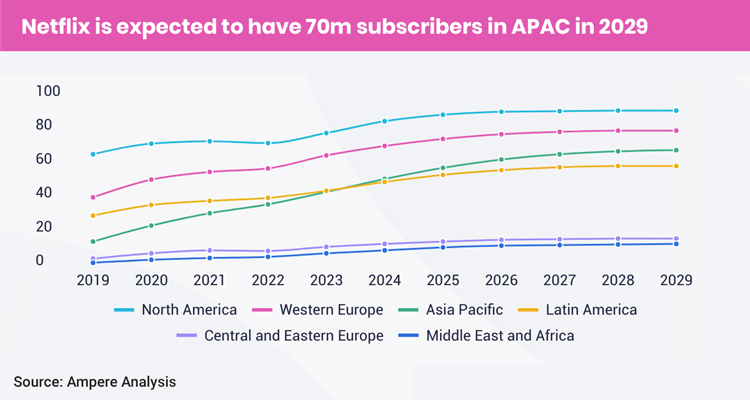

Netflix‘s focus in APAC is paying off, with the region leading global subscriber growth for the streaming giant. In Q3 2024, the region added 2.28 million net subscribers, outpacing Europe, EMEA with 2.17 million and significantly surpassing the US and Canada, which saw only 0.69 million net additions. Latin America, meanwhile, experienced a slight decline.

This subscriber boost contributed to streamer’s overall growth, bringing its total global subscribers to 282.7 million and driving a 15% year-over-year revenue increase to $9.8 billion. Co-CEO Gregory K. Peters credited the company’s ‘decade-plus investment in creative communities’ across APAC as a key factor in this success. ‘We are increasingly seeing a steady drumbeat of hit titles from countries around the world,’ said in an earnings call.

Strong local content push

The platform strategy for the region revolves around expanding local-language content, particularly in Japan, Korea, Thailand, and India. This approach has yielded tangible results: Officer Black Belt (South Korea) amassed 32.8 million views, Maharaja (India) reached 22.6 million, and Culinary Class Wars (South Korea) attracted 11 million views. The demand for locally-produced content is evident—Netflix estimates that 80% of premium video-on-demand viewership in Asia is driven by local content.

Minyoung Kim, Netflix’s VP of content for APAC (excluding India), emphasized the importance of ‘locally authentic’ storytelling. ‘The goal is to make sure that these stories find audiences not only within their home country but also beyond domestic markets’, she said.

As for company’s commitment to Southeast Asia is also particularly notable, given that competitors like Disney+ and Prime Video, which have scaled back their investments in original content from the region. This shift has left Netflix with fewer direct rivals, aside from Hong Kong-based Viu and Indonesia’s Vidio.

The Ad gamble

Beyond content, Netflix is aggressively expanding its ad-supported tier, which is now available in APAC markets including Australia, Japan, and Korea. The company reported that ad-supported plans accounted for over 55% of new signups in Q4 2024, a notable jump from 45% in July. Peters acknowledged that while the platform has seen steady growth in ad revenue—doubling year-over-year in 2024—there is still ‘considerable work’ to do.

Industry analysts remain cautious. Ian Whittaker noted that Netflix has not disclosed specific advertising revenue figures, arguing that the company’s use of words like ‘solid’ to describe growth suggests it is not accelerating. ‘If the absolute number was significant, Netflix would be reporting it’, he observed.

Despite these concerns, Netflix continues to refine its advertising infrastructure. The company plans to expand programmatic guaranteed buying in APAC later this year, a move Peters says will offer «more flexibility, more ways of buying for advertisers, and fewer activation hurdles.»

A long-term bet

Netflix is taking a long-term approach to nurturing creative talent in APAC. The company hosted a film camp in Thailand this year and plans to expand similar initiatives across the region. For local filmmakers, the service offers a platform to reach global audiences.

Indonesian director Yosep Anggi Noen, whose film 24 Hours with Gaspar was released on Netflix, believes the company provides opportunities for unconventional storytelling. ‘They are willing to choose stories that cater to an audience that can appreciate a more complex plot and characters’, he said.