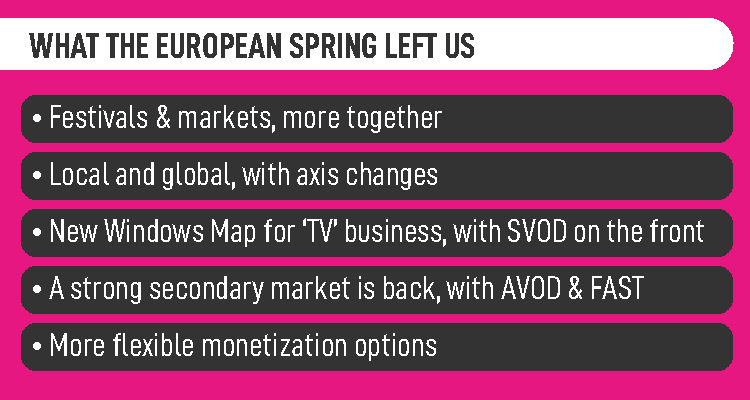

Therecent face-to-face editions of SeriesMania and MIPTV, both in France, have startedwhat can be considered to be a new era for the global content industry, with signals about what should be done in the future and also… what should be avoided.

This MIP in late April was offered jointly with CANNESERIES, a week of exhibition of French and international series with free public admission, the same format asSeriesManía, three weeks in Lille. The goal of these previews is to promote locally-produced content, as well as TV and streaming series from the rest of the world, with a U.S. participation that is not preponderant.

At MIP, this circumstance seems to have occurred by itself, as production companies from the American Union reduced their presence in France due to their current emphasis on promoting their content through digital platforms – Streaming – to the detriment of linear pay TV. This strategy is obviously not taking into account the rise of FAST (Free Advertising-Supported Television) online channels, and the rise of a secondary market for programming already exploited on linear TV and SVOD (Subscription Video On Demand). The FAST offerings aim atthe large connected audiences that are not willing to or have been unable to access SVOD, due to lack of purchasing poweror to the many platforms – between four and six services – require to sign up in order to access a reasonable content selection.

FAST systems are basedon advertising or add small subscription pricesto it;there is potential for thousands of them worldwide. And, they have an additional element that enhances them as an additional market: the thousands of ISPs (Internet Service Providers) providing internet access service thatnotice they could increase their billings by offering content to their users, on top of connectivity.

The result of all of these is the birth of a secondary market for the content already exploited on streaming or linear TV.It also adds a potential audience that has not had access to this content or is willing to see it again, such as happens many U.S. classical TV series (“Friends” is the best example, yet still successful on SVOD) and programming that has already met its share of exposure on SVOD but retains potential on free-to-air systems.

In the United States, this role was fulfilled in the past by the so-called “independent” broadcast TV channels, not affiliated with the four main networks: ABC, CBS, Fox and NBC. In the 1990’s these stations built up the market called “syndication” that fed the NATPE (National Association of Television Programming Executives) conventions; starting in 2000, they were mostly acquired by business groups, which began to sign up for the transmission licenses directly. At that pointNATPE turned to be useful to Latin American channels and the rest of the world, but the scheme failed to survive last year and the entity has been acquired by Canadian Brunico, which will return with itin Miami next January and this June organizes NATPE Budapest,aiming at the Eastern and CentralEuropeanmarkets.

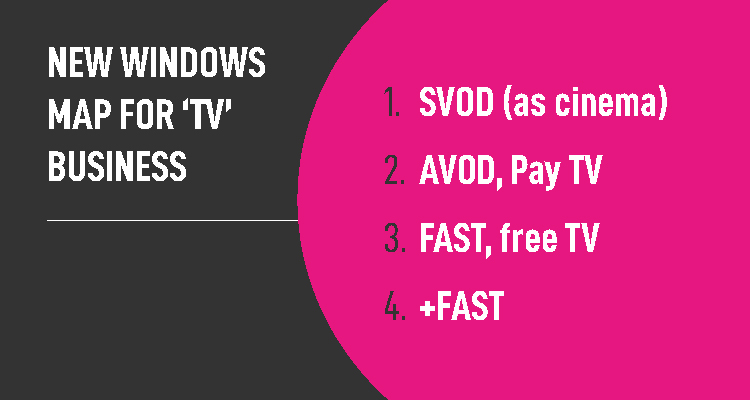

The message for the producers and distributors, therefore, is that they will have to re-adapt once again their content marketing structure, from now on, aiming to appealto a very large secondary market with little individual purchasing power. Or, more than lacking monetary power, it lacks willingness to pay a lot for a product unit in exchange forpurchasingwholesale. In the universe we currently call television, SVOD streaming will become ‘the first window’, astheaters are for motion pictures. AVOD will come a second stage (often as an addition of SVOD) and FAST and pay andfree linear TV will compound the third stage. In some cases it mightresult convenient to modify this order, but this will depend on the content, previous distribution agreements and other aspectsagreedby the producer or distributor and the different stagesin the business chain.

Whoever doesn’t accept this, will have to be very astute or will see its profitability and eventually its business decline.