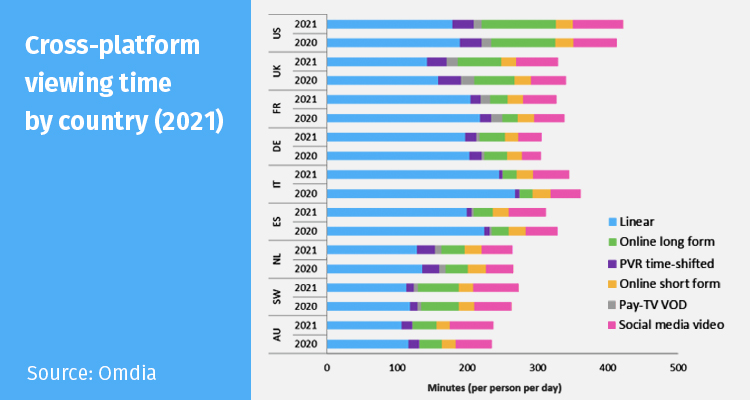

With the conclusion of the “pandemic times” the audience is clearly choosing the digital outlets to inform and entertain. Linear TV viewing down whilethe online long form viewing time increases,remarked Omdia’s “Cross-Platform Television Viewing Time Report – 2022”.

New research from global consultancy company revealed that nonlinear viewing continues to gain greater hegemony in the daily viewing habits of TV users across the US, Europe and Australia with online long form and social media video viewing growing beyond the previous year’s boom in viewing time.

“Cross-Platform Television Viewing Time Report – 2022”has recently found that across all the markets covered average total daily viewing time reached 362 minutes per person per day in 2021 (6 hours and 2 minutes), down 0.5% on last year. Declines in linear TV, online short form and pay TV VoD account for this minor drop in viewing with the former seeing the sharpest falls, growth in online long form and social media video viewing however counterbalanced these declines, leaving overall viewing to drop by just 2 minutes.

Linear TV viewing time decreased in all markets in 2021; the ending of restrictions and lockdowns that marked most of 2020 was the primary cause, with the continual shift toward on-demand viewing also driving this.

Rob Moyser, Senior Analyst in Omdia’s TV & Online Video team,said: ‘In highly developed markets such as the US and the UK, 2021 will likely be the last year where linear TV predominates over non-linear TV viewing. On a platform-by-platform level, however, linear TV still remains by some distance the most popular way to watch TV in the markets covered’.

Online long form was a key area of growth across all markets, driven largely by incumbent SVODs such as Netflix, Amazon Prime, and Disney+, and the launch of several new OTT services such as Discovery+ and Paramount+. In total, long-form viewing grew by 8 minutes, reaching 68 minutes, 8 minutes ahead of social media video viewing.

Time spent viewing video content on social media platforms increased by 9 minutes in 2021 to an average of 60 minutes per person per day across the nine markets analyzed. TikTok was the standout performer for video growth during the year, with the platform set to overtake Facebook in total time spent for the first-time in 2022.

