The 2024 Asia Video Content Dynamics report by Media Partners Asia (MPA) highlights ‘critical developments’ in the content investment and consumption landscape across seven key Asia-Pacific (APAC) markets: India, Korea, Indonesia, Philippines, Singapore, Thailand, and Vietnam. The whitepaper reveals that total content investment reached $15.5 billion in 2023, marking a modest 4% year-on-year growth amidst a post-pandemic normalization of budgets and a strategic shift in streaming investments.

Market leaders: India and Korea

India and Korea dominated content spending, contributing 80% of the total investment. While Korea remains a mature market with flat growth driven by streaming and film, India’s relatively low TV penetration (52% of households) positions it for robust growth across all content verticals. MPA projects India will surpass Korea in total investment by 2026, driven largely by its sports programming and burgeoning streaming sector.

The report forecasts a compound annual growth rate (CAGR) of 2.7%, with total investment reaching $17.2 billion by 2028. Streaming is expected to gain significant ground, increasing its share from 26% in 2023 to 33% by 2028, while TV’s share is projected to decline from 64% to just over 50%.

Stephen Laslocky, Vice President at MPA, highlighted these trends: ‘Korean content continues to lead with world-class production values and compelling storytelling. However, the rise of streaming has elevated production quality in markets like Thailand and Indonesia, with Thai titles gaining traction across Asia’. He also noted a divergence in strategies, with streamers adopting more disciplined budgeting approaches while traditional TV producers face margin contractions.

Trends in online video consumption and theatrical distribution

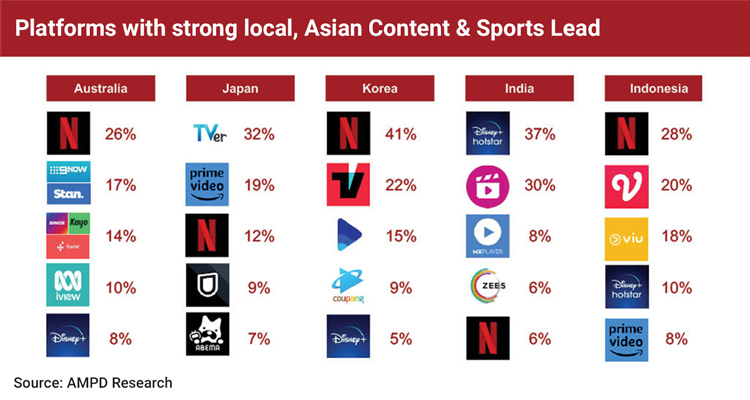

YouTube remains the dominant platform in the surveyed markets, with over a billion monthly active users, including 732 million in India. TikTok is emerging as a formidable competitor, particularly in Southeast Asia, boasting 211 million monthly active users across Indonesia, Malaysia, the Philippines, and Thailand. In the premium VOD space, Netflix maintains a commanding lead in most markets, capturing 40-70% of viewership in Korea, Indonesia, Malaysia, and the Philippines. However, it faces stiff competition in India from Disney+ Hotstar and Jio Cinema, as well as from local platforms like Indonesia’s Vidio and regional players such as Viu, which leverage Korean content to bolster their appeal.

The theatrical sector is still in recovery mode, hindered by superhero franchise fatigue and the impact of Hollywood strikes. India, however, has already surpassed its 2019 box office revenues. Other markets, excluding Korea, are expected to recover between 2025 and 2028. A notable shift in film distribution is the adoption of revenue-sharing models for internationally appealing titles, presenting opportunities for Korean and Thai producers.

As APAC’s content ecosystem evolves, adaptability and strategic investment remain paramount. Laslocky remarked, ‘The content today with the most proven travelability includes Korean dramas, Japanese anime, and select Thai and Chinese titles. Prioritizing content relevant to local audiences while balancing global appeal is key to success in this dynamic region’, concluded the exec

The report underscores the interplay between traditional and emerging platforms and changing consumer behaviors, offering valuable insights for stakeholders aiming to navigate the region’s rapidly shifting media landscape.