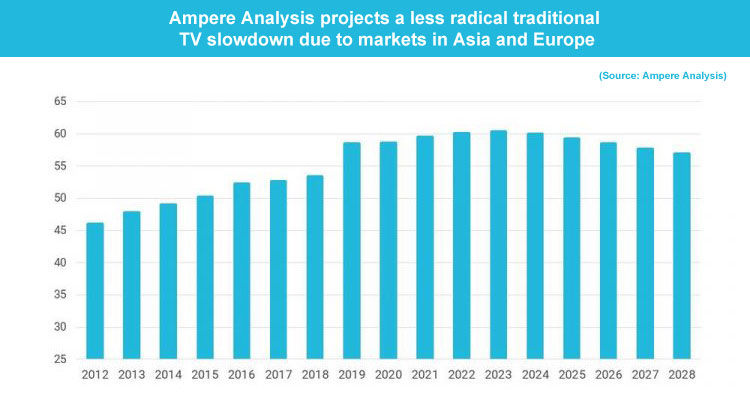

It is no a secret that traditional TV is experiencing one of its most difficult moments due to streaming. According to Ampere Analysis, the global penetration of Pay TV will experience its first annual drop in 2024. But it would not apply to all territories, APAC and Europe have presented significant growth, partly supported by the strong presence of public channels and the commitment of these with local content and battle against American streaming platforms.

But why the peak global decline? The consultancy believes that this will occur after its penetration reached a maximum of 60.3% in the fourth quarter of this year, according to the research, so they predict that by 2028 the global penetration of pay television will have fallen almost four percentage points.

North America is one of the major markets that has shown a sharp reduction of almost half, from a high of 84% in 2009 to 45% in 2023, which Ampere Analysis attributes to a combination of high costs and competition from a market ‘Mature’ SVoD. ‘Despite this decline, annual revenue generated per user (RGPU) will be more than $1,100 (€1,000.52) in 2023 across North America, the highest of any region,’ said Rory Gooderick, analyst. senior at Ampere Analysis.

Latin America has also shown significant drops in penetration since 2016. This is mainly due to Brazil, which has seen a drop of around 10 percentage points from its peak pay TV penetration of 42% in 2016. ‘Furthermore, although Latin America North and Latin America The United States is driving this change, Ampere Analysis predicts that all regions will experience a decline in pay TV penetration by 2025,’ Gooderick added.

Meanwhile, Asia Pacific and Europe have seen the highest penetration growth in recent years, with big gains coming from China Mobile after it acquired an IPTV license in 2018. This growth has been driven by low-cost IPTV services , which are often included in broadband packages for a lower cost. While these regions will also fall into decline after 2025, there are still some growth markets, such as Portugal, Serbia and Hungary, which are expected to see further growth in the forecast period.

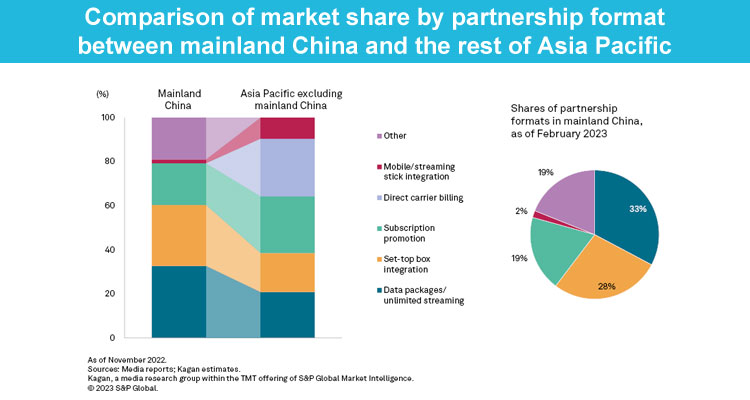

Pay TV and linear channel operators have been adapting to new business models. Asia-Pacific multichannel operators have become hybrid providers, with both traditional multichannel and virtual multichannel or over-the-top subscription offerings. This makes them more relevant, but also condenses all the TV offers into a single window.

S&P Global recently found that pay TV operators and telcos have entered 58 agreements in various formats with OTT streaming players as of March 2023. Some partnerships benefited the pay TV operators more than the OTT players due to regulatory restrictions, while others fostered the growth of all partners.

Some 28% of partnership agreements in mainland China were under the category of set-top box integration of OTT services, according to our survey. Pay TV operators benefited more from this type of partnership due to the market’s license requirement.

‘Growth in global pay-TV adoption has been driven over the past five years by Asia Pacific and Central and Eastern Europe. However, declines coming from the Americas, driven by streaming competition and the high price of pay TV in North America, which currently exceeds $90 a month, will contribute to global pay TV penetration declining by first time in 20240’, Gooderick noted

Another of the business verticals that Pay TV continues to promote in Asia is addressable TV, although some advertisers are still wary of the high prices associated with it, according to Ampere Analysis discovered that those who already use the method see addressable advertising as very profitable , and predicts significant growth in the sector in the coming years.

In 2022, addressable TV advertising accounted for one-sixth (17%), or $56 billion, of global television advertising revenue, compared to $139 billion generated by traditional television advertising revenue. Globally, addressable TV revenue is expected to rise to $87 billion by 2027, with the method capturing a fifth of global video ad buying.

Comparatively, addressable TV is projected to deliver $18 billion in revenues in Europe and $15 billion in APAC by the end of the forecast period.

‘Despite the projected decline in the reach of pay TV products, cable and satellite platforms will remain a powerful force in the television world and important distribution partners for streaming products, as demonstrated by the recent agreement distribution between Disney and Charter in the US, which saw select Disney streaming services included in Charter‘s TV packages. This bundling structure, already increasingly common in Europe and parts of Asia, offers a framework for traditional cable TV companies to transition their business into a streaming aggregation game and stabilize customer trajectories. subscribers’, concluded the consultant.