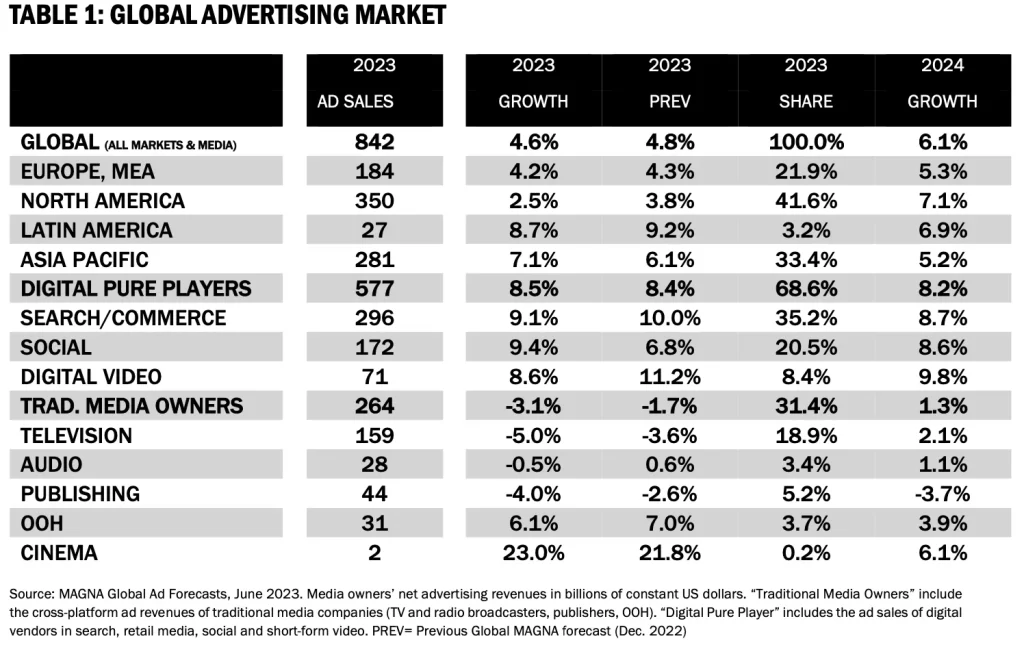

The APAC region has become an advertising powerhouse, outperforming global average growth rates and driving the expansion of the advertising economy, according to Magna‘s latest report this year. The consulting firm ensures that global advertising revenue for media owners is expected to reach $842 billion by the end of this year, marking a growth of 4.6% compared to 2022.

The consultancy highlighted that despite a ‘slight’ downward adjustment with respect to the previous forecast, this report indicates that the deterioration of economic conditions in Western markets is balanced by higher than expected growth in key regions, vertical sectors industry and specific media types.

In contrast, APAC’s advertising economy is expected to grow by an impressive 7%, surpassing the global average of 5%. ‘This is mainly due to India and Pakistan; the former saw a notable 12% increase in ad spend. Digital continues to dominate’, commented Leigh Terry, CEO of Mediabrands APAC.

The advertising segment that has driven these numbers in APAC continues to be digital advertising, with social and video formats experiencing significant increases of 12% and 11%, respectively.

Although it already represents a substantial 47% of the total digital budget, Magna expects search to grow by 9% and, along with social media formats, will continue to be the dominant advertising formats. ‘With search/commerce approaching the $300 billion mark and social media growing 9.4%. Mobile advertising campaigns drive much of the digital growth and make up almost 84% of unlimited digital budgets, and are expected to increase by 2024, representing 86% of unlimited digital budgets,’ said the exec.

‘Digital advertising in APAC has slowed significantly in 2022 and 2023 compared to the pre-2022 trend, but remains resilient and continues to lead all formats for advertising revenue growth’.

Magna highlighted that many of the obstacles that ‘held back’ digital advertising revenue growth in China in 2022 (zero COVID policy, continued government regulation hurdles, etc.) are easing in 2023 and are allowing large publishers digital continue to grow.

They also showed that exclusively digital advertising sales grew by 8.5% worldwide, reaching $577 billion and representing 69% of total advertising sales. This growth is driven by factors such as e-commerce, retail media, changes in media consumption patterns and the stabilization of the data landscape.

For its part, traditional media continues to decline globally, as traditional media companies and branded formats face significant challenges, and platform owners face a 3% decline in advertising revenue, which amounts to 264 billion dollars.

Meanwhile, television advertising, in particular, is challenged by the erosion of linear viewing, a slowdown in pricing conditions and the absence of major cyclical events. Television advertising revenue is expected to decline by 5%, while editorial advertising sales will fall by 4%.

Less conventional media such as audio advertising appear to be holding steady, but media categories such as film and print will continue to decline.

Finally, outdoor advertising, however, they argued, shows ‘promising’, with a projected growth of 5%, reaching the pre-COVID market size.

On the other hand, sales of unconventional digital advertising, such as addressable linear campaigns and AVOD pre-rolls on connected televisions, have logically continued to grow.

Finally, as perspectives for 2024, the consultancy expects that the expected economic stabilization and the return of important cyclical events will accelerate advertising investment by 6.1% worldwide. ‘While the North American and European markets are expected to benefit from this growth, the APAC markets, especially India and China, will continue to expand,’ she concludes.