Asia Pacific’s SVOD market is forecast to grow 19% in 2022 to US$24.6 bill, with China contributing 51%. But, how is this market constituted that, despite being part of a unified region, has so much diversity at both cultural and economic levels?

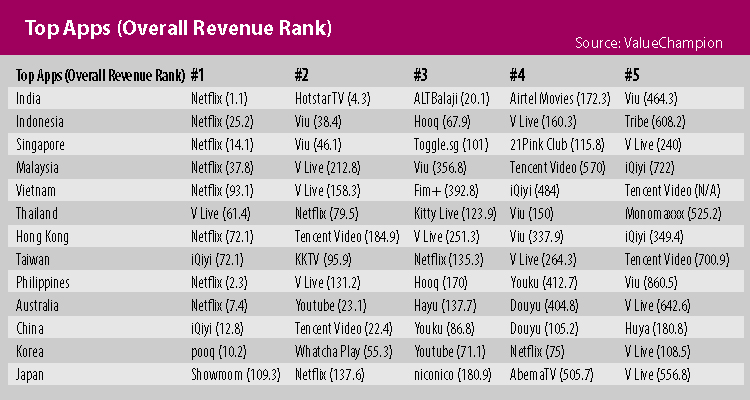

According to Duckju Kang, founder and CEO of ValueChampion, since Netflix’s grew in the industry for over a decade, many entrepreneurs in Asia have been launching their own video streaming platforms to recreate Netflix’s success.India has been probably one of the most involved in this, with aOTT video market is in its second growth phase with total revenues of US$3 billion in 2022 expected to more than double to almost US$7 billion by 2027. Five leading platforms – YouTube, Meta, Disney+ Hotstar, Amazon Prime Video and Netflix – will account for a combined 82% of total online video revenues in 2022.

There were some notable local streaming services that closely competed with Netflix, Kang says. For example, Hotstar TV in India was closely behind Netflix in terms of revenue ranking: as the 2nd most popular streaming app, it had an overall revenue ranking of 4.25 behind Netflix’s 1.08.

Also notable is the popularity of live streaming apps like V Live, Kitty Live and Showroom. Although they are free to use, these apps allow online celebrities to host their own shows live, where viewers can make «donations» to these stars in form of digital gifts. V Live, a product from Korea’s internet giant Naver, was particularly successful in Asia by leveraging its access to popular Korean celebrities

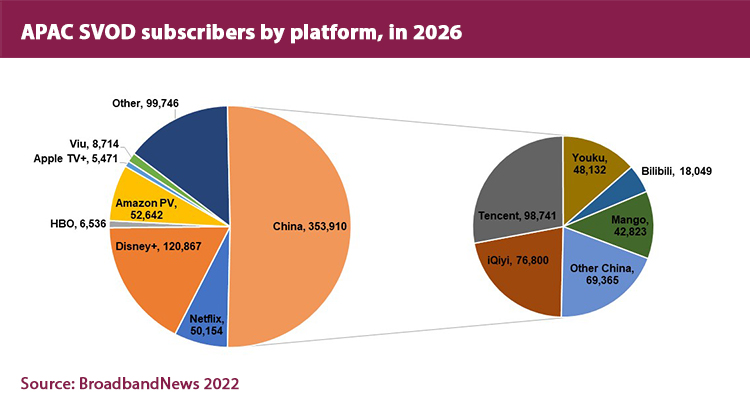

Nowadays, top 20 online video platforms account for 67% of the total APAC online video revenue pie in 2022. Ex- China, leaders include YouTube, Netflix, Amazon Prime Video, Disney+/Disney+ Hotstar, key local players in Japan, Korea, Australia and SEA such as Yahoo! Japan, TVer, Stan, Vidio and Viu.

As in the rest of the markets, local content is crucial for OTT services in order to engage to new subscribers, as well to compete with major services. And this include live sports such as cricket or rugby, especially in markets like Australia, India, Singapore and Indonesia. Having YouTube as the most downloaded video app, forces other players to bet not only on originals, but high quality. Both Hot Star and Amazon Prime are ahead of Netflix in terms of downloads because they are the cheaper service. Among the two leaders, however, it seems that Hot Star is winning due to its special set of content although it is more expensive than Amazon’s service.

