The global advertising market is undergoing a transition to digital. Traditional TV advertising, while still relevant, is losing ground to advertising on video and social media platforms. Companies such as Meta and TikTok will continue to be key players in this new scenario, while the rise of connected TV marks a promising future for advertisers seeking to adapt to the new demands of the digital consumer.

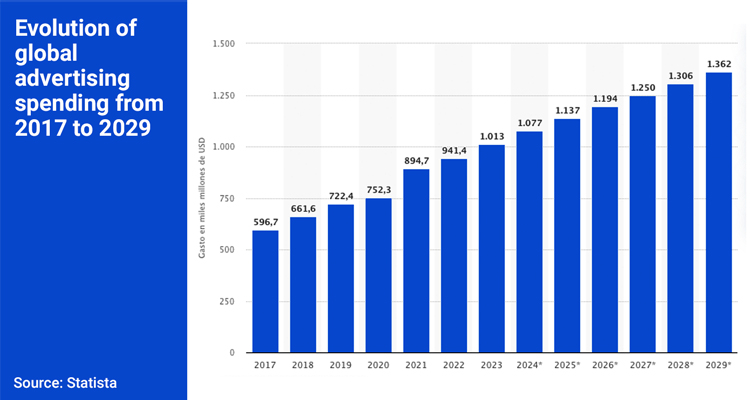

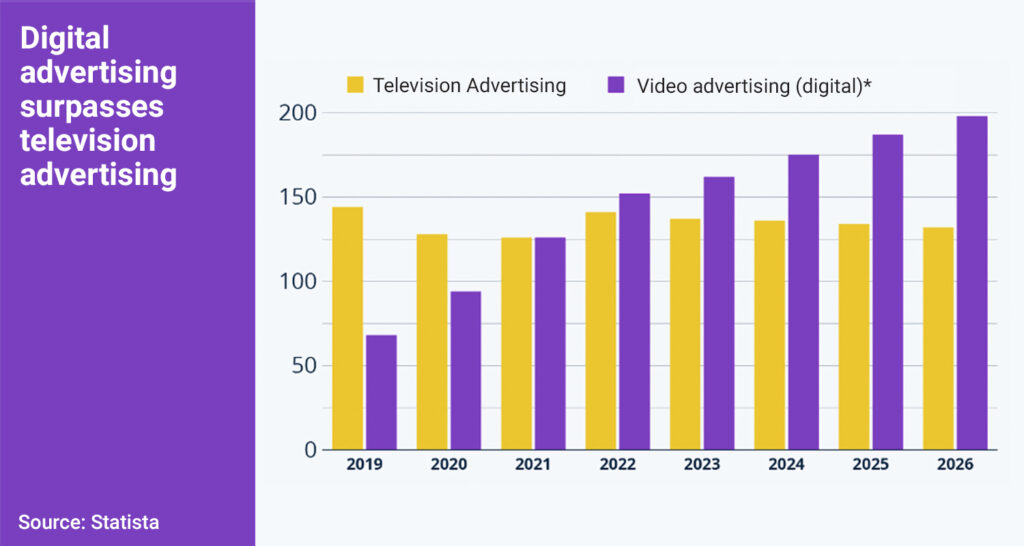

According to the World Advertising Research Center (WARC), total spending is expected to reach $1.07 trillion in 2024, representing growth of 10.5% over the previous year. This growth is largely due to the rise of digital advertising, which has overtaken traditional TV advertising for the first time. WARC’s projections anticipate an additional 7% increase for the years 2025 and 2026. This report has been supported by the analysis of James McDonald, WARC’s director of data and intelligence, who highlights the role of big tech in this process.

The dominance of large technology platforms such as Alphabet, Amazon and Meta has been crucial in this growth. These companies will attract 43.6% of all global ad spending by 2024, accounting for more than half of all ad revenue outside of China. Advertising on digital platforms has proven to be an effective investment for advertisers, primarily due to their broad audience reach and accurate targeting capabilities. The report highlights how the rapid growth of Meta and the rise of Amazon in the advertising business continue to shape the global landscape.

One of the sectors that has experienced significant change is connected TV, especially through AVOD and FAST platforms. This segment should generate $35.2 billion in revenue this year, accounting for two-thirds of the growth of the digital video market in 2024. By 2025, all of the growth in the video market is expected to come from these platforms, highlighting the transition from traditional to digital formats.

Despite this shift to digital, the report notes that traditional TV advertising continues to play an important, albeit declining, role. In 2023, spending in this segment declined by 1.2% to €100 billion, reflecting increasing audience fragmentation. Brands are investing more in reaching users on multiple platforms, which is negatively affecting conventional TV advertising. However, some regions, such as Asia-Pacific, continue to show growth in TV spend due to factors such as rapid economic development and urbanization.

Moreover, social networks continue their rise as a dominant player in the advertising market. They are expected to generate $241 billion in ad spending by 2024, accounting for 22.6% of the global total. Meta, with a 62.6% share, continues to lead this segment, but TikTok is emerging as a strong competitor. ByteDance, the company that owns TikTok, has increased its share of the social networking market to 20%, a remarkable growth from 9.3% in 2019. Despite this, TikTok’s future in the U.S. is in doubt due to a potential ban, which could affect its access to a key audience: U.S. teenagers.

On another hand, Dentsu predicted that global advertising investment growth would be 4.6% in 2024, reaching US$752.8 billion. While this forecast is more conservative compared to other sources such as GroupM, which forecasts growth of 5.3%, and Magna, with an estimate of 7.2%, it is mainly due to global economic uncertainty. Factors such as inflation, international conflicts (e.g., war in Ukraine and tension in the Middle East) and fluctuating media prices have influenced these projections.

One of the fastest growing sectors projected is connected TV, with an increase of 30.8% by 2024. This growth is driven by the launch of new ad offerings on video platforms and increased advertiser adoption. In addition, digital will continue to be the main driver of advertising spend, with an estimated 6.5% increase by 2024, reaching $442.6 billion, accounting for 58.8% of global ad spend.