Western Europe has unquestionably become one of the emerging markets within the gaming segment: it is the third largest mobile gaming market by revenue (after East Asia and North America), generating more than $7 billion of consumer spending in 2021, according to Newzoo data.

In this report, Prensario takes the most recent data from the consulting firm specialized in the gaming sector and how this region is experiencing great opportunities and developments within the segment.

At the end of 2021, Western Europe was home to almost 209 million mobile gamers. According to Newzoo’s mid-2022 update of the global gaming market report, it forecast that player growth in Western Europe would outpace other mature mobile gaming markets.

That is why the firm ensures that between 2019 and 2024, the number of mobile gamers in Western Europe will grow with a compound annual growth rate (CAGR) of +2.3% compared to +0.8% in North America. and +2.2% in East Asia.

These figures, which represent a sustained global growth rate (+4.4% 2019-2024 CAGR), are due to the high growth of gaming in emerging markets such as Southeast Asia, Latin America, India, and the Middle East and Africa.

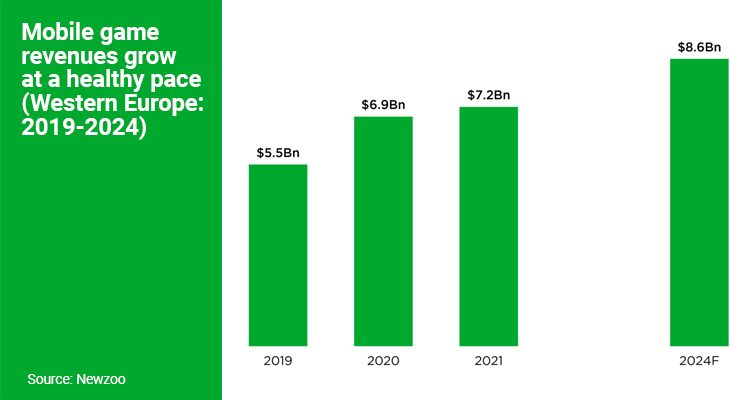

In Western Europe, mobile gaming generated $7.2 billion in revenue from consumer spending in 2021 (excluding ad revenue). Although income still grew between 2020 and 2021, growth was slower than in the pre-pandemic period, so it can be seen that the global crisis pushed this type of consumption.

In addition to the Covid-19 factor, these numbers were impacted by user acquisition on iOS due to Apple’s removal of IDFA in Q2 2021.

That is why Android mobile games in Western Europe continued to experience stable growth last year for several reasons, one of which is due to the progressive digitization and improvement of internet speeds in the world and the next due to revenue growth in Android, which was made more fruitful by the impact Apple’s removal of the IDFA had on iOS game developers.

These forecasts are positioning this market in Western Europe for long-term sustained growth, reaching $8.6 billion by 2024.

The drivers will be eSports and hybrid monetization innovation; early console and PC companies taking their franchises to mobile devices to fuel their growth and revenue streams, such as “Apex Legends Mobile” and “Diablo Immortal,” which launched on mobile last year; also complex narrative will be one of the drivers as games become more and more immersive, attracting core gamers to the platform and increasing revenue.

eSports, beyond a business in CEE

In line with what was exposed by Newzoo, new countries continue to position themselves as important markets for the eSports business.

Slovenia is one of these, and that is, the recent recognition of eSports in India, which was a very notable event early this year, a similar news came from the CEE region in last year. The Slovenian Olympic Committee, the central sports organization in Slovenia, has accepted the Esports Federation of Slovenia (EŠZS) as a member of the Association. The exact benefits of being a member of the Olympic Committee are still unclear for the local esports community, but getting governmental recognition will help in the further development of the scene.

Despite being a country with a population of around 2 million people, Slovenia has already produced some world-class esports players, such as Mihael ‘Mikyx’ Mehle, current support player for G2 Esports in the LEC, and Tai ‘TaySon’ Starčič, an 18-year-old professional Fortnite player who has already won close to $900,000 (~£729,000) on various Fortnite competitions; The country is also the home to Jernej Simončič, who won the first ever Sim Racing World Cup in Monaco in October 2022.