The powerful audiovisual industry in Europe continues to take advantage of the enormous tax incentives that countries offer to attract dynamism in local investments. These incentives seek to promote economic and cultural development through the creation of jobs and the promotion of local infrastructure.

Productions such as White Lotus (season 2), the recent winner of the Cannes Film Festival, The Substance, have taken advantage of these benefits, thereby reducing production costs.

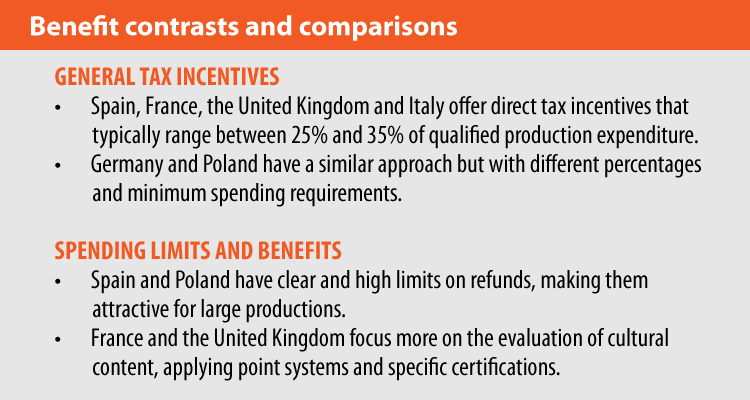

Spain is one of these countries. The peninsula offers a series of tax incentives both nationally and regionally. At the national level, there is a system of tax refunds (administered by the ICEX) of 30% for the first 1.1 million euros of expenditure, and an additional 25% for the remaining expenditure. At a regional level, Navarra offers a 35% tax credit, while the Canary Islands provide a 50% refund for the first €1.1 million, and 45% for additional spending.

National incentives require that at least 50% of the deduction base correspond to expenses incurred in Spanish territory for Spanish productions and co-productions, while for foreign productions a minimum expense of 1 million euros is required in Spain.

For its part, France is known for its tax credit system, the «Crédit d’Impôt International» (CII), which offers a 30% credit for foreign productions that spend at least 250,000 euros in the country or 50% of its production budget in France, whichever is lower. Additionally, the expense must be related to eligible cultural activities, such as filming, post-production, and visual effects.

This tax credit system has made France an attractive destination for major international productions, such as Mission Impossible and Inception, films that have taken advantage of these benefits to film in iconic locations in the country.

The United Kingdom offers several incentives through its «Creative Sector Tax Reliefs.» This system allows productions to claim a 25% tax credit on 80% of central expenditure made or consumed in the United Kingdom. This scheme applies to both high-profile films and television programmes, documentaries and other forms of audiovisual production.

Likewise, it also has the «British Film Certification», which evaluates the eligibility of productions for these incentives through a point system that measures the British cultural content of the production.

Germany offers the «German Federal Film Fund» (DFFF), which provides a 20% refund of qualified production costs. Additionally, the German Motion Picture Fund (GMPF) offers up to 25% reimbursement for high-profile productions and VFX (visual effects) projects. To qualify, productions must spend at least 20% of their budget in Germany.

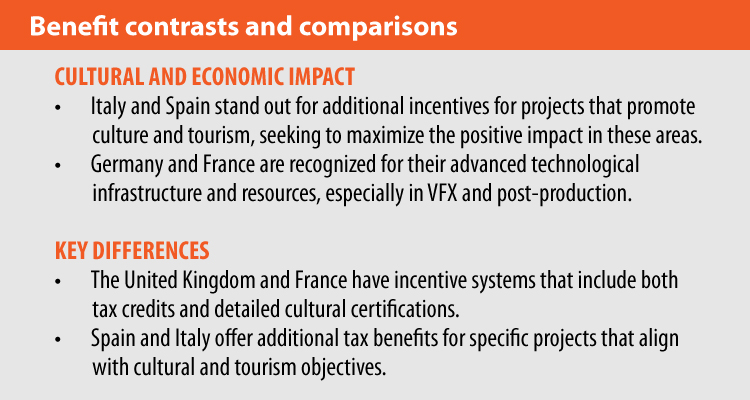

These incentives have made Germany a competitive destination for film and television production, attracting large-scale international productions.

Italy offers a 30% tax credit for film and television productions, applicable to both domestic and foreign productions. This credit is valid for expenses incurred in Italy, and applies to both production and post-production. Additionally, Italy provides an additional 15% credit for projects that promote Italian tourism and culture.

Likewise, Poland offers a 30% refund through the «Financial Support for Audiovisual Production». This incentive is available for movies, television series, documentaries and animations. To qualify, productions must spend a minimum of 1 million zlotys (approximately $237,000) for feature-length fiction films or series seasons, and 300,000 zlotys (approximately $71,000) for documentaries.

In conclusion, tax incentives in Europe are varied and are designed to attract audiovisual productions of different magnitudes and types. Each country presents a unique set of benefits that reflect its economic and cultural priorities, making Europe a highly competitive and attractive continent for the global audiovisual industry.