ‘Obviously, producers always prefer to obtain direct money, but programs based on tax credits that require subsequent conversion to local tax payers are still widely used’, added Fittipaldi.

The most competitive programs are those that, on the one hand, offer the most advantageous financial return (up to 45% recovery) and directly («cash rebates» beat «tax credits») and, on the other, offer operating conditions more advantageous. ‘A country offering a 40% “tax credit” with restrictive definitions of “eligible costs” is less competitive than a 25% “cash rebate” with broader eligibility criteria,’ he exemplified.

Territories

Currently, there are various mechanisms established in practically all continents, that is, in about 100 countries. According to Olsberg|SPI, they are classified as «well-established locations», «location-based programs» and «development-oriented programs». Fittipaldi defined them as ‘interesting’ concepts and, although they are not very precise in defining it, they ‘demonstrate a variety of mechanisms and states of implementation’.

The first, which have been around for a reasonable time and are successful in attracting significant investment, are the UK, Australia, Canada, Germany and some US states (Georgia, Arizona and California). There, there is a ‘track record’ that gives investors extra security: ‘In these locations production centers were achieved and are often used as successful examples for the implementation of incentive programs in other locations’, stressed the lawyer.

In Latin America are the Dominican Republic, Colombia, Mexico and Uruguay more recently. ‘The first, for example, takes advantage of its long coastline and beautiful landscapes combined with competitive incentives based on a 25% “tax credits” program; it offers a very well-structured process of approval and granting of permits and temporary internment of equipment’, he highlighted.

And he added: ‘Colombia is another great case for development purposes, since it is integrated into a general program for the promotion of creative industries called “Orange Economy”, which has turned it into a very interesting regional production hub.’

Fittipaldi emphasized: ‘The audiovisual industry is positioned as one of the most dynamic and fastest growing in the world. It contributes to a strategic vision of many countries: the knowledge economy reserves a very special position for industries based on creativity, and the countries that recognize it add an important competitive advantage on the global stage’.

‘Its development adds very concrete and tangible benefits to the economies where it is inserted. The data clearly demonstrates that attracting investment adds considerable growth in terms of value added and tax collection’.

The lawyer exemplifies with the UK, where some £3.18 billion (USD 4 billion) were invested in 2018, according to Olbserg|SPI, which generated a return on investment (direct or indirect, under the definition of added value) of £7.7 for every £1 invested in the incentive program. Similar results are shown in Australia (A$4 for every A$1 invested in 2017). ‘Tax collection also shows growth, and many times they compensate or exceed the investment made through incentives’, he completed.

The concept of ‘added value’ is relevant since it reaches direct investment but also the chain effects for the economy, with an increase in direct and indirect jobs. ‘These results are possible due to the nature of the audiovisual production process, in which costs feed a wide variety of industries and economic sectors, benefiting the economy in general’, he said.

Conclusions

Another study from the company on the importance of the audiovisual industry for the post-pandemic economic recovery, remarks that on average only 31% of the amount invested in an audiovisual production is invested specifically in that sector, the other most important being: construction (11%), travel and transportation (8%), financial and legal services (5%), which are directly and positively impacted.

Fittipaldi said that mechanisms cannot be classified by genre or activity, although he clarified that the associated development policies may lead to a ‘certain’ specialization. And he exemplifies: ‘In Canada or the UK, the implementation of a robust post-production infrastructure is noted, largely associated with the increase in production due to incentives. The same happens with the Dominican, since its locations are very privileged for entertainment formats produced on beaches or lush landscapes, or Colombia, which has been growing as a hub for regional production in the Hispanic language’.

In a market where audiovisual investment by streamers is growing by leaps and bounds due to increased demand, incentives are a key element. ‘It is expected to continue growing for at least another 3-5 years. Netflix, Amazon, HBO Max, Disney +, Paramount +, Apple TV+ are the ones that use them the most. However, they are also widely used by independents and in international co-productions, especially European incentives’, he concluded.

About José MaurícioFittipaldi

Recognized as a leading lawyer in the media and entertainment sector by various international industry rankings, José MaurícioFittipaldi is a partner at CQSFV Advogados, where he is responsible for the regulation and media areas. In the past, he was the executive director of TelevisaInternacional in Brazil, the distribution arm and maximum benchmark for new business of the Mexican giant in that territory. He is also president of the Special Commission for Media and Entertainment of the Ordem dos Advogados do Brasil (OAB) in Sao Paulo, Brazil.