Audiovisual co-productions and the incentives driving them continue to be pivotal in the global content industry. Offering a general rate of approximately 25-30% of eligible spending (with higher rates and additional benefits available), they serve as a cornerstone for project financing and play a crucial role in securing funds for productions. This significance has been amplified due to the pandemic-related costs associated with ensuring on-set safety during filming.

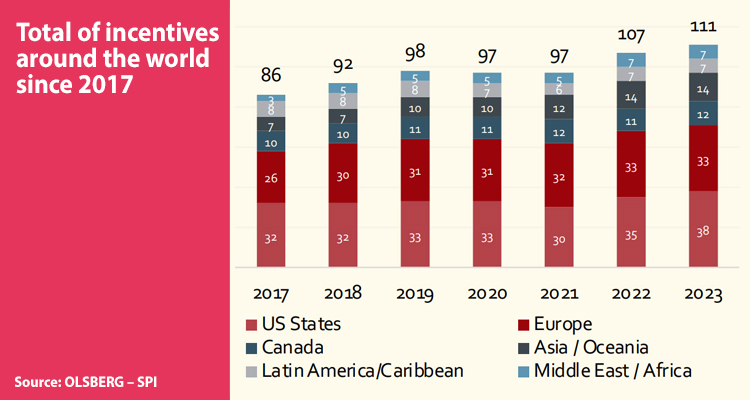

At December 2021, over 100 incentive programs supporting film and television production were active across more than 40 countries. Emerging markets like MEA and Latin America have attracted substantial foreign investment, with MEA drawing in around US$3 million and LATAM seeing approximately US$6 million in 2020, according to Kearney consultancy. Recent incentive initiatives by the Kingdom of Saudi Arabia and Morocco have further bolstered investment, signaling a promising potential for these regions to capture a larger share of global production expenditure.

This report by Prensario examines the new entrants to this trend, as well as countries that have made adjustments to their existing programs.

Austria stands out as one such country that recently unveiled an enhanced incentive program. Film in Austria warmly received the Austrian government’s decision to introduce a 35% incentive for film and television production. This measure, which took effect on January 1, takes the form of an automatically non-refundable subsidy. Contributions can reach up to 5 million euros for film projects and 7.5 million euros for serial projects. Specifically, the incentive comprises a 30% cash bonus for each project, along with an additional 5% ecological bonus based on the implementation of specific environmental sustainability criteria.

Thailand also witnessed a significant boost in audiovisual incentives within the country. Building upon the scheme established in 2018, which allowed foreign productions to receive a 15% discount on their localization activities in Thailand, an additional 5% is offered for shoots that extensively employ local personnel and promote Thai culture and cinema in lesser-known areas. The maximum refund is capped at THB75 million ($2.25 million) per film.

The new program elevates the base rebate to 20%, with the additional rebate doubled to 10%, potentially totaling a subsidy of 30% of production expenditure in Thailand. The maximum allowable refund has also been raised to THB150 million ($4.50 million).

In Finland, the government recently modified the minimum requirements for the production incentive provided by the «Business Finland» program for this year. Notably, there is now a requirement for funding from outside Finland to be at least 25%. In addition to the approved general budget of 9.5 million euros from the previous year and the supplementary financing of 7.5 million euros received in June, an additional 3 million euros will be provided by the end of this year.

Serbia renewed its incentive policy for this year, incorporating a new regulation that took effect in January. The government aims to attract audiovisual investment with a cash rebate ranging from 25% of qualified Serbian spending for feature films, TV series, documentaries, animation, and post-production work, to 20% for TV commercials, and 30% for feature films with Serbian expenditure of at least 5 million euros.

Meanwhile, Sweden is witnessing the first cycle of its incentive program come to fruition, backed by an expanding budget that took effect last year. Due to overwhelming demand, the call for applications closed just two days later. Administered by the Suena Agency for Economic Growth, the program has an annual budget of 9.2 million euros and offers a 25% cash rebate for projects with locally incurred costs exceeding 368 thousand euros for a film. Over its 30-year existence, the program has funded more than 1,300 productions, including acclaimed titles like «Triangle of Sadness,» «Holy Spider,» and «Boy from Heaven.» Additionally, it provides a wide range of post-production and filming facilities, including the Studio Fares Trollhättan, the second-largest sound stage in Scandinavia, and its new virtual production wall (24×8 meters), which was launched on January 31st.

In the southern cone, Brazil is another country that has embarked on an audiovisual boost policy with a cash rebate program. Following the success of the first edition of the program in 2021, the Film Incentive Attraction Program in São Paulo will have a budget of 40 million R$. Luiz Toledo, Director of Investment and Strategic Partnerships at SPCine, commented: ‘In 2022, we launched the first cash rebate in São Paulo, which sold out in 24 hours. This indicates the level of importance of these actions in the audiovisual industry in the region.’ The program operates by reimbursing a percentage of eligible expenses incurred in the São Paulo region during a film production.

Colombia remains another prime destination for productions, thanks to the Colombian Filming Law designed to promote the country as an ideal backdrop for cinematographic works. With resources from the General Budget of the Nation, the law grants foreign productions compensation of up to 40% of spending on cinematographic services and 20% of spending on logistic cinematographic services (such as catering, transportation, and accommodation) provided by Colombian suppliers.

According to the Audiovisual Incentives report by Proimágenes, during the period of 2012-2022, 44 audiovisual projects were approved to benefit from the Colombia Film Fund (FFC), investing a total of $270.438 million in the country and receiving compensations of $73.710 million, equivalent to 27.2% of the investments.