As one of the most diverse and largest markets in Latin America, the TV and content industry in Brazil is always interesting to explore. Statista forecasts that by the end of 2022, the value of the Brazilian media and entertainment market will reach USD 32 billion, up 14% from the US$28 billion recorded in 2020 amid the Coronavirus outbreak.

Brazil’s figure for this year corresponds to 1.39% of the global entertainment and media market value of 2.3 trillion dollars estimated for that same year.With a TV penetration of more than 32%, according to data from IAB Brazil, Statista believes that the penetration of SVOD users in this country will be almost 14% in 2022 and is expected to reach 18.4 % by 2027; there is no doubt that it is a key market for the industry.

As the most consumed medium in the country, about 70% of the concentration of the TV audience in Brazil is divided between four networks, TV Globo, SBT, Record and Band, according to data from the Global Media Registry.In 2021, Globo consolidated its new vision for the national and international market, and reinforced its importance in various countries based on strategic alliances and successful productions. This is due to the strong digital transformation that it has been developing, such as Globoplay, its streaming platform, and the complementation of its digital environments, hand in hand with its air signal.

The broadcasters

‘It was a process of corporate cultural and business model change,’ said Erick Bretas, director of Digital Products and Pay Channels at Globo, adding: ‘GloboPlayis essential in this unification because it adds channels from the Globo Group, that is, TV Globo, Globosat channels and digital channels of the media conglomerate, now defined by the technology sector as a Media Tech’. The executive highlighted the importance of live broadcasts, linear consumption, original production and how these fits with his strategy with GloboPlay, while mentioning the recent agreements with Roku and Deezer, highlighting the importance of alliances.On the other hand, following the digital and alliance strategy, Record TV recently signed an agreement with Paramount‘s AVOD Pluto TV, with which it seeks to reinforce its multiplatform vocation. The partnership allows the company to add more than 400 hours of content to the streaming platform, with a dedicated channel with 24-hour transmission. Dado Lancellotti, Multiplatform Executive Director, said: ‘With this new viewing window we seek to attract new audiences and also more participation outside of our ecosystem’.

Bandeirantes also undertook a strong digital strategy in 2020 with the creation of its Vibra Digital unit and its AVOD BandPlay, with which the company faces new forms of consumption. Today it has set good numbers in this ecosystem as a whole: programs like Faustão Na Band had more than 1.2 million views during its premiere last January; or the digital transmission last February of the final of the FIFA Club World Cup, which brought together more than 460,000 spectators; while the presidential debate last August shot up the digital ratings for Band as a whole, with more than 1.5 million views.

One of the novelties is that as of January 2023, the UFC will have Band as the exclusive distributor of its live events in that country. ‘For us at Grupo Bandeirantes it is a source of great pride to be able to say that we are the new free-to-air television partners of the UFC in Brazil starting in 2023. We are always looking for new and relevant products for Band’s sports pillar’, said Denis Gavazzi , Sports Director at Bandsports.

The telcos

According to Statista, in the second quarter of 2022, the net operating income of pay TV amounted to 4,000 million Brazilian reais, more than mobile telephony and fixed broadband internet combined. The pay TV penetration rate in Brazilian households reached 23.6% in the last quarter of 2021, being the highest participation in three years. Among the consultant’s forecasts, they project that the number of subscribers in the country would go from 14 million in 2022 to 14.3 million four years later. And a specific part of the country could be home to the most potential new customers.

The number of pay TV subscriptions in the Northeast region of Brazil increased by 72 percent in just two years, exceeding three million at the end of 2021, the highest figure in at least a decade.One of the strongest providers in the country, Claro TV, recently reported at the PayTV Forum 2022 that although its client base has decreased, they have remained. With a total of 13.1 million subscribers, it continues to be the largest operator in the country, representing 43.3% of the total, according to data from the Anatel.

Márcio Carvalho, CMO of Claro stated: ‘Although our Pay TV business has been reduced, we have maintained our subscriber base. It is a global trend that many countries are experiencing, so we are working on diversifying the businesses.Another strong player in this segment is Sky, which is the second largest pay TV operator in Brazil and the first with DHT technology, with a base of more than 4.1 million subscribers, representing more than 31% of the total. Due to its technology, the service reaches 99.99% of Brazil, and in many municipalities, we are the only service, said the company’s president, Raphael Denadai, at the PayTV Forum, an event held last August.‘We know that the market is dynamic and our focus is on adding value to the product, offering better experiences and products to customers’, said Denadai, adding: ‘Sky works with respect, always thinking of building a fairer competitive scenario’. The executive also said that they are working on new innovations in the field of FAST, to adapt to the new times.

Majors and indies

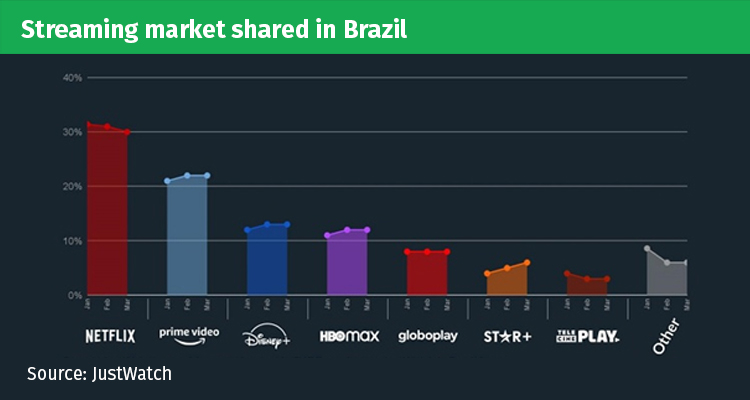

According to a Statista study, more than a quarter of consumers surveyed in Brazil in 2021 said paying for all the streaming platforms they wanted was too expensive, and one in three respondents said they used alternative websites and apps to watch content. payment for free. Therefore, the consultant highlights that this territory is promising for new models such as AVOD or FAST.

In addition to BandPlay, Pluto TV and, TVCoins, which recently landed in the country, the Ad-Supported models platforms also coexist in the country.Fabricio Proti, SVP of Ad Sales Multiplatform Latam& Country Manager Brazil of Paramount, at the 2022 edition of PayTV Forum, said that its local content aggregation strategy in its AVOD, Pluto TV, has been a winning strategy: ‘We are taking a combined strategy of local production through our studio dedicated to content in the region, as well as continuing to expand our catalog of content and channels on Pluto TV. We acquired Porta Dos Fundos to boost national production and this fits perfectly with Pluto TV‘s aggregation strategy, which is complemented by our content providers here.

Today we have very varied content designed for the Brazilian audience, because we know how much they love the experience of traditional TV, but in digital’.Lastly, TVCoins arrives in Brazil as a new player in the AVOD space, with an advertising revenue sharing business model that allows creators to launch a fully customizable direct-to-consumer (D2C) streaming application with no upfront investment. The difference is given by the unique association between the company and the creator of the content. There is no need for investment and the development of the platform is done through an administrative portal without code, which makes it easy to have the application ready as quickly as possible.

Gustavo Marra, CRO of TVCoins, added: ‘The AVOD business model that combines free content and advertising space, offers great opportunities for brands and favorable conditions. In a country like Brazil, where open TV still concentrates larger audiences, costs are the most important factor for millions of people who access content on demand. We at TVCoins are targeting this industry with a free cloud-based streaming platform’.

This report was produced by Alberto Buitron based on interviews from Prensario International correspondent Fernando Moura