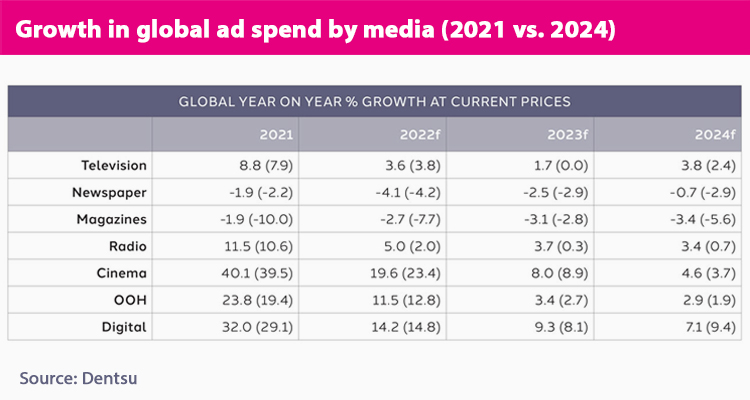

After the outbreak of COVID-19 in 2020 and its impact on some sectors of advertising such as offline, the sector has begun to show notable improvements. Zenith expects that by the end of this year global advertising investment will grow by 8.0%, 1.1% less than the estimate in its previous report, but equally encouraging if one takes into account that the business saw a drop in 17% in 2020 due to the pandemic.

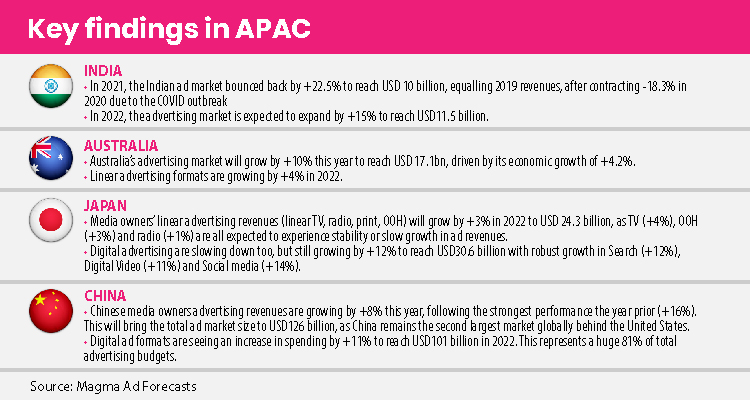

In Asia-Pacific, regional ad spending is estimated in US$35.7 billion above the 2019 pre-pandemic level in the region, led by India (+16.0%), Malaysia (+11.0%), and Hong Kong (+10.1%) which have all achieved double-digit growth, according to Dentsu Global Ad Spend Forecasts. The report predicts advertising spending will increase globally by 8.7% in 2022m with ad spend in the Asia Pacific anticipated to reach US$250.0 billion, with digital making up the majority of spending.

As said, India leads the Asia-Pacific with a growth rate of 16.0% this year and predicted increases in advertising spending of 15.2% in 2023 and 15.7% in 2024, while spending on advertising in China is expected to rise by 4.0% in 2023 and 5.4% the following year.

‘This year, India (+16.0%), Malaysia (+11.0%) and Hong Kong (+10.1%) have all achieved double-digit growth,’ said PrernaMehrotra, CEO Media APAC, dentsu international, adding that ‘digital continues to drive growth accounting for 60.7% of all spending in Asia Pacific with Social, video and search predicted to lead digital growth.’

Overall ad spend growth in Asia Pacific ise boosted by key sporting events such as the Indian Premier League, FIFA World Cup, Beijing 2022 Winter Olympics and Paralympics, and country elections in Australia and India.

Digital continues to be the powerhouse driving APAC ad spend, as the fastest growing medium at 11.5% to reach US$151.7 billion, a 60.7% share of total ad spend. Fuelling this is the double-digit growth of Programmatic (32.3%), Paid Social (27.4%), and digital display (13.3%) in 2022.

