The Center National du cinéma et de l’image animée (CNC) recently reported the intricacies of the French audiovisual animation industry and examined several aspects including funded animation production, the volume of animation content produced, associated costs, and the contributions of television channels alongside other financiers.

The international presence of French animation underscores its export success and the burgeoning involvement of foreign partners in production due to the consumption of the genre on television and digital platforms, where it notes shifting consumption trends. ### Key

Altrough the notable slowdown in 2022 both funded animation production and the number of hours of animation content produced, the industry is reverting to levels similar to those of 2015. This marked a significant shift from previous years, which had seen consistent growth in production. Despite this decline in volume, the quality and complexity of productions remained high. In that sense, the investment per hour and the creative and technical efforts remained substantial. This shift reflects the industry’s adaptation to current market challenges, prioritizing quality over quantity and focusing on productions distinguished by their innovation and artistic value.

French television channels continue to play a crucial role, although there is a discernible trend towards reduced investments. Conversely, contributions from the CNC have increased over the last decade, reflecting an evolving financing landscape where international partners are playing an increasingly significant role.

International presence of French animation

French animation has continued to bolster its international presence, emerging as a leader in the global animation export market. This growth has been partly fueled by the appeal of international tax credits. The CNC reported various international incentives: ‘Spain offers the foreign producer a 20% deduction on expenses incurred during the film activity provided these amount to at least one million euros. The total aid cannot exceed three million per film. France, on the other hand, returns 30%, requires a minimum expenditure of 250,000 euros, and deducts up to 30 million per film. Canada returns 45% without requiring a minimum expense’.

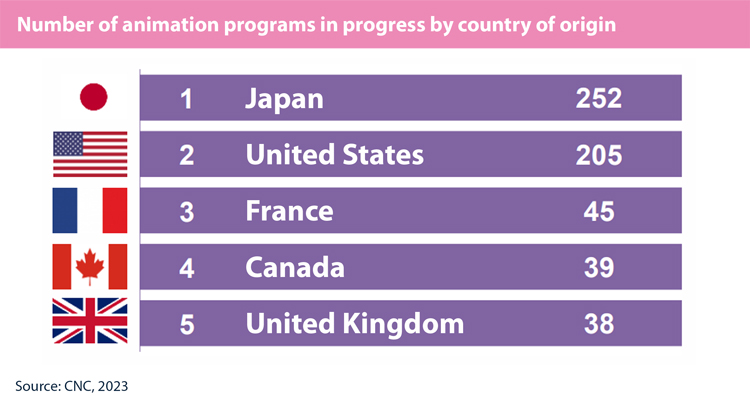

In 2022, 52 animated works were approved for the international tax credit (C2I), with 41 audiovisual works generating expenditure in France. France has consolidated itself as the third country with the most announced animation programs in the last 12 months (first in Europe), following the United States and Japan, and ranked as the fourth best-represented production internationally.

France not only retained its position as the leading exporter of animated content in Europe but also saw significant growth in foreign participation in animation production. In 2022, foreign financing contributions amounted to 44.2 million euros. This rise in international collaboration underscores the global appeal of French animation.

Consumption on different platforms and changing consumer trends

Animation consumption in France is undergoing significant changes with the diversification of viewing platforms. While television remains an important medium for animation, the viewing time for animation has halved over five years on national networks, particularly among children’s audiences. In contrast, digital platforms such as streaming services and video on demand (VOD) are rapidly gaining traction, with the number of animated episodes available on these platforms increasing 2.3-fold in five years. This shift towards digital platforms reflects the industry’s adaptation to modern viewing habits.

Moreover, there is a growing trend towards shorter formats and content specifically designed for children on digital platforms. This trend highlights the industry’s responsiveness to the evolving preferences of its audience, ensuring that it meets the demand for more flexible and accessible viewing options.

A comprehensive vision of current and future trends

The French animation industry is characterized by its adaptability and dynamism, maintaining a strong presence in both local and global markets. Nationally, the industry faces challenges such as decreased production volumes and shifts in consumer trends towards shorter and digital formats. Internationally, French animation continues to solidify its position as a major exporter and a valuable partner in co-productions, demonstrating its attractiveness and global competitiveness.

These trends indicate a future where French animation will continue to innovate and adapt, sustaining its reputation for quality and creativity. The industry is poised to respond effectively to the changing demands and opportunities of the global market, ensuring its continued success and relevance in the years to come. As articulated by a CNC spokesperson, ‘The evolution of French animation is a testament to its resilience and capacity for innovation. While the market dynamics are shifting, the core values of quality, creativity, and artistic excellence remain steadfast’.