APAC is one of the markets that is seeing the greatest transformations this year, and although the battle is fierce among content distributors, pay TV and SVOD have stood out significantly in 2021. Prensario reviews in this report for ATF 2021, the most current data on both content segments in the Asian giant.

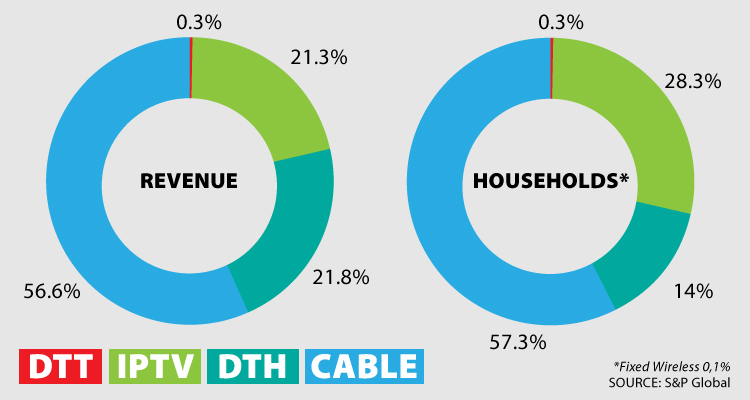

According to a report by S&P Global, Asia-Pacific represents 17 key Pay TV markets the largest in the world, with 63% of penetration and 655 million subscribers. The company also assures in its most recent report for 2021, that in particular, traditional Pay TV services in APAC lead revenue and accessibility to content, returning 63% of market penetration. It is noted that according to a survey carried out this year, it shows that consumers are looking to expand their existing Linear TV services, instead of cutting the cable completely.

One of the factors that affect these numbers of traditional TV is age: the average age range of the major pay TV countries represents an older demographic that leans toward traditional media. This may be due to the fact that Asian and Pacific countries maintain a more traditional multigenerational family structure.

In the five most prominent markets, the average age of TV consumption ranges between 28 and 48 years. As an example, for China, the average age of linear TV consumption is 38 years with a household size of 3.8; and for Japan the mean age is 48 and a household size of 2.3.

The S&P report also states that multi-channel cable households account for about 58% of the market and, over the next 10 years, cable is expected to maintain its leadership in subscribers and revenues.

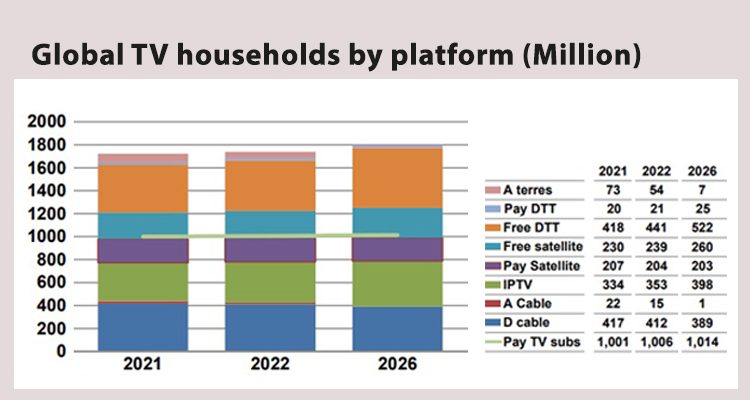

In terms of revenue, the study says that pay TV growth between 2025 and 2029 will be worth $ 26 billion across all services, and that satellite will continue to meet growing audience demands while generating revenue and reaches the programmers.

The consultancy adds that much of Pay TV’s growth comes from emerging countries in Southeast Asia, which show a large number of growth opportunities for cable and DTH services. It made mention to India, calling it the ‘backbone’ of the TV industry, for its affordability to traditional TV, as well as the availability of this service in rural areas. He also mentioned that digitization is promoting access to cable in areas outside the big cities, which is why he highlights that the migration from analog to digital connections will be the turning point in these markets.

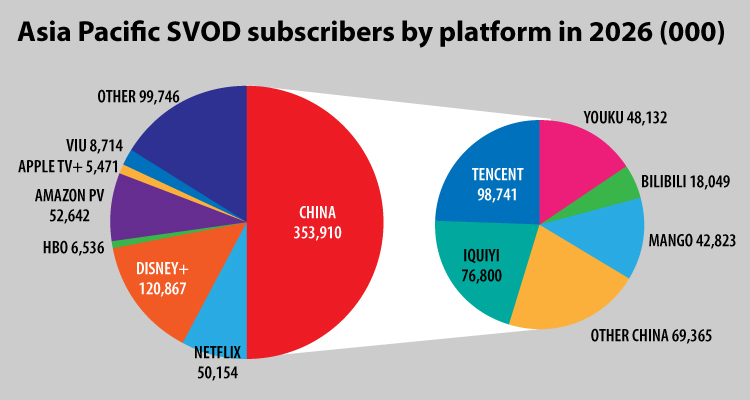

On the SVOD segment, Digital TV Research forecast 698 million subs by 2026, up from 502 million at the end of 2021. Among all the territories, China will provide 354 of these subs in 2026, or half of the region’s total. Also, India will reach 157 million.

Regarding this segment in APAC, Simon Murray, Principal Analyst, underlines: ‘China will remain dominant, although its growth will slow. This is due to new online anti-fan regulations that limit game time for minors and force SVOD platforms to screen fewer reality shows. This will dampen interest in SVOD’.

According to DTR, Disney + surpassed Netflix in terms of subscribers in 2021, almost entirely due to its success in India. Likewise, it projects that the service will reach 121 million subscribers in 2026; double their total this year. Likewise, Tencent stands out for its base of more than 98 million subscribers this year, followed by iQiyi with 76.8 million, and Amazon Prime Video with 52.6 million.

At this point, S&P Global explains that the appearance of new content distribution models with the OTT has put pressure on the linear distribution market, due to the costs and flexibility of some companies towards content providers, and because of the access in some markets with vast territories where the mobile internet is arriving.

Especially noteworthy are Australia and Singapore, where several OTTs with AVOD or SVOD models have seen great success due to broadband penetration. Among the services are: Viddsee, HAYU, MeWatch, IWonder; plus HotStar, Netflix, or Apple TV +.

In terms of consumption per day, S&P reported that during 2020 in India, 70 billion OTT viewing minutes was reached in a week.

However, the consultancy highlights, that like other markets, the OTT segment is experiencing oversaturation, and this is causing a higher dropout rate as viewers are forced to jump between subscriptions, so niche OTTs are having greater success as a complement to Pay TV, and it comments that some mainstream broadcasters are already being seen that are only adding OTT services to attract or keep subscribers.