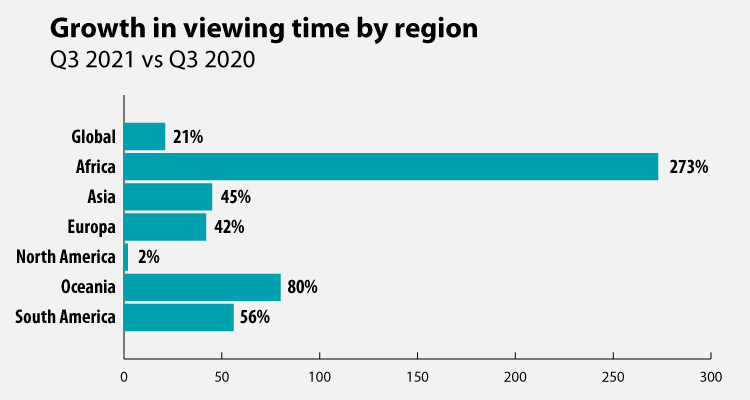

Streaming content continues to gain ground in almost all regions and companies are adapting to it. According to the latest “State of Streaming” quarterly report from Conviva, in 3Q 2021, the adoption of streaming increased by 21% compared to the same quarter of last year, mainly led by more incipient regions, including Africa, which experienced a massive increase of 273%, followed by Oceania with 80% and South America with 56%.

The report conducted by the consultancy company took data across almost 4 billion applications transmitted on devices, and also took data from social networks of more than 2,800 accounts, between posts and interactions on Facebook, Instagram, Twitter and YouTube in 3Q 2021.

In general terms, it was noted that streaming viewing time grew by 21% worldwide in the third quarter of 2021 compared to the same quarter of 2020. Apart from Africa, Oceania and South America, Asia grew by 45% on display; while Europe had a growth of 42% and the North American transmission market was stable with the most modest growth of any region, only 2%.

Advertising

Conviva confirmed a good performance for streaming advertising after an unstable 2020. Between this quarter and last, ad attempts and impressions increased more than 30%, calling it a ‘good sign’ for publishers and advertisers. Only 15% of ads in Q3 2021 did not deliver as planned, representing an impressive 23% decrease in lost ad opportunities quarter over quarter. The report also showed that streaming publishers invested more in video content on social media platforms in the third quarter of 2021, particularly YouTube.

The research company also highlighted that those streaming platforms increased their content production on Google’s online video platform by 97%, which resulted in an 8.4% increase in views and a 24% increase in participation. Streaming platform account audiences grew 66% on YouTube in Q3 2021 compared to Q3 2020.

At this point, streaming advertising saw optimizations on the quality of the experience for its success. ad buffering was 22% worse from last quarter, at a 1.3% buffer shift rate, while image quality also marginally decreased, 1% less than the prior quarter, at a rate average bit rate of 2.93 Mbps.

Devices

Technology of both, devices and transmission platforms, showed significant improvements in transmission quality with reductions in video startup failures, 24% down, buffering, 22% down, and image quality. , 10% up, across all devices. It also noted that most enjoyed double-digit improvements in buffering with the most improved game consoles, down 62% from the prior third quarter to a barely perceptible 0.08%, and connected TVs improved modestly with a decline. 7%.

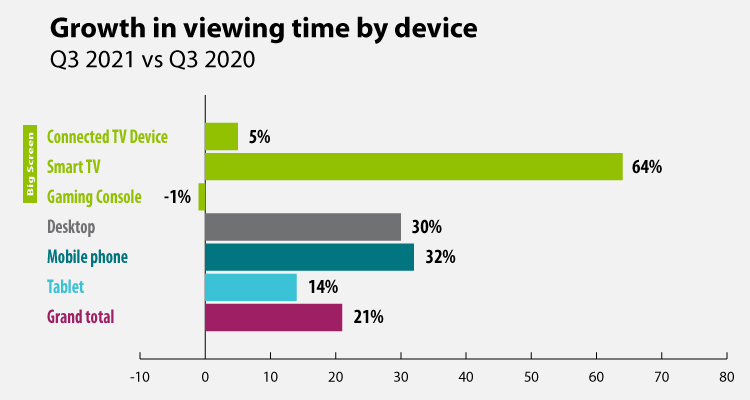

The report also underlined the predominance of the ‘big screen’, where connected TV devices, smart TVs and game consoles, continue to dominate in almost all regions of the world and again obtained the majority of global viewing time with 73% in the third quarter of 2021. In all parts of the world except Asia, large screens took the majority of the audience, particularly in North America with a massive 82%. Mobile phones, desktops, and tablets barely registered in North America at 8%, 6%, and 4%, respectively.

Regional TV viewing

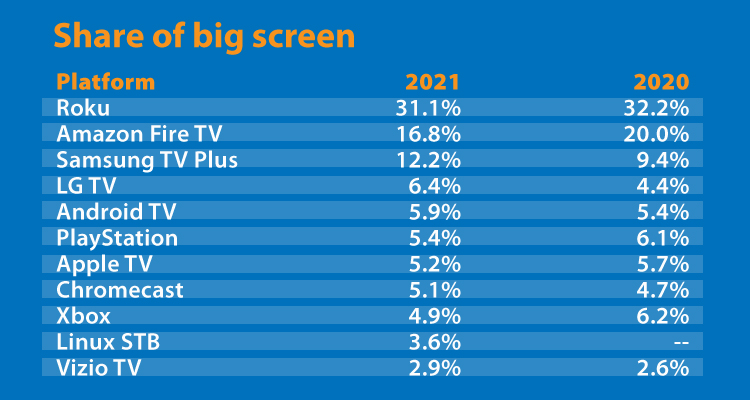

In this segment, the preference for TV varied enormously in each territory: in North America, Roku accounted for a remarkable 39% of watch time, while it only saw a small share in Europe and Oceania with 6%, 5% in the South. America and Africa were only 1%.

In Europe and Oceania no TV device dominated. Europe featured only a few percentages among them: Samsung TV with 19%; Chromecast, Amazon Fire TV, Linux STB each at 12%; Android TV at 11%; and LG TV with a 10% stake. While Oceania was equally close; Chromecast with 21%, Samsung TV and Android TV both with 17%, PlayStation with 11% and Apple TV with 10%.

Africa had a much broader outreach with Linux STB taking the largest share at 29%, while Chromecast, Android TV, and Samsung TV followed with around 15% share each. LG TV with 8% and PlayStation and Apple TV, both with 7%, rounded out the best devices in Africa.

Lastly, in Asia big screen viewing time was only 12% of the total viewing time in the region in 2021, with a 52% share, Android TV achieved the highest share of any large screen device in any region such as the Asia’s favorite big screen. It was followed fairly closely by Amazon Fire TV with 22%.

The four most important large screens in South America were separated by a maximum of 7% with Samsung TV with 28%, LG TV with 21%, Android TV with 17% and Chromecast with a 14% share display. The rest of the measured devices had a single-digit share with Roku and Amazon Fire TV near the bottom of the list.