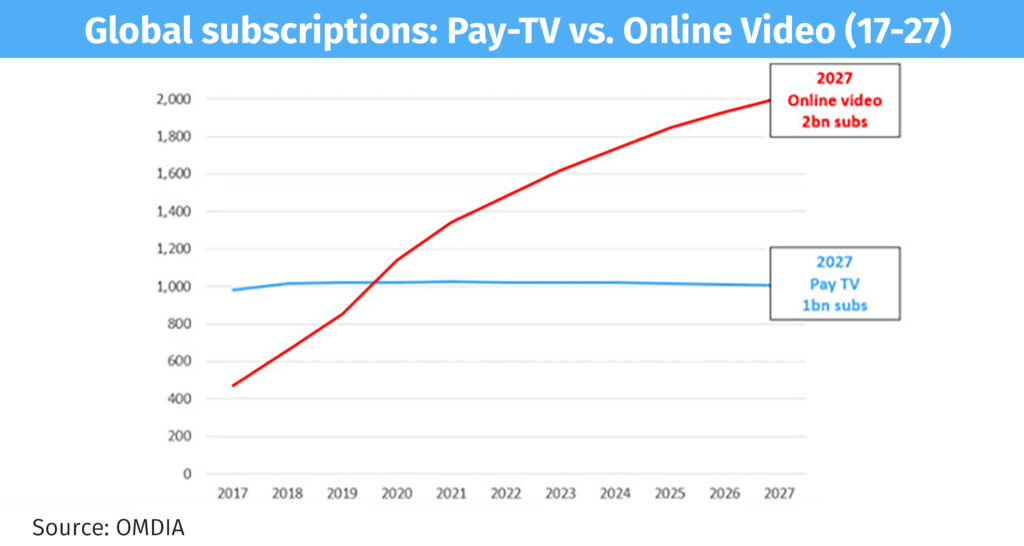

Pay TV vs. SVODs

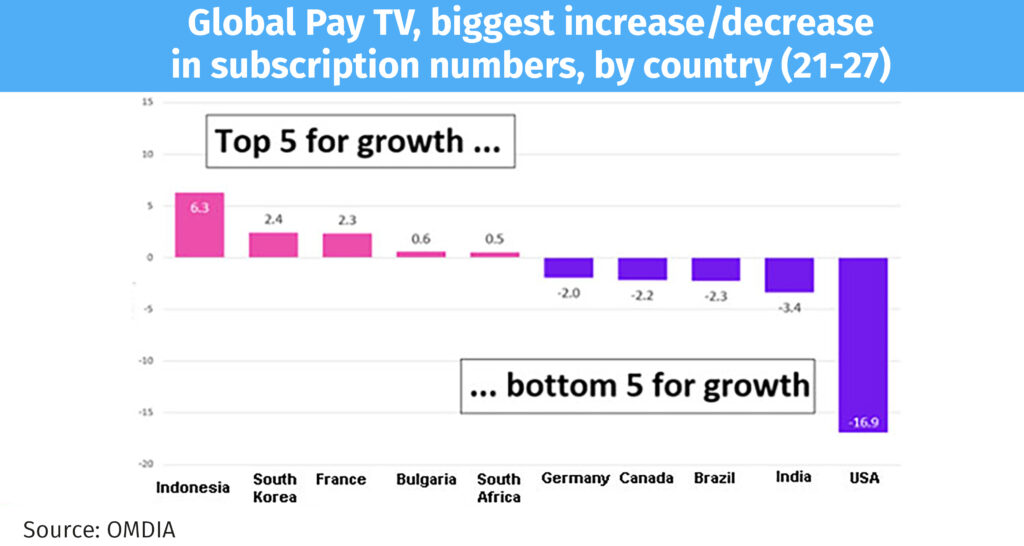

The researcher also forecastedthat global Pay TV andSVODs will pass 3 billion in 2027, with the first surpassing 1 billion and the second going over the 2-billion mark. While online video subscription numbers are growing just about everywhere, Pay TV is much more mixed, with Omdia data showing 55 countries growing, 41 declining and 5 static

Although the outlook remains positive, with Netflixlosses of 1 million clients in 2Q22, it is clear online video services cannot take growth for granted.

Omdia’s“Global: Pay TV & Online Video” report discovered that the global total increased from 1.14 billion at end-2020 to 1.34 billion at end-2021, up 17.7% year-on-year.

The company predicted a further 10.5% growth in 2022 to take the figure to 1.48 billion by year-end. With new services continually entering to market and, crucially, major players still only part of the way through their respective global expansion efforts, this means the market will continue to expand for several years and the forecasts show the global total will exceed 2 billion in 2027.

Adam Thomas, Senior Principal Analyst in Omdia’s TV & Online Video team,added: ‘Online video services are continuing to experience impressive growth levels and there is a lot more to come. Disney+ has enjoyed an incredibly successful launch but there are several more attractive territories for it to enter over the next couple of years. And the same goes for Paramount+, Peacock and several others. The prospects for the alliance of HBO Max with Discovery+ also looks exciting. There are numerous reasons to be positive for online video’s prospects over the next few years which are reflected in our forecasts’.

Meanwhile, global pay TV subscription numbers grew by 0.6% in 2021, from 1.02 billion to 1.03 billion. With competition from online video intensifying, Omdia expects the pay TV market to exhibit slow decline looking ahead and forecasts subscription numbers to drop from the 1.03 billion figure to one billion in 2027, down by 1.9%. And while online video subscription numbers are growing just about everywhere, the scenario for pay TV differs a great deal from country-to-country. Of the 101 pay TV markets that Omdia tracks in most detail, the outcomes show significant fluctuations, with 55 countries still reporting subscription growth, 41 reporting decline and five essentially static. Over the next five years Omdia expects those contrasting fortunes to continue, with countries like Indonesia continuing to post solid increases, while others – most notably the US – seeing ongoing decline.

Thomas concluded:‘The one small note of caution I would add is that with pay TV as a whole plateauing, the TV and video business is becoming increasingly reliant on growth from online video. But with that business having been built on high content investment aligned with low subscription prices, a price-sensitive public has come to expect a lot of bang for their buck. The content costs versus pricing balancing act is a tricky one to navigate and we’ve already heard from Netflix that it expects to lose 2 million customers in this quarter. It is quite clear that constant growth for online video is by no means guaranteed’.