Following the footsteps of the US and Europe, the APAC region is making its way into the streaming market, driven by technological improvements, digitization of rural areas, and greater connectivity and access to the internet. And although Netflix leads some territories, local services cope with original content, so the expansion of these players does not stop.Prensario reviews these figures and the main trends of one of the most dynamic and diverse markets in the world.

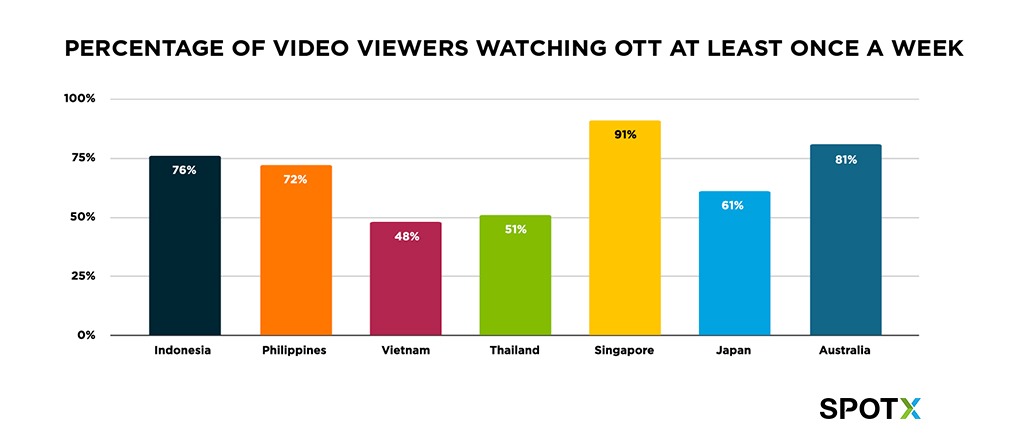

Some figures precede the future of the content field in APAC: Media Partners Asia (MPA) announced that online video industry in the region grew revenue by 14% YoY on 2020, and forecast to scale to USD 55 billion by 2025. Meanwhile, the Digital media platform and consultancy Spotx, estimated that there are close to 400 million active OTT viewers in this region, and that over two-thirds (69%) of them consume streaming content at least once a week. Both consulting firms assured that the market has matured, both due to the access to new internet speeds, and the powerful digitization of the towns that were previously more isolated.

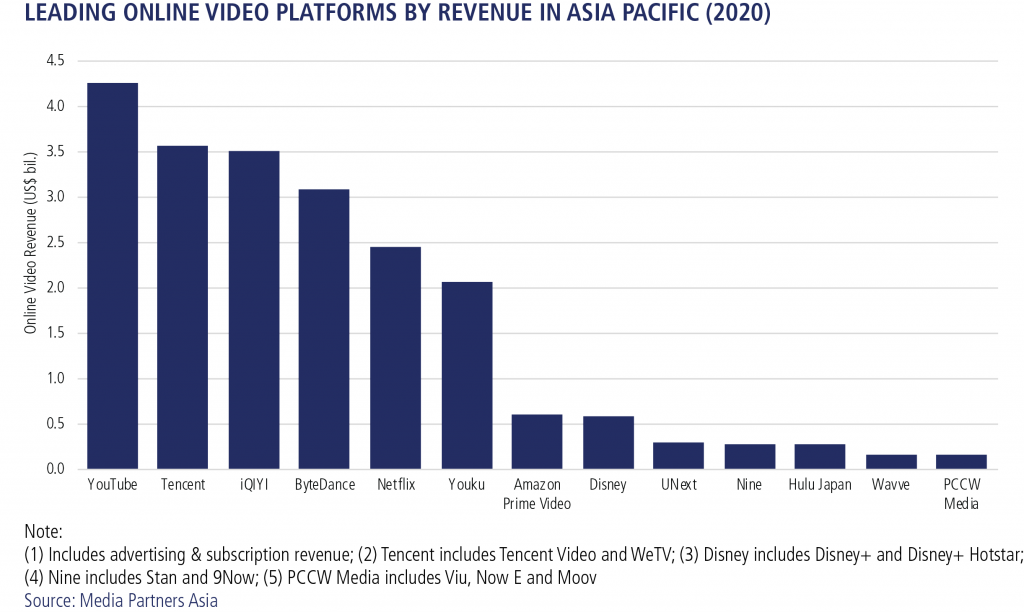

According to MPA, the SVOD sector grew 34% last year in this region. Countries such as China Pacific stand out, whose share fell to 58%; while in Ex-China, the sector grew by 47%. Japan and Australia follow with 70% of revenues, followed by Southeast Asia (10%), Korea (9%) and India (7%).

