Fred Black, Head of Research at Ampere Analysis, brought to the forefront an increasingly critical issue for the children’s industry: the evolving relationship between streaming platforms and content producers. During a recent conference, the executive commented that despite a decline in commissions for new kids’ programming, children’s content continues to be a key driver of engagement on streaming platforms—revealing a contradiction in current industry strategies.

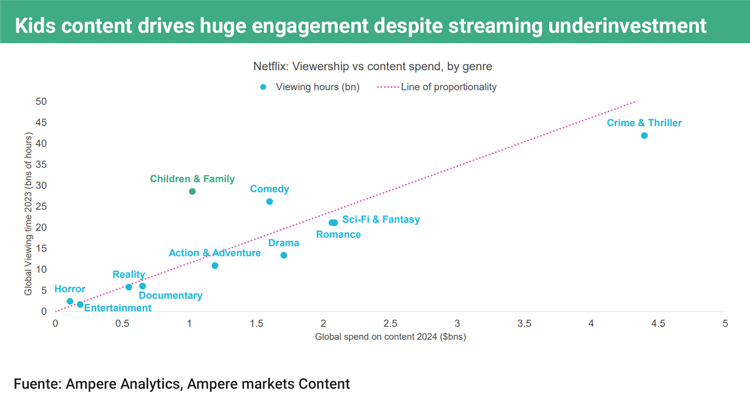

According to data presented by Black, in 2023 and the first half of 2024, kids’ content on Netflix accounted for 30 billion hours watched—surpassed only by crime and thriller genres. However, the estimated budget allocated by the platform to kids’ titles in 2024 did not exceed $1 billion. Meanwhile, the total number of global commissions for kids’ programming dropped from 737 in 2023 to 706 in 2024, indicating a retreat in investment in original content for this segment.

At the same time, the total volume of kids’ content available in the U.S. continued to grow, particularly on AVOD platforms, where the number of available hours increased from 22,500 in December 2023 to 28,500 in December 2024. In addition, SVOD platforms acquired 18,706 hours of non-exclusive kids’ content in 2024—an increase of nearly 4,000 hours compared to the previous year.

‘Platforms still rely on kids’ content, but increasingly acquire it through non-exclusive deals’, Black explained during his session. This strategy is based on a market logic where children’s programming may not be the primary reason for subscription, but it plays a major role in user retention. ‘A family may keep their subscription if their child finds their favorite series there’, he added.

This oversupply in the kids’ segment also creates challenges for those seeking visibility. By December 2024, there were more than 49,000 hours of children’s content available on U.S. platforms. Such market saturation makes it difficult for new productions to stand out—particularly those not linked to established franchises.

Faced with this scenario, Black’s analysis suggested a shift in strategy for producers. The recommendation is clear: adopt a multiplatform distribution model and reduce dependence on exclusive deals. ‘With a fragmented audience and such a wide offering, creators who embrace a non-exclusive approach—including SVOD, AVOD, FAST, broadcast TV, and social platforms like YouTube—will have a better chance of reaching their audience and generating sustainable revenue’, he said.

The report also highlighted that while traditional funding models have eroded, there are alternative paths that some studios are already exploring. These include participation in ad-supported free platforms, launching their own apps under direct-to-consumer models, and hybrid deals or co-productions that allow for some level of creative and commercial control over intellectual properties.