By Fabricio Ferrara

There is a positive outlook that travel restrictions will be eased further for many Asian territories as the end of 2022 is arriving. Even though the APAC region has not stopped dealing onthe content businesses, it has been one of the most affected when attending tradeshows in different parts of the world. The return of the largest programming markets to the global scenario.

Prensario has been attending key Asian tradeshows in the last 10 years, witnessing the evolution of its creative community, its business leaders and the domestic market. Once called “emerging” territories, some of these countries are now developed TV and streaming markets.

The Indonesian market remains an interesting market for development, and in line with that. Vietnam and Thailand are also markets to keep a look out for, the first one being a burgeoning market which continues to grow, and this is reflected at ATF with the hike in numbers of Vietnamese buyers who will be attending this year.

As for the second, its local content has always been successful and continues to trend well in Asian markets and on OTT platforms. In this light, and catering to the demand for Thai content on the market floor, Thai companies are again strongly represented at ATF.

Lastly, Korea will be given greater focus at ATF this year, not just in terms of Korean finished products, but also that of Korean production value, IP co-ownership and the proliferation of Korean-Southeast Asian partnerships.

Market Data

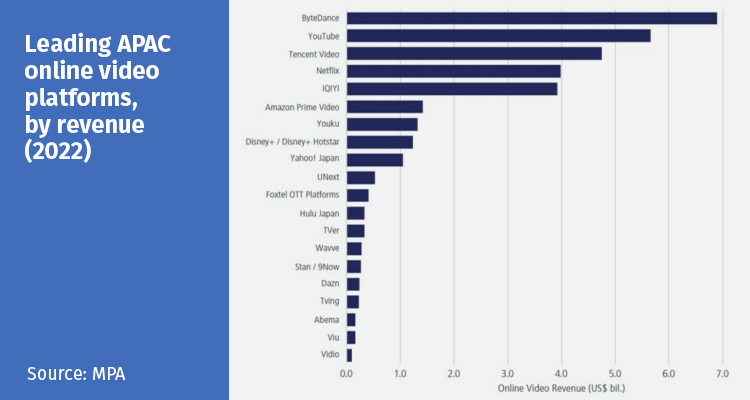

Media Partners Asia (MPA) has revealed good times ahead for its region’s online video industry with 16% year-on-year growth in 2022 to reach USD 49.2 billion scaling potentially to USD 73 billion by 2027.

The “Asia Pacific Online Video & Broadband Distribution 2022” noted a number of key drivers of the market such as the growing availability of high-quality local content online with travelability – led by Korea, Japan, China, India, Thailand and Taiwan – and premium sports rights for the likes of football and cricket transitioning online in markets such as Australia, India, Indonesia, Korea, Singapore and Thailand.

The source also noted that ‘growth at any cost models’ were fast transitioning towards more rational models, anchored to monetisable reach through telcos and organic, direct customer funnels.

The study forecasts online SVOD will grow by 19% in 2022 to USD 24.6 billion in revenues with China contributing 51%. Apart from China, the Asia Pacific SVOD sector is set to grow revenues by 25% year-on-year to USD 12 billion in 2022. SVOD revenue is projected to reach USD 19.1 billion by 2027 in APAC ex-China and USD 36.5 billion with China.

AVOD is forecast to generate USD 24.6 billion in 2022 in APAC, up 13% Y/Y. APAC ex-China drove USD 13.4 billion, up 24% Y/Y. YouTube leads with an estimated 42% share of the APAC ex-China AVOD market in 2022. AVOD is forecast to grow at an 8% CAGR over 2022-27 to reach USD 37.6 billion in APAC. APAC ex-China is projected to grow at a CAGR of 12% to reach USD 23.7 billion, while APAC ex-China UGC AVOD share is expected to reduce from 80% in 2022 to 76% in 2027 as the premium AVOD category, led by broadcaster video-on-demand platforms, expands.

Looking at the companies that will be driving the market, MPA noted that the top 20 online video platforms will account for two-thirds of total APAC online video revenue in 2022. Non-Chinese leading vendors include YouTube, Netflix, Amazon Prime Video, Disney+/Disney+ Hotstar, key local players in Japan, Korea, Australia and SEA such as Yahoo! Japan, TVer, Stan, Vidio and Viu.

