There is no doubt that digital consumption in Latin America continues to grow, but now not only driven by the major streaming players, but also by smaller local actors, including regional broadcasters, mobile operators, and even new entrants in the streaming landscape.

One element that is undoubtedly changing consumption habits is Connected TV (CTV), which refers to audiovisual content or services streamed over the internet to TVs or external devices connected to them. This model has experienced accelerated growth in Latin America and Central America in recent years, marking a significant transformation in audiovisual consumption habits in the region. Many established and new players are joining this trend, seeking to capitalize on the wave, sometimes as a complement to traditional TV.

Some of the things that contributing to this growth is the TV manufacturers, who now include operating systems that support, in addition to SVOD services, FAST channels, and smaller streaming services, some of which are ad-supported.

According to the latest study by ComScore focused on the CTV segment, 55% of the online population in Latin America identifies as a “CTV Watcher,” a significant increase from the 41% in a study conducted by the consultancy in 2022. This represents a 35% YoY increase, covering over 200 million people in the region.

Additionally, nearly one in six households with CTV in the region has at least four devices (Smart TV, video game console, set-top box, or streaming device). This means that 16% of households in Latin America have all four devices, with the Smart TV being the primary way to watch TV.

Consumers in this region have clearly shifted toward streaming platforms and other connected TV services, in some cases complementing traditional cable television models. “This phenomenon is partly due to the search for more personalized experiences and the growing availability of local and global content through CTV apps. The ability to access content anytime, anywhere has been a key advantage for the expansion of these platforms,” said ComScore.

Countries with the highest growth in CTV adoption include Brazil, Mexico, and Argentina, where a significant portion of the population already has access to smart devices. These countries represent a major opportunity for advertisers, as the AVOD model has gained ground, allowing brands to reach specific audiences through targeted ads.

YouTube, PlutoTV, Facebook Watch, and TikTok are some of the most consumed free services in the region. The consultancy reported that in the last month, 95% of CTV households watched content on at least one of these platforms. Meanwhile, 87% of respondents said they watched programs from at least one of these brands several times a week.

However, it is not just these services; other players also coexist in the market, even if they don’t have pan-regional mass appeal, having launched locally to meet specific consumption habits. These include ViX from TelevisaUnivision (launched in 2021), Tubi from Fox Corporation (launched in 2014), Canela TV from Canela Media (launched in 2022), RCN Total from Canal RCN in Colombia and Caracol Play from Caracol TV both in Colombia, TVPeru Play, part of the National Institute of Radio and Television of Peru, TVN Pass from TVN Panama, Azteca Now from TV Azteca in Mexico, and many others.

Challenges and opportunities for advertisers

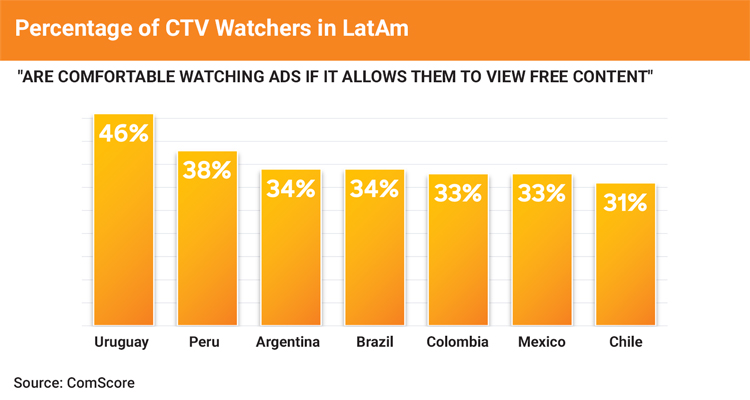

Despite the exponential growth, advertisers in the region still face challenges in fully leveraging the potential of Connected TV. The market’s fragmentation and platform diversity complicate audience measurement and the implementation of unified marketing strategies.

Nevertheless, the increasing adoption of technologies such as programmatic TV and data-based segmentation is helping advertisers overcome these barriers, allowing for more precise ad personalization based on viewing habits and consumer preferences.

In fact, many services are investing in offering better and broader solutions and opportunities for advertisers. The fact that more TV manufacturers like Sony, LG, and TCL are joining the trend of incorporating NEXTGEN TV-compatible technology into their devices opens up new opportunities for the advertising market. This technology not only enhances the visual and audio quality of content but also enables greater interactivity between users and ads, leading to more effective advertising impact.

Some services, such as Mercado Play (Mercado Libre‘s AVOD service), Disney+ with its AVOD tier, or Tubi, are using technology that allows advertisers to track the performance of their campaigns. As a result, more advertisers are relying on streaming as a real lifeline in light of the decline in advertising spend on traditional TV.