Nowadays in the world, the OTT platforms are moving focus from SVOD to AVOD, from subscribers to advertisement. What can we say about broadcasters at this new media scenario?

Last Mipcom, at theFRAPA Formats Summit, there was an interesting debate between iconic European broadcasters. How do you perform better?Julien Degroote, EVP content development, TF1 France, said: ‘We give priority to unscripted formats, because they always score better numbers. When fresh ideas appear, we get event programming’.Hannes Hiller, SVP Content Development ProSieben Sat.1, Germany: ‘We are open to everything, but we usually perform better with local projects and German producers. It is simpler and faster’.

Joanne Wallace, Sr. commissioning editor, BBC TV (UK): ‘We vary unscripted and non-scripted, the success depends more on good ideas or stories than nationality. Even, partners from new origins can bring us freshness, new points of views’. Jessica Schmiedchen, development director, unscripted, CBC Canada: ‘More than formats we prefer to co-develop, this way you are more original and you see not only your market, but also to expand abroad’.

In Latin America, the two biggest broadcasters, TelevisaUnivison (Mexico, USA) and Globo (Brazil) have stressed a way to follow: they have created strong own OTTs (VIX+ and Globoplay) and announced an alliance: ‘All the flowers’, last Globoplay original production, will be emitted also by VIX+ in exclusive for Latin America, and viceversa: VIX+ originals ‘Bad Girl’ and ‘The Devil’s wife’ will be also in exclusive through Globoplay for the region. This is the first of more deals together, as co-productions. They both usually give priority in their groups production maps, to OTT original top budget productions, to enter strong OTTs worldwide.

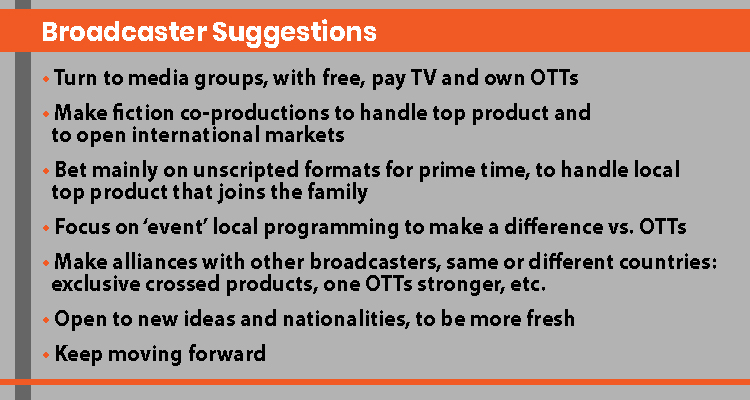

So… broadcasters at the new media game, use to form media groups, including many Pay TV channels and own OTTs, to be more solid. They make focus on co-productions to handle top local fictions and open international markets, and in formatsthey give priority to unscripted, because they are faster and easier to produce, to have local top content that joins the family. This ‘event’ programming also makes a difference vs. global emerging OTTs, both SVODs and AVODs, that now pull their advertising incomes.

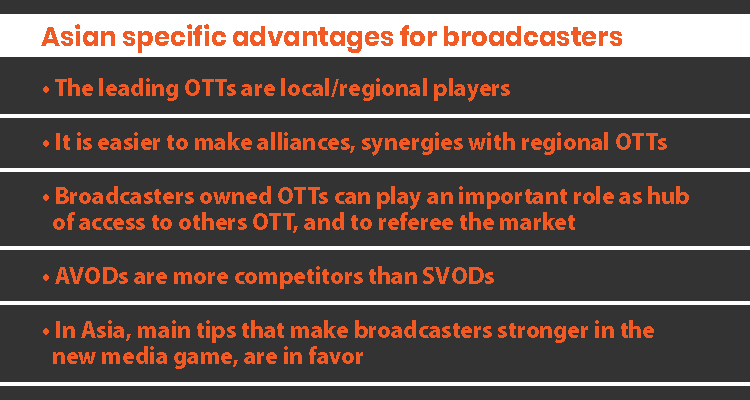

What can we say specifically about Asian broadcasters, below the ATF umbrella? In Asia and the Middle East, on the opposite of Europe and the Americas, the leading OTTs are local players, not the big global titans: Viu, Hooq, Iflix, Tonton, Want, Watch, Tving, etc. They are the leaders in 1-2-3 territories, not more, so the map is different from the rest of the world. Broadcasters can generate alliances, synergies with some of them easier than with Netflix, etc., for two-screen releases, co-productions, commercial strategies, etc.

They can select an OTTs that doesn’t compete directly in core segments or countries. They canmatch a competitor, to make a block together stronger vs. others, and for instance to stop big titans. The broadcasters’ own OTTs can be a very appreciated hub of access for any OTT, from the locals to even, the titans, and to be a judge in the OTT evolution of its market. Many options are possible.

Broadcasters are not dying in this new media game, they usually get stronger with all these strategies, while the OTTs are expanding among SVOD and AVOD models. The AVODs are the direct competitors to broadcasters, because they want their advertisement, but in fact everybody can be partner and competitor at the same time. Pay TV is the more damaged sector, turning into a second-tier segment. But it also depends on the market and the players. Take decisions and move forward, above all.

Nicolás Smirnoff