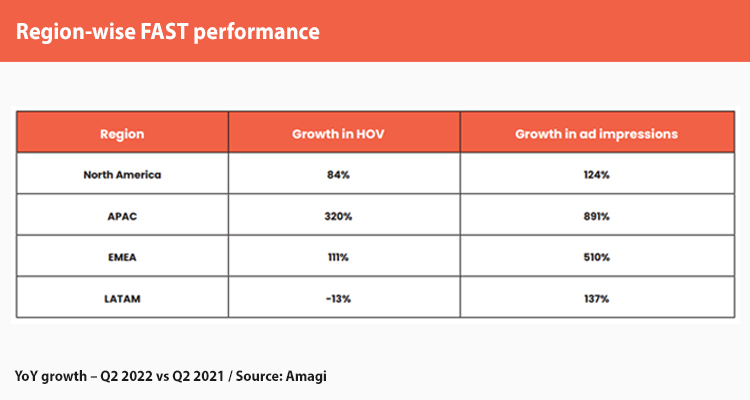

The Asia Pacific (APAC) market has been experiencing the fastest growth in FAST business so far this year, with a 290% increase in ad impressions and views and a 181% increase in hours on view (HOV).

This data was contained in Amagi’s recent report, where it also stated that while the USA is expected to remain the largest FAST market, the region experienced relatively moderate growth during the period, with a 20% increase in impressions of ads and 12% on HOV. For its part, Latin America remains a competitive second and EMEA third after APAC in terms of growth, underscoring the importance of expanding FAST’s offerings globally.

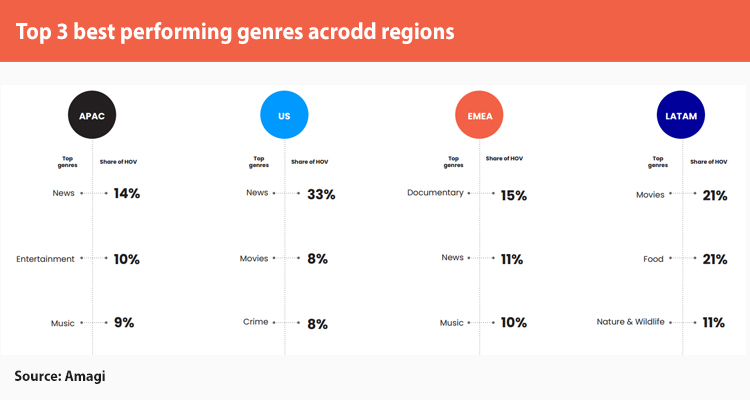

Among the drivers of FAST channel consumption are news channels, which have a large audience in APAC and the USA. Compared to other genres, news channels generated more global (40%) and HOV (37%) ad impressions. In fact, at this point, both regions have recorded similar viewing percentages.

Meanwhile, the FAST segment remains a promising business in EMEA and LATAM, especially for its movie channels: from Q2 2022 to Q2 2023, LatAm saw 174% growth in ad impressions and 20% growth % in HOV, while EMEA saw a 64% increase in ad impressions and a 58% increase in HOV. Interestingly, movies contributed the most to ad impressions and HOV in both regions, indicating a clear preference for this genre.

These figures are due to the fact that these genres have brought back family or group viewing, returning to the traditional ways of watching television at home.

Content recommendations present challenges and opportunities: Approximately 70% of those surveyed by Amagi reported experiencing confusion about what to watch next on CTV platforms. However, only half of respondents who receive recommendations from their CTVs said the suggestions were helpful, suggesting more needs to be done to improve content discovery on FAST and CTV.

Personalization

One of the differentials of the FAST platforms is personalized advertising, which has become a pressing need: only around 19% of respondents found ads relevant to their interests, 24% reported that they prefer interactive ads and 22 % made a purchase from an ad with an interactive or shopping feature. These statistics demonstrate that improving personalization, interactivity and sophistication in CTV advertising should be a top priority in the industry.

KA, co-founder and chief revenue officer of Amagi, said: ‘As we delve deeper into the insights and data presented in the latest edition of this report, it is clear that FAST is not just there; is thriving, expanding, and reshaping the way viewers consume content. FAST’s remarkable growth on a global scale is both an opportunity and a testament to the evolving preferences of the modern viewer. With FAST 2.0 on the horizon, we are entering an era where personalization, interactivity and innovative advertising formats will be key to creating a truly dynamic and engaging linear television experience. We invite broadcasters, content owners and advertisers to join us on this exciting journey in which we are redefining the future of television.