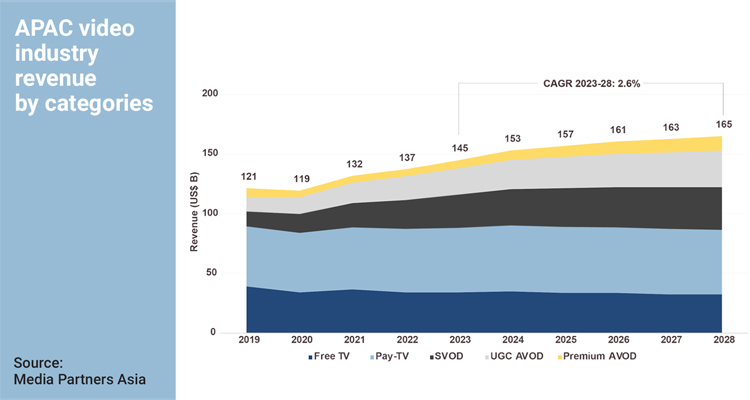

Last year, APAC region video industry experienced significant growth, reaching US$145 billion in revenue, a 5.5% increase from the previous year. This growth was fueled by the online video sector, which surged 13% to US$57 billion, while traditional TV revenue showed minimal growth, rising by less than 1% to US$88 billion. Media Partners Asia (MPA) highlighted these findings on its recent publication “Asia Pacific Video & Broadband Industry 2024” report, showcasing how digital technology continues to reshape the industry across the region.

The online video sector has emerged as a major driver of industry growth. According to MPA, the APAC video industry’s revenues are expected to grow at a compound annual growth rate (CAGR) of 2.6% between 2023 and 2028, reaching US$165 billion by 2028. Excluding China, which remains the largest and most regulated market with US$64 billion in revenue, the sector is projected to grow at a faster rate of 3.3%, reaching US$95 billion by 2028.

The increasing adoption of online streaming platforms in emerger markets, combined with the widespread availability of internet-connected devices, has transformed how consumers engage with video content. Leading the charge are global giants such as Amazon Prime Video, Netflix, Disney, and Google’s YouTube, along with regional players like Jio Cinema in India, Tving in Korea, and Vidio in Indonesia.

Key markets and growth drivers

The APAC video industry’s growth is not evenly distributed across all markets. China continues to dominate, accounting for nearly half of the region’s video revenues. However, Japan, India, Korea, and Australia also play crucial roles, generating US$32 billion, US$13 billion, US$12 billion, and US$9.5 billion, respectively, in 2023. By 2028, the top six markets—China, Japan, India, Korea, Australia, and Indonesia—are expected to contribute over 90% of APAC’s total video industry revenue.

The fastest-growing markets, in terms of percentage CAGR, include Indonesia (7.3%), the Philippines (6.2%), India (5.6%), Vietnam (4.6%), and Thailand (4.2%). This growth is largely driven by improved internet connectivity, the rise of connected TV (CTV) penetration, and increasing investment in premium local content.

Artificial intelligence (AI) is playing a transformative role in the video industry, helping companies optimize content delivery, personalize user experiences, and streamline production processes. AI-driven innovations, including machine learning algorithms and real-time data analytics, have enabled broadcasters to offer enhanced content that is more engaging and interactive. These advancements have been particularly impactful in markets where online video is rapidly replacing traditional TV.

As highlighted by MPA, companies are increasingly investing in AI-powered tools to enhance their offerings. These tools provide viewers with personalized recommendations, real-time data overlays, and predictive analytics, creating a more dynamic and immersive viewing experience.

Advertising continues to be a major revenue generator for the APAC online video sector, contributing 51% of total revenues in 2023. This figure is projected to grow to 54% by 2028, driven by the expansion of ad-supported video-on-demand (AVOD) platforms. User-generated content (UGC) remains dominant within the AVOD category, accounting for 80% of AVOD revenues in 2023, while premium AVOD contributed the remaining 20%.

On the subscription side, the subscription video-on-demand (SVOD) market grew by 15% in 2023, reaching US$28 billion. However, MPA projects that SVOD growth will slow in the coming years as price increases and the introduction of ad-supported tiers encourage a more cautious approach to subscription-based services.

On the other hand traditional TV continues to face challenges. The segment revenues, including advertising and subscriptions, are projected to contract by a marginal -0.4% CAGR between 2023 and 2028. Key markets such as India, Japan, and Korea are expected to see slow growth in TV revenues, while Indonesia is likely to face significant downside risks in TV advertising.

The shift from linear TV to digital platforms has put pressure on broadcasters to innovate. Local broadcasters in markets like Australia, India, and Japan are increasingly turning to premium AVOD and SVOD models to capture a share of the growing online audience.