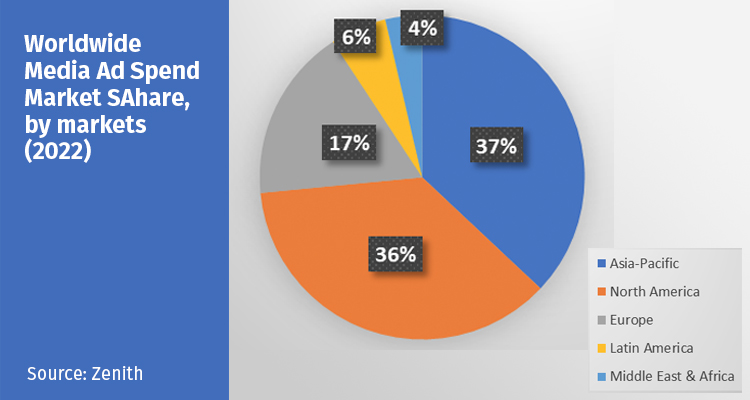

‘Investors are increasingly focused on enhanced scale, improved monetisation and real profitability across global, local and regional online video platforms. In this context, the role of APAC continues to have a critical role in the future of the global online video industry. The region remains the largest growth contributor to global online video customers and users today and is emerging as a significant contributor to revenue growth. With the US and Europe fast maturing and China inaccessible, APAC’s large markets – India, Indonesia, Japan, Korea and Thailand – will be increasingly important to global platforms’, said MPA executive director Vivek Couto.

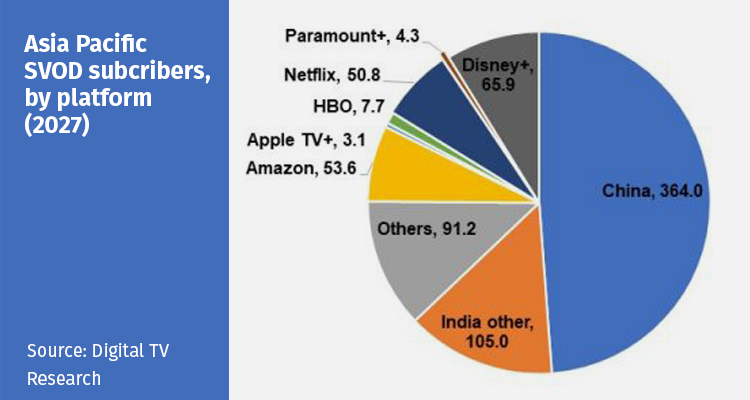

According to Digital TV Research, the Asia Pacific region will have 746 millionSVOD subscriptionsby 2027, up from 541 million in 2021: China will have 364 million or 49% of the region’s total, while India will add 92 million to reach 176 million in 2027.

‘The six major US-based platforms Netflix, Disney+, Paramount+, HBO Max, Amazon Prime Video and Apple TV+ will only control a quarter of Asia Pacific’s SVOD subscriptions by 2027, much lower than in any other region in the world. These platforms will never gain access to China and India has plenty of local players’, underlined Simon Murray, Principal Analyst.

Disney+ overtook Netflix in subscriber terms in 2020, almost entirely due to its success in India. Disney+ Hotstar reshaped the SVOD landscape in India, mainly by controlling the rights to India Premier League cricket. The operator did not retain the IPL rights from 2023. The platform will lose 4.5 million subscribers in 2022 and 10 million in 2023 before plateauing.Assuming that Disney+ retained the IPL rights in India, the previous forecasts estimated 127 million Disney+ subscribers across the region by 2027. Our revised forecasts predict 66 million by 2027 – 61 million less.

Programming Exports

‘More creators and producers are realising that they need to make content successful not only for their own local markets, but also ensure that their content has the ability to travel. As such, there has been more interest in understanding how to fashion more adaptable finished products, as well as acquiring the competence of tapping their IPs for development in local markets across Asia’.

This statement from Yeow Hui Leng, Group Project Director, Asia TV Forum & Market is a good summarize of APAC, a region that has been gaining momentum in the last decade. As the most populated market in the world, the continent also offers some of the most compelling stories originating from books, online novels, and webtoons, it has also become more apparent for IP owners to elevate themselves, endeavouring for a more in-depth business mindset.