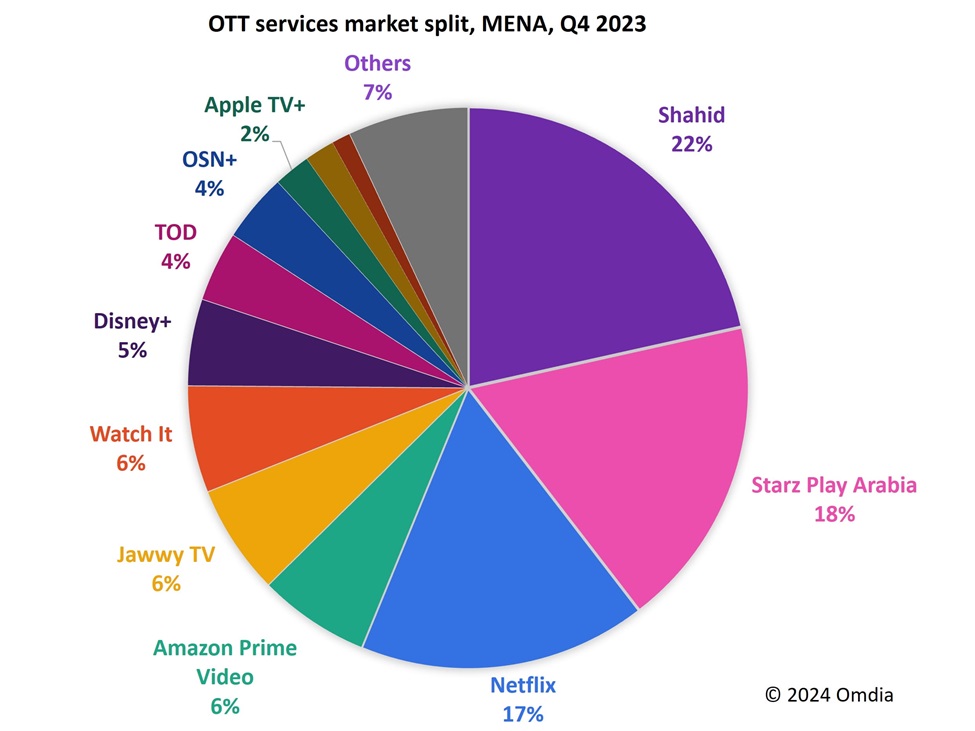

MENA is one of the regions that, like Latin America, has also been experiencing unprecedented growth (especially visible last year), with revenues exceeding $1 billion. According to media analysts Omdia, this figure is expected to increase by another 13%, reaching $1.2 billion by the end of this year. Leading the charge in this rapidly evolving market are two major streaming players: MBC‘s Shahid and StarzPlay, each employing unique strategies to capture the attention of regional audiences.

Shahid, part of the MBC Group, holds a commanding 22% share of the MENA streaming market, translating to 3.6 million subscribers by the end of 2023. The platform’s success lies in its extensive library of local Arabic content, which resonates deeply with audiences across the region. This focus on Arabic programming, especially during key periods like Ramadan, has allowed the platform to maintain its dominant position in the market.

Specially Ramadan remains the peak season for drama consumption, and Shahid, along with other platforms like ADTV and Watch IT, experiences a surge in viewership during this time.

However, MBC‘s platform appeal is not limited to seasonal trends. The service’s year-round content production strategy has helped mitigate the fluctuations in subscriptions typically seen after Ramadan. By providing a steady stream of high-quality Arabic content, Shahid has reduced subscriber churn and maintained a strong connection with its audience, making it the top choice for MENA viewers.

StarzPlay is not far behind. The only Lionsgate streaming unit alive has an 18% market share and 3 million subscribers, and successfully carved out a niche by identifying and addressing content gaps in the region. Its strategy of offering exclusive and diverse content, including popular international series and sports events, has given it a competitive edge.

The Lionsgate service has particularly focused on securing rights to major sporting events, which has proven to be a key growth driver. In September 2023, the platform gained exclusive rights to broadcast the Cricket Asia Cup, and past March, the OTT aired the Six Nations rugby tournament. These sports offerings, combined with its exclusive streaming of hit shows like The Walking Dead: Dead City, have positioned StarzPlay as a go-to platform for both entertainment and sports fans.

Another significant development for StarzPlay is the launch of its AVOD and FAST tier, Starz On. After a soft launch in November 2023, the service had its debut past March. This move into ad-supported content is expected to further bolster StarzPlay‘s market position, offering advertisers new opportunities to reach MENA audiences.

Future prospects

The MENA region’s OTT market growth highlights the increasing demand for digital entertainment. Strategic partnerships and bundling options have made streaming services more accessible, while also expanding content diversity. This trend is expected to continue, with Omdia forecasting steady revenue increases in the coming years.

At CABSAT 2024 in Dubai, Maria Rua Aguete, Senior Research Director at Omdia, emphasized the growth potential in the MENA region. ‘The top three players—Shahid, StarzPlay, and Netflix—each have unique strategies and complementary offerings. In the advertising space, FAST is currently limited in this region, but we anticipate significant growth over the next four years, with global players like Samsung entering the market’.

FAST channels in the MENA region generated $7.2 million in revenue in 2023, but this is just the beginning. With the expected entry of more global players and increasing adoption of programmatic advertising technologies, the market for free, ad-supported content is poised for rapid growth. Online video advertising, in particular, represents one of the most significant opportunities for expansion in the region, providing brands with a platform to reach specific audiences at scale.