Another thing to consider, is that in key markets such as Japan, China and South Korea, where foreign services have not garnered popularity, having big local titles has become crucial for services like Hulu or iQiyi. As result, this had a direct impact in the growth of the availability of high-quality local with travelability, led by Korea, Japan, China, India, Thailand and Taiwan.

A report published by Media Partners Asia (MPA) indicates that total Asia Pacific online video industry revenue will grow by 16% year-on-year in 2022 to reach US$49.2 billion. SVOD will contribute 50%; UGC AVOD, 37% and Premium AVOD, 13%. The industry is to grow at an 8% CAGR to reach US$72.7 billion in 2027. According to the article, leading APAC online video platform by revenue areByteDance (includes Douyin/Huoshan in China and TikTok outside China), YouTube, Tencent Video, Netflix, iQIYI, Amazon Prime Video, Youku, Disney+ / Disney+ Hotstar, Yahoo! Japan, UNext, Foxtel OTT Platforms, Hulu Japan, TVer, Wavve, Stan / 9Now, DAZN, TVing, Abema, Viu, Vidio

MPA executive director Vivek Couto says: ‘Investors are increasingly focused on enhanced scale, improved monetization and real profitability across global, local and regional online video platforms. In this context, the role of Asia Pacific continues to have a critical role in the future of the global online video industry. The region remains the largest growth contributor to global online video customers and users today and is emerging as a significant contributor to revenue growth. With the US and Europe fast maturing and China inaccessible, APAC’s large markets – India, Indonesia, Japan, Korea and Thailand – will be increasingly important to global platforms. Each of these markets require local content and distribution strategies with long-term investment’.

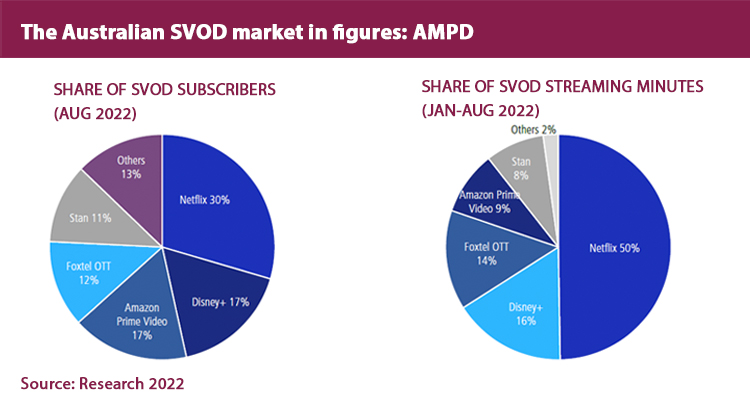

Last but not least, successful platforms are emerging in Australia, Indonesia, Japan, and Korea. Indonesia’s Vidio, owned by Emtek’s SCMA Group, is leveraging content production synergies and a library of popular local entertainment content and sports rights, to drive a potentially large scale SVOD business. Australia’s Stan is on a similar SVOD trajectory but faces greater competition from global giants and is more reliant on licensed and acquired content. In Korea, Tving from CJ ENM and Wavve from SK Telecom and Korea’s major FTA networks, have also reached a level of SVOD scale but consolidation in the market is likely. Consolidation is also likely to occur in Japan where Hulu Japan and UNext have emerged as important local SVOD platforms.

In India, new local players with deep pockets are gearing up to grab market share, led by a newly recapitalized Viacom18, backed by strategics Reliance, Bodhi Tree and Paramount while domestic incumbents Zee and Sony are merging to create a strong TV / online video business. Going forward, Viacom18’s new streaming platform, leveraging IPL cricket and local entertainment, will emerge as an important player in the AVOD space in particular, grabbing material share over time as it leverages massive reach via Jio mobile and connected TV.