The global advertising market continues to grow and recover after the ravages of Covid-19. In the case of the countries of Central and Eastern Europe, GroupM predicts that the segment will grow by 4.5% this year, however it will be inferred with respect to other Western European countries.

According to the consultant, in a report that analyzes the situation in the Czech Republic, Hungary, Slovakia, Romania, Croatia, Serbia and Poland, this growth will be less than the 6% registered in 2022 and adds that it will be less than the current economic situation and associated uncertainty. to investment in marketing in certain countries.

Being one of the largest markets in this region, Poland is one of the countries whose advertising segment will grow more slowly than others this year. Traditional media advertising revenue will increase by 0.5% according to current estimates compared to 2022 figures, and will amount to just over PLN 12.6 billion (EUR 2.69 billion). The smaller markets in the region, such as the Czech Republic, Hungary, Romania and Croatia, will continue to maintain a growth rate of several percentage points in this year.

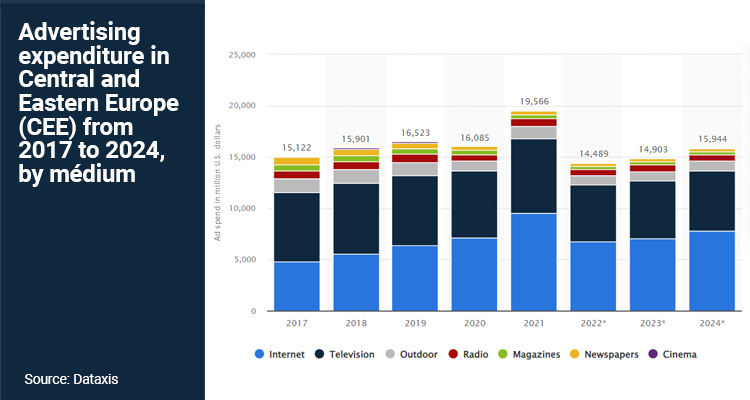

Meanwhile, in the next two years, GroupM expects only minor changes in the various areas of the regional advertising business between individual outlets. Digital advertising share alone in 2022 passed the 50% mark in CEE, while globally it was already at 73%. These statistics include the digital extensions of traditional media, that is, the income obtained by radio and television stations, newspaper networks, or digital advertising on streaming services, applications or websites.

Digital media have the share of the advertising pie in Poland, Slovakia, the Czech Republic and Hungary, while the lowest is recorded in Serbia and Croatia (below 40%).

GroupM also analyzes the relationship between the size of GDP and GDP per capita and the size of advertising spending: In only two markets in the region, the Czech Republic and Slovakia, media advertising revenue slightly exceeds 0.5%. of GDP at current prices (in Poland it was 0.4%; size of GDP is based on data from the European Commission).

This relationship that consutancy analizes is influenced by both the wealth of individual markets and the state of their advertising sectors: the level of competition or concentration within media owners.

In addition, the consultancy observed a relationship between the size of GDP per capita in individual markets and the size of advertising spending per capita in individual countries. The level of wealth of the inhabitants is clearly correlated with the investments that advertisers make to reach them.

Commenting on the report’s findings, Izabela Albrychiewicz, CEO of GroupM Poland and CEE group leader at the consultancy, said: ‘In this context, Poland’s position can be puzzling. The annual Ad Per Capita in the Czech Republic is almost twice that of Poland, while the Czech GDP per capita exceeds the Polish by less than half. Considering the number and purchasing power of Polish consumers, we are certainly not a market that invests heavily in advertising’.

‘In the coming years, we will develop faster than Western economies, according to the forecasts of the European Commission, and the historically low unemployment rate in the region leads to think of CEE as a safe place for investments, even advertising . Consumers continue to be good customers of the retail, telecommunications and FMCG sectors, but also, given the stability of employment and wage dynamics, of the durable goods sectors such as electronics, furniture and the automotive industry’, concludes Albrychiewicz.