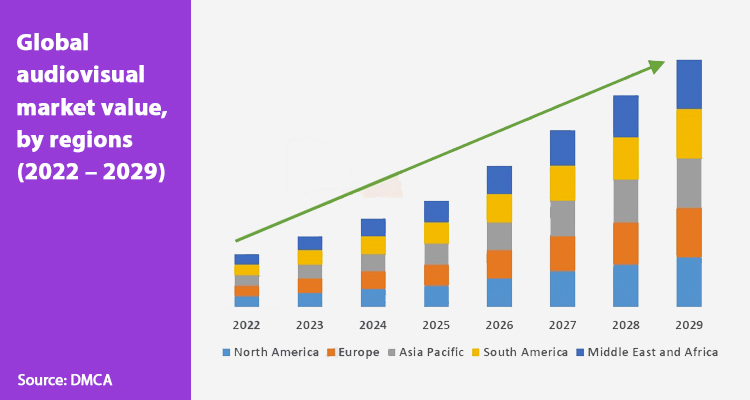

As we will see throughout various reports in this edition of ATF 2022, the APAC audiovisual market is in full expansion and on what many highlights as the ‘second phase of the audiovisual expansion’, driven mainly by VOD platforms. But what challenges does the territory still have to overcome?

Despite being a region that is analyzed as a whole in many cases, the truth is that each country has its particularity. In the case of China, for example, being the country with the largest population, to which is added a strong cultural presence, led them to focus on the domestic market. In addition, there is the language barrier, where many of the producers do not speak other languages fluently, such as English.

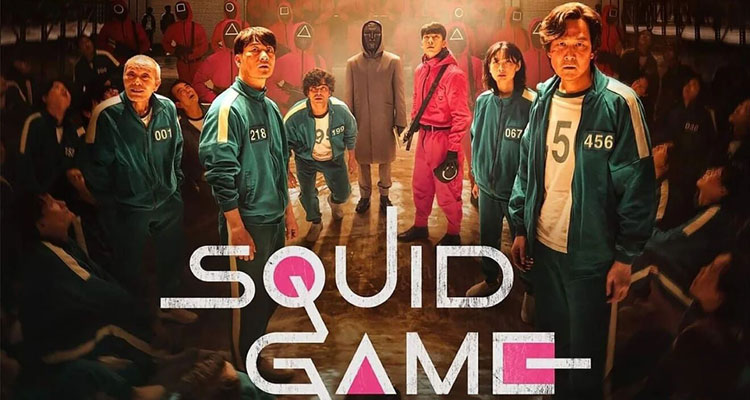

The South Korean government, on the other hand, opted for a strong investment in promotion in the international market and support for the so-called K Wave, which includes both K-pop music, dramas (dramas and telenovelas), and other cultural and artistic expressions. And in recent years, their productions have also gained a place in the mainstream, with strong exponents such as Squid Games (Netflix).The Indian government too – under the information and broadcasting ministry – has put in place measures to encourage international biggies to set up base in India as well kick start co-productions and collaborations between India and international studios.

Markets such as the Philippines and Malaysia have learned about the production models and narratives of international content like Latino telenovelas, while Japan has known how to stand out, not only through anime but also through large productions that have been adapted worldwide, such as Mother (Nippon TV).

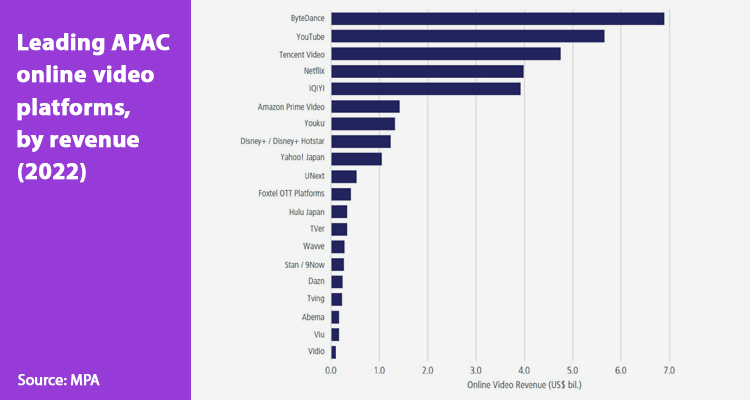

Thailand has also become a regional hub for film production, relying on a well-established infrastructure, a highly-active film industry, and a red-hot economy. And Indonesia is Southeast Asia’s largest online video market, generating close to US$1 billion in revenue in 2022.

Indian animation and visual FX are on a roll. Service work for domestic kids channels and for Hollywood and European clients has for long been a staple of Indian studios. And that work continues even as some of them are working hard on creating globally relevant original IPs and series. Meanwhile, broadcasters and OTTs continue to acquire animation content locally and globally.

The Asia-Pacific Professional Audio-Visual Systems Market is expected to be highly competitive owing to the presence of many small and large players in the market providing their solutions in domestic and international markets. The market appears to be moderately concentrated, with the major players adopting strategies like product innovation and mergers and acquisitions, among others, primarily to stay ahead of the competition and expand their geographic reach.

However, despite the good moment that the region is having and the differences of each country, two things still unite them: on the one hand, to be able to continue expanding into new territories, especially the Americas, not only with the sale of formats but also of its original content, and on the other, being able to make the leap from being service providers or hubs to more. ‘We have the challenge of getting them to see markets like India not only as providers of services or low production costs, but as strategic partners with great potential and international quality,’ says Manoj Mishra, CEO, Powerkidz Entertainment (India).

The success of the titles produced in Asia, not only locally but also internationally, and the opening of a market that is increasingly receptive to projects from other countries, is opening a door for this to happen. The key will be to take advantage of the momentum that content, especially from Korea, is experiencing and ride that wave, as well as look for new co-development and co-production models.

Costs, creativity and infrastructure will undoubtedly be the key, as well as the support of government entities through funds and competitions that allow bridging bridges between the West and the East.