In recent months, several streaming giants have rolled out their first Ad-Supported Subscription plans in Europe. Netflix was a pioneer in November 2022 by launching its first ad-supported plan in the United Kingdom. A year later, Disney+ followed the same strategy in the United Kingdom, France, Germany, Italy, Spain and the Nordic countries. Amazon Prime Video was the latest to join this trend, launching its Ad-Supported Subscription plan in the UK and Germany in February.

Other major players have also announced the upcoming launch of their advertising-supported plans in Europe: SkyShowtime launched its plan on April 23 in all European countries where it operates, while Max is available in the Nordic countries, Spain, Portugal, and in Europe Central and Eastern since May. But what is leading many of these big players to try cheaper plans with advertising in Europe, and particularly in these countries?

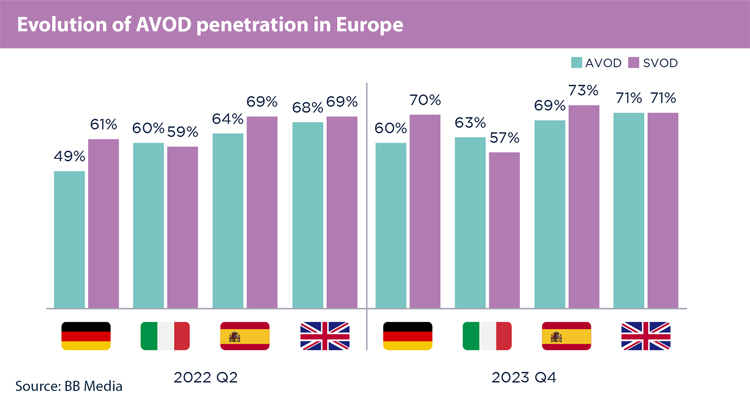

First, it is essential to understand the evolution of the advertising-based model in the EMEA region, which has been on a constant rise over time. From Q2 2022 to Q4 2023, this revenue model saw significant growth in many major markets in the region. During this period, the model saw notable increases in Germany (10.44%) and Spain (5.21%), while its penetration reached 63% in Italy and 71% in the United Kingdom for the fourth quarter 2023.

While the AVOD model has been expanding its reach quarter by quarter, the Subscription model has shown more moderate growth. In Germany, Spain and the United Kingdom, the Subscription model has grown by 9.04%, 4.01% and 1.73% respectively. However, compared to the evolution of the model, the subscription growth has slowed. Penetration of it has increased 1% more than subscriptions in all countries. The situation appears to be particularly challenging in Italy, where subscription penetration decreased by 2.12% during the period analyzed.

In Q4 2023, YouTube led with the largest subscription market share in the EMEA region. But how is the Advertising-Based market composed excluding YouTube‘s participation? Pluto TV emerges as the leader, with a 10% share at the regional level.

When analyzing the composition of each country’s market share excluding YouTube, many streaming platforms have benefited from the increase in demand for Advertising models. Amazon‘s Freevee has seen a notable increase in its share in Germany, reaching 39% in the fourth quarter of 2023, up from 31% in the second quarter of the same year. Similarly, Freevee has seen growth in the UK, with a share of 15%, up from 10% in Q2 2023. Also in the UK, ITVX and My5 have increased their shares, rising from 19% and 14% in the second quarter of 2023 to 21% and 17% in the fourth quarter of 2023, respectively.

The growing preference for Ad-Based strategies in some major European markets indicates that previous resistance to ads has decreased significantly. During the fourth quarter of 2023, almost 4 in 10 British, German and French users expressed a preference for accessing online content for free with ads included. This inclination was even stronger among Italian users, with a notable 61% stating their preference for free, ad-supported content. Additionally, when asked about the option of adding commercial ads to their Subscription plan to reduce costs, half of French and Spanish users preferred cheaper plans, even if it meant having ads interrupting content. This preference was even stronger in Germany and Italy, where 6 in 10 users showed a preference for Ad-supported plans, and particularly in the United Kingdom, where a staggering 69% of users favored cheaper plans.

The emergence of Ad subscription offerings and the steady increase in the penetration of the Ad-Based model in major European markets signals a significant shift in consumer preferences towards ad-supported streaming models. Streaming giants are adapting to meet this demand, with more diverse and flexible options to meet varied consumer needs. As consumers look for affordability and choice in their streaming practices, it is vital that the industry continues to innovate and provide a range of experiences for users to mix and match to suit their tastes.

Por: Delfina Gianibelli, Media Analyst at BB Media