Special Report

The gaming industry is a business that generates billions of dollars a year, and its growth has been sustained over the last decade, opening opportunities for brands that seek to reach the youngest, including the audiovisual sector.

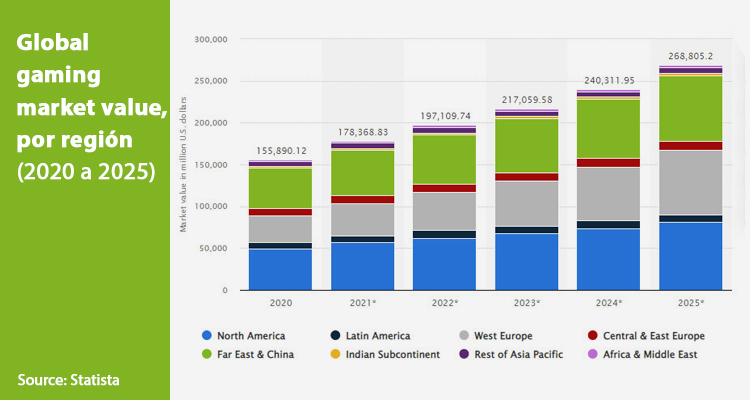

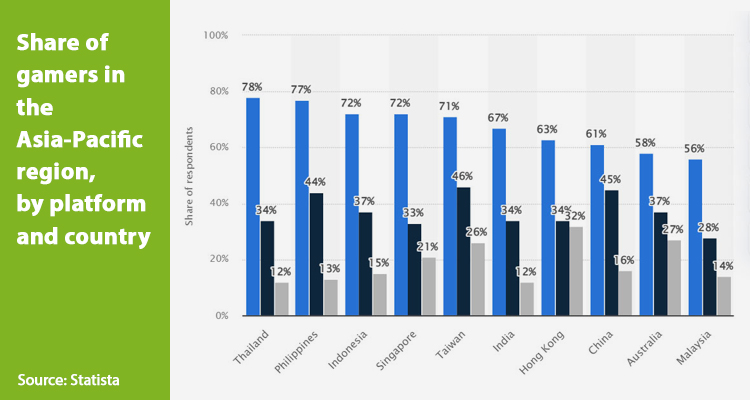

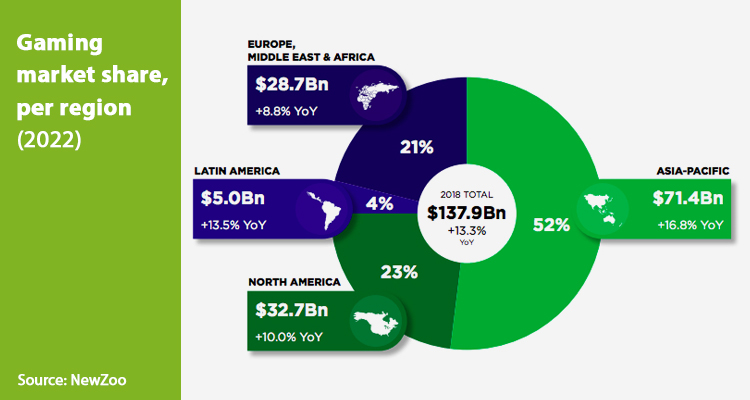

In Asia, the growth of gaming over the past years has been rapid, and there are no signs that this trend will slow down any time soon. Like many digital shifts, the COVID-19 pandemic accelerated a pre-existing trend as consumers spent more leisure time at home, on smartphones or games consoles. For gaming publishers this has obviously been a huge boost to the industry. Globally gaming industry revenue is predicted to grow from USD$178bn in 2021 to USD$269bn in 2025, an increase of 51% in just five years. And this is especially true in Asia, which leads the world in its number of active gamers. Almost half of all gaming revenue came from Asian markets pre-COVID-19 and this percentage has been maintained despite the growth of gaming globally in the past two years.

For this 2022, The Business Research Company calculates that the market will scale 17.2% more than in 2021 even despite the impact generated by the war between Russia and Ukraine. Additionally, the esports market is expected to reach $2.56 billion by 2026, with a CAGR of 16.1%.

The keys to this growth? On the one hand, the expansion of technology, with new tools and a considerable increase in the quality of content, and on the other, the commitment to narratives closer to the world of cinema. And if we add to this the professionalization of e-sports and the space it has gained thanks to streaming services such as Twitch, where in many cases the youngest consume videos or streams of other people playing, niche platforms such as NickX – a platform launched by Viacom and that uses Nickelodeon game content – or linear channels that allocate part of their nightly programming to gaming lovers, the range widens even more.

According to PwC, revenues are expected to continue to rise driven by increased investment in in-app advertising, expanding brand confidence in digital promotions, as is happening with AVOD services and FAST channels.

Nowadays, video games accounted for just 6.1% of global spending in the entertainment sector, but by 2026 they are projected to gain a 10.9% share as gaming becomes even more massive. China and the United States were the market leaders in 2021, with nearly half of revenue, but future growth could come from less wealthy countries with growing populations.Elinforme de PwC predicts that the gaming market will expand fastest in Turkey, with an average annual growth of 24.1% between 2021 and 2026. Pakistan will follow, with an expansion of 21.9%, and India with 18.3%. .

The genres that have the greatest arrival are those based on the multiplayer online battlefield (MOBA), real-time strategy, first-person shooters, fighting and sports, are the main ones. And for each genre, a different possibility of monetization, from income from sponsorship, advertising, merchandising, as well as transmission rights.

Lastly, another point of contact with the audiovisual industry focuses on the exploitation of video game IPs for the production of series and films based on video games, such as Uncharted (Sony), the Trivia Cracks series (Etermax), Mario Bros. (Nintendo), League of Legends (Netflix), Halo (Paramount+), Sonic (SEGA), Angry Birds (Rovio Entertainment), among many other titles.