As for China, the consulting firm foresees an increase in SVOD subscribers of 375 thousand by 2025. As for Japan, SVOD overtook AVOD as the largest revenue contributor, accounting 56% of revenues of online video; highlighted Net SVOD subscribers addition reached a record 8.9 thousand in 2020, due to Netflix as market leader.

While in Korea, SVOD subscribers doubled their number, also driven by Netflix and the debut of Diney + in the territory.For Southeast Asia, MPA ensured a promising future in the field of SVOD for countries such as Indoneia, the Philippines and Thailand, as the major brands are developing functionalities specially dedicated for the consumption of content through mobile phones.

Regarding the AVOD sector, YouTube continues to dominate several of the territories in APAC, with 60% of the total Avod revenues. The platform is a destination for promotional clips and often entire episodes of professional content in Korea, Japan and Southeast Asia. This is due to the rapport that exists between the content creators and the firm. He also assured that local players such as iQiyi are growing and gaining space in the market, as they establish alliances with broadcasters and local sports rights.

China will remain the largest AVOD market in the Asia Pacific, where platforms such as iQiyi and Tencent stand out. In India, YouTube dominated the segment, with an estimated share of 67% in 2020.

On the other hand, in Korea, YouTube and Facebook stand out for having more than 75% of AVOD revenues in 2020; but domestic platforms such as Kakao and Naver also stand out, due to their profile for advertising. The first of these, is capitalizing on the success and scale of its instant messaging platform Kakao Talk to launch Kakao TV, which debuted in Q4 2020.

Finally, in Southeast Asia, key local TV broadcasters transitioning to online will shape the future AVOD opportunity. Local and regional platforms ’share of AVOD revenue is expected to grow in the future driven by platforms such as Viu, Vidio, RCTI + and LineTV.

One of the indicators of new consumer trends is the penetration of the internet in APAC, especially in rural areas. According to the World Bank and the Internet World Stats, there are more than 2.7 billion Internet users in the region, and penetration is 64%.

In the region, Singapore is one of the emerging markets that is experiencing this boom, because of its user base with internet access, about 91% of these consume content in an OTT at least once a week, followed by Australia with 81%.

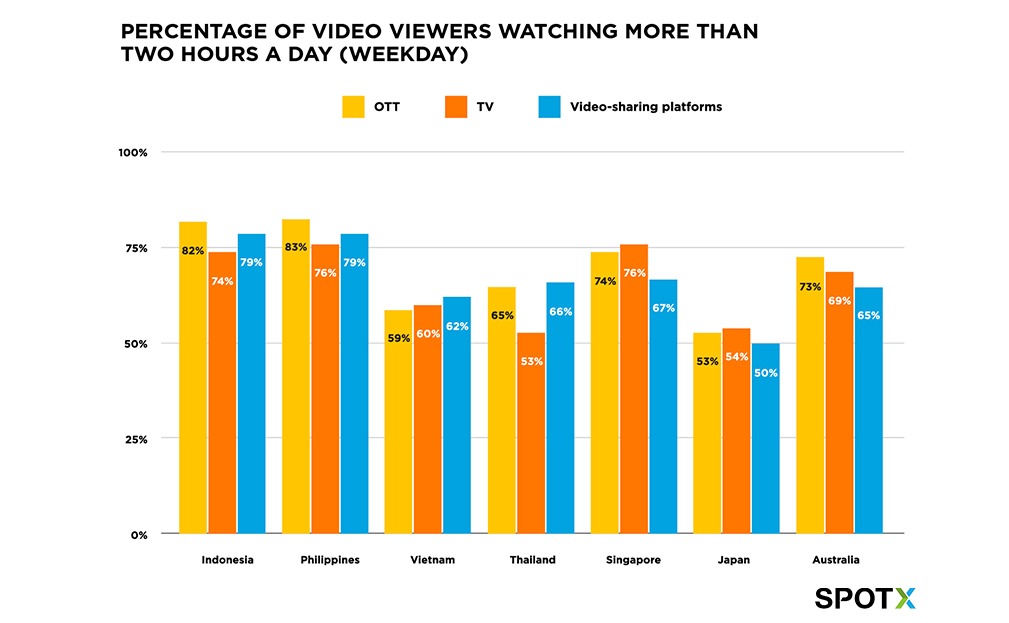

MPA report concluded by saying that OTT viewers are highly engaged, with a majority watching more than two hours of content per day. On a regional basis, this is higher than time spent with content on traditional TV or video-sharing platforms and highlights an important shift in viewership behavior. Among all the markets, Indonesia highlights by having new digital consumers who are coming online from non-metro areas and driving this growth, with a 47% of viewers by one or two hours per day.