Base on a recent webinar organized by the Argentine Chamber of Advertisers (CAA), featuring Pablo Verdenelli, CEO of Seenka, it was discussed the rise of new «electronic communication media» in the LatAm country.

These new platforms, commonly referred to as «streaming channels,» utilize YouTube and Twitch to reach audiences that are estimated to be resistant to tuning into traditional linear TV. They have caught the attention of advertisers for their ability to reach younger, digitally native audiences, particularly Gen Z, who tend to avoid conventional advertising but still possess significant purchasing power. Through tracking tools on social networks, Seenka collects data on subscribers, advertisers’ usage, and viewers of on-demand shows, providing a clearer picture of audience engagement post-broadcast.

According to August data, seven major streamers were identified: Olga, with 1 million subscribers; LuzuTV, with 1.5 million; Urbana Play, with 700,000; Vorterix, with 600,000; Blender and Gelatina, with 400,000 each; and Neura and República Z, with 150,000 each. The dominant programming consists of talk shows and interviews, resembling a “radio with images” format. While not a new concept—it was tested in the United States years ago—it has recently garnered attention from viewers, advertisers, and media outlets in Argentina, standing out in the region as a potential alternative to traditional linear TV. Some analysts view this as a form of rebellion by talents who feel underappreciated or unsupported by free-to-air and pay-TV networks.

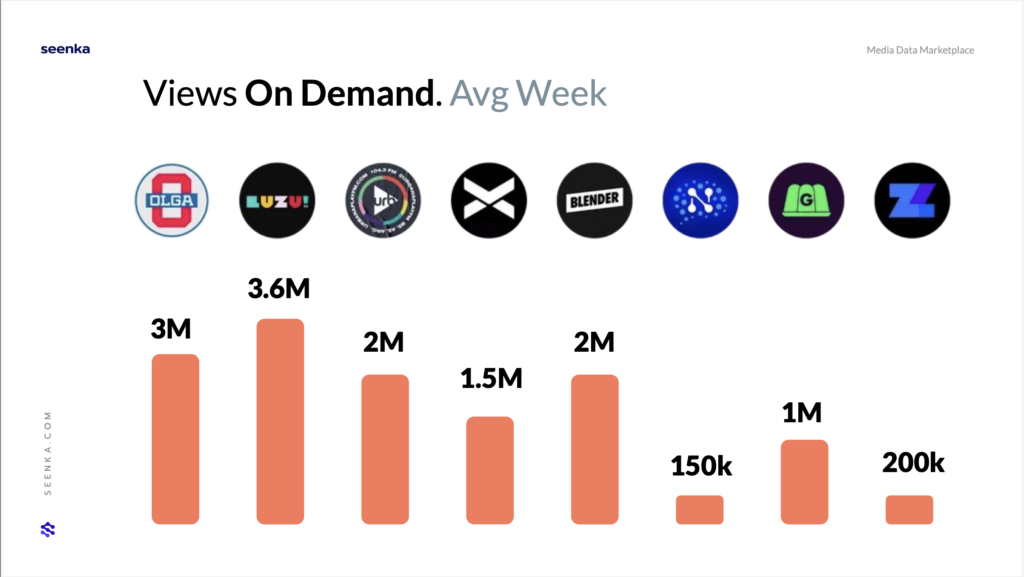

The average weekly on-demand viewership following the live broadcasts showed Olga with 3 million views, LuzuTV with 3.6 million, Urbana Play and Blender with 2 million each, Vorterix with 1.5 million, and Gelatina with 1 million. República Z registered 200,000 views, while Neura had 150,000.

Seenka highlighted Olga due to its theoretical advertising revenue, which surpassed that of LuzuTV. In August, Olga’s estimated gross revenue—calculated based on each medium’s advertising rates and detected ads—was around 1.1 million USD, compared to LuzuTV’s 472,000 USD and Urbana Play’s 71,870 USD. Olga featured 91 brands with 329 ad spots, while LuzuTV had 78 brands with 264 ad spots.

The report also offers comparative figures—always following the same methodology—for radio, free-to-air TV, and linear pay-TV (also known as “cable”), along with advertising investments from industries like Banking and Finance, Retail, Beauty and Cosmetics, Alcoholic Beverages, Textiles, Clothing and Accessories, and Telecommunications. It breaks down the gross investments made by each sector in August and their share of the total across different media platforms.

In terms of brands, the top advertisers in streaming during August were Mercado Libre (67,000 USD), Mercado Pago (59,000 USD), and Supermercados Día (almost 44,000 USD), with Cabify ranking seventh and showing a significant increase compared to its previous investments.

One of the challenges faced by these “electronic media” is the limited availability of advertising slots. Due to their ability to manage fewer conventional commercials, they tend to focus on product placements (PNTs) and screen overlays, as the traditional ad break is deemed unbearable by digital natives.

Despite the growing popularity of these “streaming channels,” advertisers are still assessing the effectiveness of their investments. The report includes cases where ad spending increased or decreased from July to August, likely reflecting each advertiser’s perception of results or their willingness to experiment with this new medium.

One key factor to consider is the better accessibility these “streaming channels” offer via mobile phones compared to traditional TV. This complements the aforementioned indifference of digital natives towards linear channels, as they tend to spend only 3 to 5 seconds deciding whether a program is worth watching. Traditional TV faces challenges in keeping up with these quick decisions, though similar approaches are being tried in other countries.

Additionally, these “streaming channels” are competing with “influencers.” Verdenelli posed the question, “Are they worth what they cost?” In his view, “the cost per contact point is still high compared to an influencer.” Furthermore, “70% of the investment is focused on a 2-to-3-hour block per day, without any guarantee of the exact time of airing.”

He also noted that, for now, YouTube and Twitch have not intervened in the matter, merely serving as distribution platforms. It remains uncertain whether this will continue to be the case in the future.