2024 proved to be a transformative year for the sports industry, with record-breaking deals, shifting media consumption, and evolving sponsorship trends—but not without significant challenges. According to a comprehensive report by Ampere Analysis, the year showcased both the industry’s resilience and its growing pains, particularly in media rights and sponsorship.

The Streaming Takeover and Its Consequences

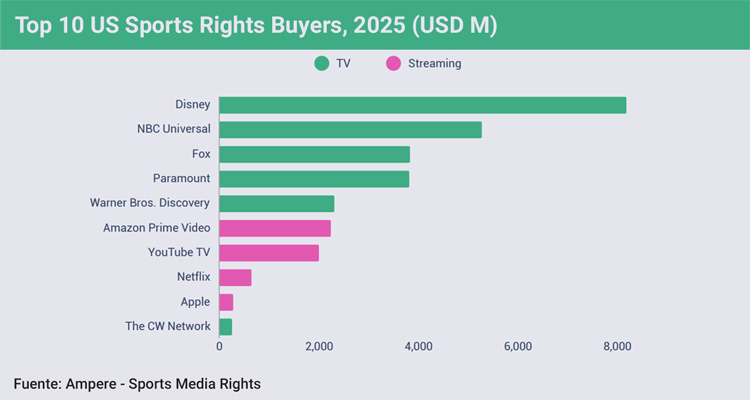

Ampere Analysis reveals that global spending on sports TV rights by streaming platforms surpassed $10 billion in 2024, a dramatic increase from $2.8 billion just five years earlier. Netflix, after years of avoiding live sports, made a high-profile entry with a $500 million-per-season deal for WWE’s Raw, followed by agreements with the NFL for Christmas Day games and FIFA for the Women’s World Cup. Meanwhile, Amazon secured a landmark $1.8 billion-per-season deal for NBA rights, further solidifying streaming’s dominance.

However, this shift has created a fragmented viewing experience for fans. Ampere’s data shows that NFL games in the U.S. were spread across 11 different broadcasters and streamers in 2024, up from seven in 2019. A survey conducted by the firm found that 47% of sports fans feel overwhelmed by the number of subscriptions required, while 51% would pay extra for a consolidated service.

The proposed Venu Sports bundle—a joint venture by ESPN, Fox, and Warner Bros. Discovery—aimed to simplify access but faced delays due to antitrust concerns. At the same time, piracy surged, with 69% of U.S. sports fans admitting to illegal streaming, primarily due to cost barriers.

Europe’s Football Leagues Face a Cooling Market

While streaming drove growth in the U.S., Europe’s top football leagues struggled. Ampere Analysis reports that Ligue 1’s domestic rights deal declined by 14%, while Serie A saw a 3% drop. Only the Premier League (4%) and Bundesliga (2%) managed modest increases. The report identifies three key factors behind the stagnation:

- Lack of competitive bidding – Few new players entered the market to drive up prices.

- No major global streamers – Unlike in the U.S., European football failed to attract deep-pocketed streaming giants.

- Limited inventory – Most leagues already broadcast all matches, leaving little room for additional revenue streams.

This trend raises concerns for clubs dependent on TV revenue, especially as emerging leagues like the Saudi Pro League lure talent with lucrative contracts.

Sponsorship boom and backlash

Sponsorship revenue grew by 21% in 2024, according to Ampere Analysis, driven by events like the Paris Olympics and UEFA Euros. Title partnerships surged by 16%, while stadium naming rights lagged behind.

A notable trend was the rise of Middle Eastern investment, with Saudi Arabian companies increasing spending by 74%. Aramco, backed by Saudi Arabia’s Public Investment Fund (PIF), signed major deals with Aston Martin F1, the ICC, and FIFA. However, this influx of money has sparked ethical debates—over 100 women’s football players publicly opposed Aramco’s FIFA partnership, citing concerns over sportswashing.

What’s Next in 2025?

Ampere Analysis highlights several key deals to watch in 2025:

- Media Rights: The UFC (U.S.), NHL (Canada), and Saudi Pro League are expected to secure record-breaking contracts.

- Sponsorships: The Women’s Super League, McLaren F1, and 2028 LA Olympics are actively seeking new partners.

Yet, challenges remain. Fragmentation in broadcasting, declining European football revenues, and ethical scrutiny over sponsorships suggest that the industry’s unchecked growth may be slowing.