Historically, Asian countries were characterized by an extremely high level of local cultural consumption. Today, the audiovisual industry is seen as a lucrative investment opportunity due to the huge consumer interest gained. Media in APAC is undergoing rapid change as content and distribution evolve with the needs of consumers in fast-growing digital economies.

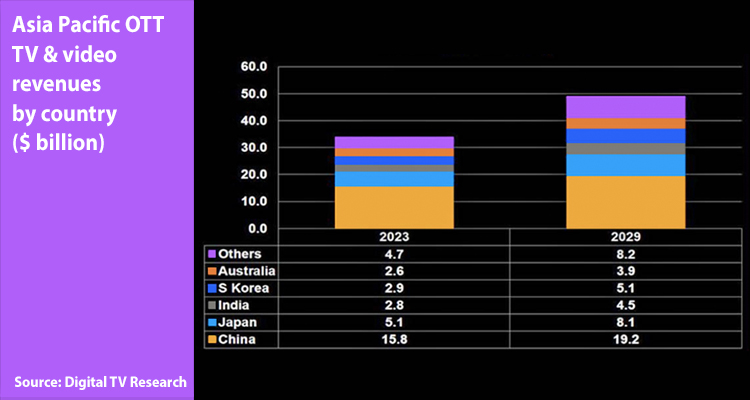

Digital TV Research‘s recent report claims that OTT revenues in the region will increase by US$15 billion by 2029: reaching US$49 billion, up from US$34 billion in 2023. This is because China, the world’s second largest market, is reaching SVOD maturity and India is undergoing SVOD restructuring. China will account for 39 percent of the region’s total revenue by 2029, up from 47 percent today; while India’s SVoD was disrupted by the conversion of Indian Premier League cricket to AVoD in 2023.

This is complemented by the figures of Mordor Intelligence, which recently reported that market size in APAC is expected to grow from USD 1.23 billion in 2023 to USD 1.55 billion by 2028, at a CAGR of 4.77% during the period. The report asserts that the growing admiration for OTT streaming in audiovisual content is positively impacting the market in the region; and major studios are observed to adopt enhanced marketing strategies with increasing investment in promotional activities.

These numbers are driving by rising trends around personalization and increasing digitization are expected to drive market growth. The overall market development in the region will be bolstered by a 5G network driven by Multi-access Edge Computing, in addition to the incorporation of emerging technologies such as artificial intelligence, cloud computing, and robots. This success is driven by substantial financial backing from central governments.

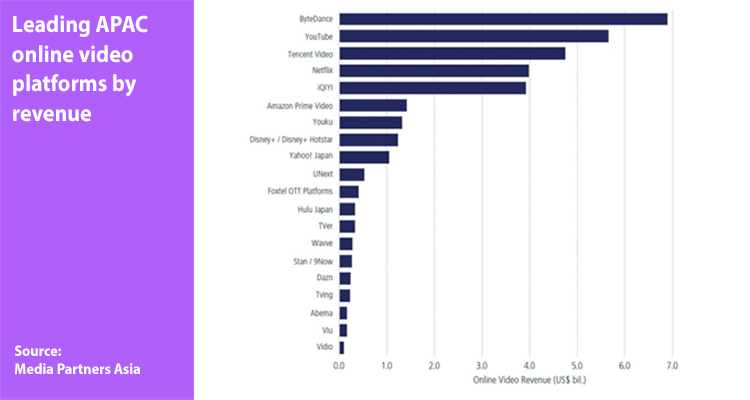

China is one of the markets that are boosting this increase due its powerfull players, online video platforms companies which reaching more than 660 million users in the last year. The segment offers a diversified ecosystem for online video content, and no service has yet come close to achieving a market share comparable to Netflix‘s 87% share in the U.S.

It is important to understand that the most popular streaming platforms do not operate in China; rather, most of the domestic market is divided among the three largest online video platforms: iQiyi, Youku and Tencent. In the past two years, with the emergence of state-backed Mango TV, Bilibili has gradually expanded from animated content to fully licensed media with a product line of film and television services.

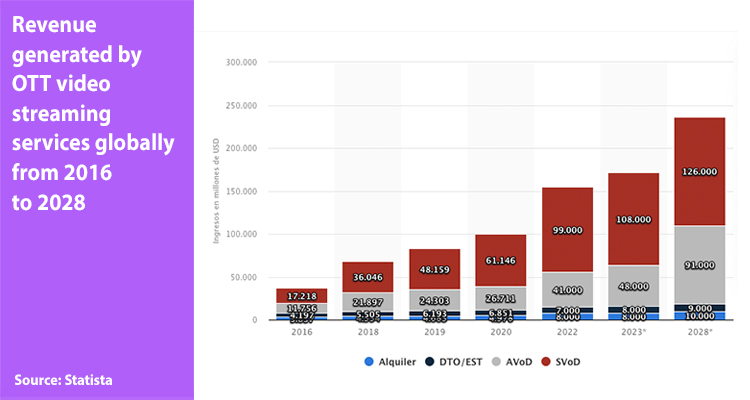

‘The U.S., Canada, Europe and MENA represent about 80% of the market in terms of revenue, but Asia-Pacific and Latin America are the regions that are emerging. They are the territories of the moment’, said Alejandro Rojas, VP of applied analytics at Parrot, at Content Americas 2023.

Meanwhile, in the Indian market, rising revenues and increasing internet penetration are expected to contribute to more sales of smart TV, online streaming subscriptions, generating growth in the market. IBEF, the size of the country’s OTT video streaming market, reached USD 5 billion this year.

According to Bain and Company‘s ‘Unlocking Digital for Bharat USD 50 Billion Opportunity’ report, India has the second largest number of active Internet users, with approximately 390 million residents using the web at least once a month. Its government’s initiatives towards digital transformation, such as the digitization of cable TV and direct-to-home (DTH) services, are also favoring IPTV adoption in the country. However, the growth of the sector faces challenges with respect to increasing competition in the market, the high cost of content creation, and the technical difficulties associated with viewing online video.

‘China is becoming the world’s leading audiovisual industry ahead of Hollywood and India. Until recently it was the world’s leading film industry in terms of production data. The impact of the platforms has clearly been positive for the globalization of Asian culture’ commented Gloria Fernandez, director of CineAsia in a dialogue with ABC.

On the Japanese audiovisual market, David Almazán, professor of the Master in Japanese Studies at the University of Zaragoza, said: ‘The Japanese market abounds in a phenomenon called «crossmedia«, a commercial strategy that links content in various media so that any project can be transformed into a manga, anime, novel, film or video game, which multiplies the marketing channels and intertwines them.