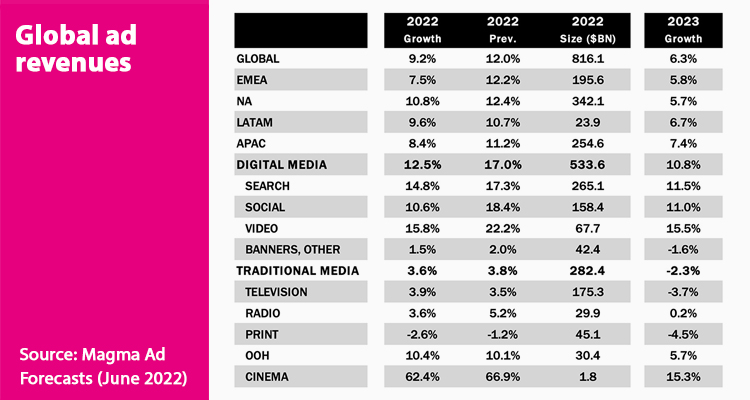

Globally, according to WARC, if media investment in 2022 is taken into account, they lead videos, social networks, mobile advertising and online searches, sectors that have reflected an increase in their advertising investments, ranging between 60% and 70%. %. In 2021, it is estimated that digital advertising increased by 31%.

According to Magma, the Asia Pacific advertising economy will grow by +8% this year, following the 2021 rebound (+18%). In 2023, the Asia Pacific ad market will expand by +7%, slightly higher than the global average of +6% and in line with the pre-COVID long-term regional growth. Growth is powered by large markets such as China (+8% in 2022, +9% expected in 2023) and India (+15% in 2022, +16% expected in 2023). In 2023, APAC advertising revenues will increase by +7% to $273bn, 35% above the pre-COVID spending level, driven by digital advertising growth (+12%).

The experience of Asia Pacific with COVID throughout 2021 has been mixed. Many countries in Southeast Asia suffered their worst outbreaks in the last few months of 2021 into early 2022 (Thailand, Philippines, Vietnam, Indonesia), which have caused pullbacks on advertising activity. Vaccine rollouts are also mixed. China and Japan have vaccinated three quarters or more of their population, whereas India’s vaccination rate is lagging and only increasingly slowly. On the other hand the experience of COVID and a home-centric lifestyle have changed the consumer behavior towards more streaming, more Ecommerce, and more integration of digital platforms into day-to-day lives, driving digital advertising spending, much as it has in the US and Western Europe.

Linear advertising spending (Linear TV, Print, Radio, OOH) will grow by +2% in APAC this year. In 2023, media owners’ linear advertising revenues will begin its decay at a -2% decline to represent 30% of total advertiser budgets. The growth of linear format spending in 2022 and 2023 will not come close to offsetting the huge declines during the peak of the pandemic in 2020. At the end of this year, linear advertising revenues will still be just 88% of the pre-COVID total. In fact, despite the bounce-back in spend observed in 2021 and expected this year, linear advertising revenues remain on a long-term declining trajectory to reach 23% of the total advertiser budgets (compared to 46% in 2019) by 2026. For that reason, linear advertising revenues may never again reach the pre-COVID total of $92bn in APAC. By 2026, linear advertising revenues will stand at $74bn.

Digital advertising spending, on the other hand, continues to grow this year and will continue to take shares from linear formats. Digital advertiser revenues are up +12% this year, and will grow by another +12% in 2023, to represent 71% of total advertiser budgets. This is up from just 54% of total budgets pre-COVID in 2019. This is also higher than pre-COVID expectations, as consumer behavior changes are positive for digital advertising spending trajectories. Increased Ecommerce spending, and increased video streaming, will both result in a higher share of attention of ad revenues going to digital formats.

Gurpreet Singh, Managing Director MAGNA APAC, said: “Advertising spends in Asia Pacific are getting back on track after hitting negative growth in 2020 due to covid. Most of the APAC markets recovered the loss with double digit growth in 2021 over reduced 2020 base. This gap has largely been filled by massive growth in digital spends while spends on linear media have still not recovered back to pre-covid levels in most of the APAC markets. This year digital media is expected to hit the highest share of spends across the majority of APAC markets, including some of those markets which had been TV dominant until a couple of years back. Digital spends have grown much faster than all pre-covid predictions.”

.