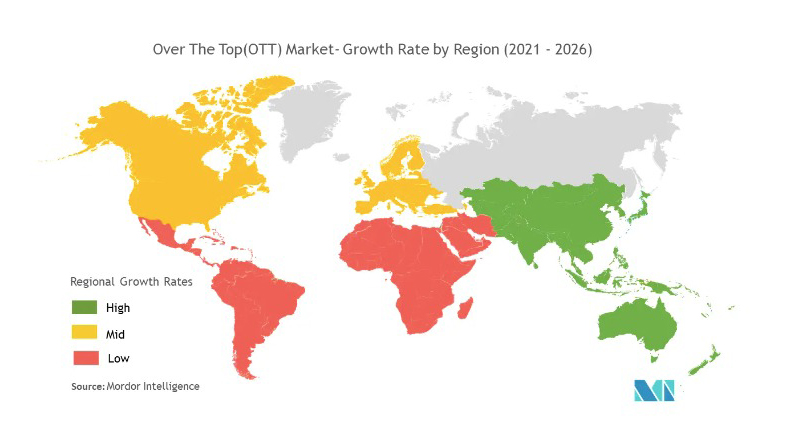

With a population of over 676 million, rapidly growing mobile broadband penetration, and fewer regulatory barriers than other markets, Southeast Asia remains an emerging market for streaming services. Valuates Report estimates that the global OTT market will register more than USD 1,039.03 billion by 2027. But in the case of Southeast Asia, the success rate may be sustained.

With several pan-regional platforms on the rise and large streamers reaching this market, Media Partners Asia (MPA) reported that in Southeast Asia, during 2022, there was an increase of 11.8 million new customers, reaching 43.5 million total paid subscriptions. This number was recorded in Indonesia, Malaysia, the Philippines, Singapore, and Thailand.

The increase in viewership (6% QoQ) and premium video subscriptions was driven by strong demand from platforms such as Netflix, Disney+ Hotstar and Viu (particularly in Indonesia and the Philippines); Meanwhile, Amazon Prime Video enjoyed a big boost in Southeast Asia after launching local versions of its service; and Vidio positioned itself positively in the sports segment after broadcasting the 2022 FIFA World Cup.

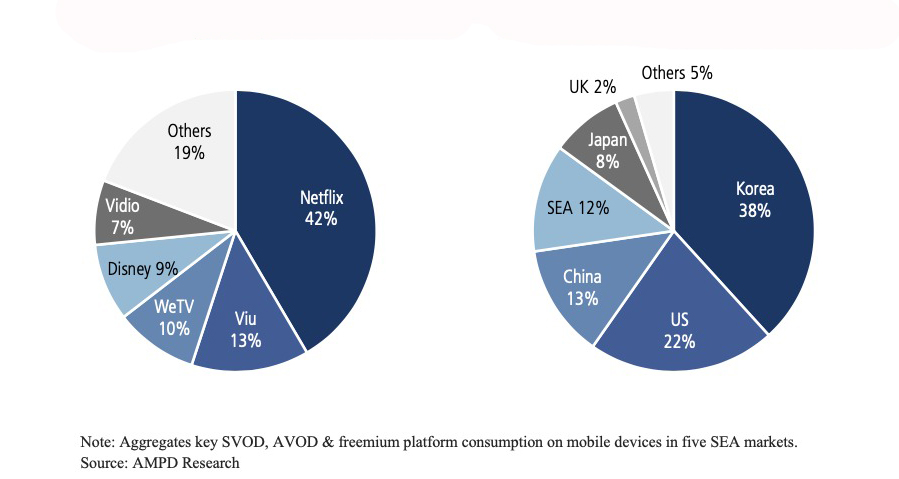

(Source: AMPD Research)

Digging deeper, Netflix led online video viewership with 42%, across all Southeast Asian markets, due to a strong marketing push in the Philippines, accompanied by a price cut, in addition to the vast library of content offered by the platform.

For its part, Disney+ Hotstar experienced a notable increase in Indonesia, where it exceeded 5 million subscribers, after its arrival in this market, becoming the first SVOD platform in this region, according to MPA.

Viu, the Hong Kong-based SVOD/AVOD service, has been able to tap into the global interest in Korean culture and is now available in 16 markets, including Malaysia, Singapore, Indonesia, Philippines, Thailand. Along with Indonesian WeTV and Vidio, it had notable success in local content, led by original titles Boys Over Flowers and F4 Thailand.

After its subscribers stagnated in the US, Amazon Prime Video launched in 11 Asian countries and achieved success thanks to critically acclaimed shows such as Transparent and Mozart in the Jungle. In addition, the enormous efforts to localize its content in Indonesia, the Philippines and Thailand drew close to 400,000 additional subscriptions.

Indonesia continues to be a scene of competition and scale for streamers. In the case of Vidio, it led the growth of regional subscriptions reflecting a solid start to the year with the transmission of the local soccer league Liga 1 and the Premier League, later with the transmission of the FIFA World Cup, ending 2022 with 4 million subscribers.

‘The launch of new packages is probably the key to boosting customer acquisition and limiting churn; along with local content, in Indonesia and Thailand, as well as American and Korean, and live sports, will generate a boost in demand from premium customers. With all this set, a boost in demand from premium customers is expected for this year,’ said Vivek Couto, executive director of MPA.

Titles that drove growth

Among the featured shows, Extraordinary Attorney Woo helped boost Netflix‘s leadership in Southeast Asia: the Korean series recorded 77.43 million hours of viewing during the week of August 22-28, 2022, topping the top 10 and being one of the most viewed series on that platform.

Big Mouth also caused a stir on Disney+, and Amazon‘s Love in Contact. The latter, starring Lee Jong-Suk, earned an average rating of 13.7 percent in its final episode, making it the most-watched drama in its time slot, and setting a new record for hit drama.

Ending 2022, original content such as WeTV‘s Love Mechanics, Netflix‘s School Tales The Series and Vidio‘s The Sexy Doctor is Mine were the highlights. Korean dramas were the most watched premium video category, with 32% of the total viewership.

In this region, we are observing how the freemium model is having great acceptance, due to the economic disparities and the limitations of the use of broadband in rural areas. Many consultancies are seeing how the local streamers that seem to be thriving are those that are trying to grow ad and subscription levels simultaneously. That is why alliances with telecommunications companies, e-commerce platforms, digital wallets and other applications are growing, since credit card penetration is low and most consumers access online videos through their mobile devices.