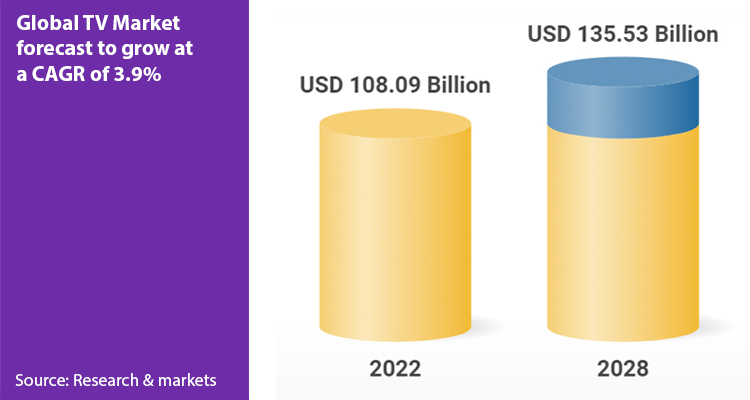

The global television market is undergoing an unprecedented transformation, with projections indicating exponential growth in the coming years. According to recent data from Business Wire, it is estimated that the market will have substantial growth that will exceed USD 135 billion by 2028, this is complemented by the market for display devices reaching a value of more than USD 200 billion by the year 2030. This phenomenal growth, driven by technological advances and changes in consumption patterns, is redefining the way we interact with visual content.

Streaming services drive TV evolution

Streaming platforms have become the undisputed protagonists of the entertainment landscape. The consultancy highlights that the exponential growth of services such as Streamflix, Prime Video Plus and Disney+ is changing the way we consume audiovisual content in all global markets. This paradigm shift has led to a decline in traditional cable and satellite television subscriptions, with an increasing number of users preferring the convenience and flexibility offered by streaming platforms.

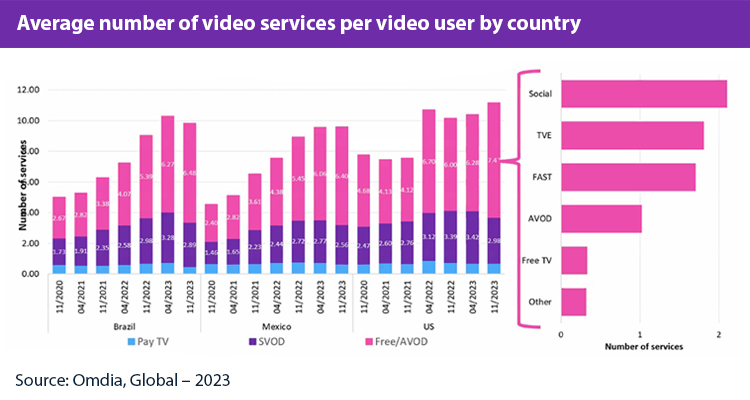

The streaming models that consume the most continue to vary. Although streaming is in great demand, the advertising-based model is gaining great importance in homes, driven by enormous personalization, but also by the TV experience similar to that of traditional TV. Even Television manufacturers are adapting to this trend, with a focus on seamless integration with streaming platforms. Televisions now feature dedicated buttons and user-friendly interfaces for convenient access to popular streaming services, and have already become platform distributors and essential partners for streamers.

Platform interfaces go hand in hand with television manufacturers. Samsung and Hirense are focusing their efforts on developing screens that seamlessly integrate these streaming platforms. Even voice assistants are emerging as important allies for services, functioning as convenient solutions to maintain and retain subscribers.

Asia-Pacific’s Role in the screen revolution

The Asia-Pacific region is emerging as a key driver of audiovisual market growth. With an increase in urbanization and purchasing power in countries such as China, India and South Korea, the demand for televisions and other display devices is on the rise. Consumers in the region are increasingly looking for larger, higher-quality screens to enjoy multimedia content, from movies and television shows to live sporting events.

“Improved connectivity and rising connected TV penetration, combined with the growth of local creator economies, investment in premium local content as well as the wide availability of premium sports streaming, will continue to drive dollars and eyeballs online,” says MPA’s managing and executive director Vivek Couto.

Asia’s video industry is set to grow by an annual 2.6% over the next five years to reach $165 billion by 2028, says a new study from research and consultancy firm Media Partners Asia. That follows 5.5% growth in 2023.

Adoption of 4K UHD technology is growing rapidly in the region, with increasing demand for televisions that offer exceptional picture quality. 4K displays offer four times the resolution of Full HD displays, resulting in sharper, more detailed images. This demand for image quality is driving the production of content in 4K resolution, with streaming platforms and content production companies offering more and more content in this quality.

Europe, opportunities for FAST and AVOD

Advertising-based streaming platforms based in Europe continue to grow, driven by the FAST and AVOD model. According to projections by Statista, revenue in Europe’s FAST market could pass $490 million in 2024. Compare that to America’s $1.3 billion market, which is projected to triple in five years. This change is led, for the most part, by public television stations, which are developing platforms based on advertising.

The European market for FAST services continues to show fragmentation compared to the more consolidated landscape in the United States.

In Europe, competitors like Samsung TV Plus, Rakuten TV, LG, and Rlaxx are vying for market share alongside well-known names such as Pluto TV and Freevee.

Data from the 3Vision FAST Tracker reveals that nearly 1,200 distinct FAST channels are active across the EU5 countries (Britain, France, Germany, Italy, and Spain), operated by 243 different channel owners. While the market remains fragmented, there are indications of improving quality. For instance, Germany experienced only a 6% increase in new channels in 2023, suggesting a shift towards prioritizing quality over quantity in programming.

Industry analysts anticipate that the availability of premium content will be a key driver of growth in Europe’s FAST ecosystem moving forward.

Tech advances as great allies

4K UHD TVs are dominating the global market, offering unparalleled picture quality with four times the resolution of Full HD screens. Decreasing manufacturing costs have made 4K TVs more accessible to consumers, while advancements in display technology like High Dynamic Range (HDR) have enhanced visual quality. The availability of a vast library of 4K content on streaming platforms has been a key driver of adoption.

Screens with this technology have also begun to emerge in medium sizes, and are boosting the consumption of platforms, as they offer a perfect balance between size and comfort, being large enough to offer an immersive viewing experience, but compact enough. enough to fit most living spaces. Additionally, these displays are more affordable compared to their larger counterparts, making them popular among a wide range of consumers.