Europe has been experiencing a strong presence of US-based OTTs, whilethe toplocal players are making great efforts to compete within the region. Pay TV remains stable as a leading source of news and entertainment.Prensario analyzes the context, competition on linear and non-linear, and how the business looks for the next years.

The European media and entertainment market is one of the most versatile in the world and, as it has happened with other regions, pandemic has been a hinge. According to a recent report from the European Audiovisual Observatory(EAO), four platforms are controlling +70% of subscriptions: Netflix, AmazonPrime Video, AppleTV+ andDisney+. SVOD stands out as the most concentrated segment, followed by Pay TV with 72% of subscription cumulated by the top 20 Pay-TV operators.

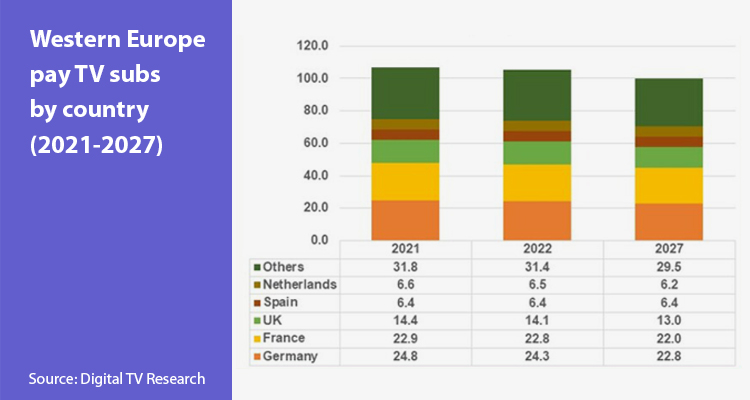

With this panorama, some consultants predicted that Pay TV ‘will lose strength’, as 5G advances in Europe and as more countries join cord-cutting. Digital TV Research reportedthat Western Europe is set to lose 7 million subscribers between 2021 and 2027. The number will fall in 14 of the 18 countries in the region, with Germany losing 2 million, the UK 1.4 million and France nearly 1 million. As of 2027, the total will stand at 100 million.

The number of pay TV subscribers and revenues saw significant decreases, according to Analysys Mason, where it explained that the segment saw sustained reductions between 2020 and 2021, mainly due to the continued proliferation of SVOD services and other digital video alternatives. The consultancy explained that the study determined that this may be a ‘delayed collateral effect of the pandemic’, because many of these consumers chose to keep their OTT video services and abandon their traditional pay television service.

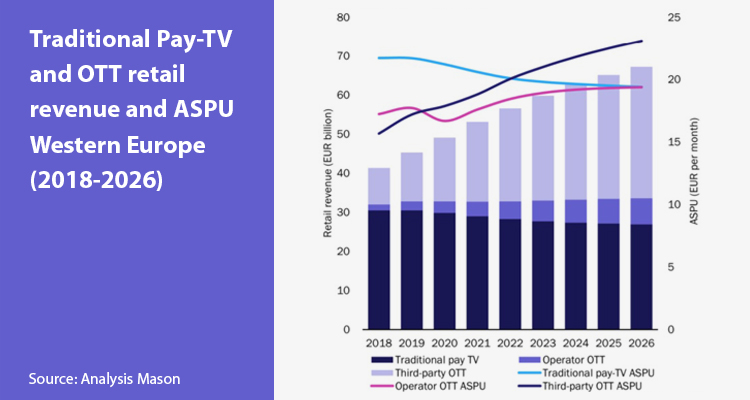

Consumer spending on third-party OTT video will grow from €20.4 billion in 2021 to €33.6 billion in 2026; this will be the key driver of the overall increase in spending on television and video services. The average spend of a third-party OTT video user will exceed that of a traditional pay TV user by 2022 and this, combined with increased uptake of third-party OTT video, will result in third-party OTT video revenue outpacing revenue. of the TV operator.

While the European pay TV landscape comprises several regional broadcasters, Sky continues to prevail as the leading pay TV company in the UK and Italy, and also in Germany, ranking among the three pay TV operators. The Comcast-owned company serves more than 20 million viewers in six European countries and since the service is also constantly expanding its streaming portfolio.In that sense, Statista reported until December 2021, that the pay TV penetration rate in Eastern Europe is 65.1%, and for Western Europe it is 61.4%, highlighting the UK as the largest European market.

Moreover, Ampere Analytics estimated that the number of active users of Amazon Prime Video grew by 1.4 to 12.6 million subscribers last year in Germany.Netflix only grew by 300,000 to 9.6 million in the same period, reported German news magazine Der Spiegel. This year, the gap is expected to widen further: market researchers expect Amazon to have 13.8 million active customers by the end of the year, while Netflix will only have 10 million. Apart from Austria, Germany is currently the only market in Western Europe where Amazon is ahead of Netflix.

Digital

The EAO report offered interesting data on purely digital players. The whitepaper shows that the cumulated operating audiovisual services revenues of the top 100 audiovisual companies in Europe (+7.7% over 2016 at the end of 2020) grew slightly more than average inflation and the overall market, boosted by the private sector (+12% over the same period), with over 75% of the incremental revenues cumulatively delivered by pure SVOD players alone: Netflix, Amazon and DAZN, for which separate data on European operations was available.

Conviva also painted a picture of strong streaming growth in Europe in its most recent regional report. The consultant reflected in the document that Europe as a whole experienced a 20% increase in streaming viewership, Southern and Western Europe saw roughly double that growth with 44 % and 34%, respectively.

Another relevant point that the report showed, focused on the fact that device preferences in Europe differed from the rest of the world in 4Q 2021: large screens (connected televisions, smart televisions and game consoles) represented 68 % of viewing time, and Samsung TV had the highest share of large screen viewing at 20%, followed by AndroidTV and Amazon Fire TV at 13% and 12% respectively. Roku, which has a global share of 31.8%, gained just 5% of Europe’s big screen viewing time.

Content spending and Advertising

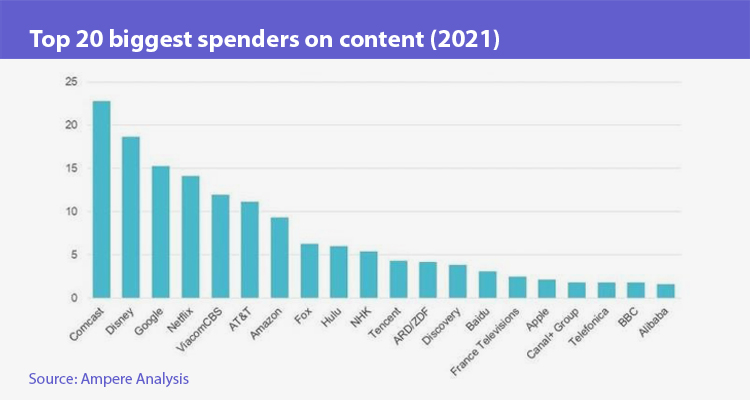

Ampere Analysishighlighted that the streaming services, led by Netflix, are helping to re-drive total global content spending to more than $220 million (Q4 2021), up 14% year over year. OTTs increased overall investment in emn content by 20% in 2021 (to almost US$50 million). Apple TV+, Disney+, HBO Max(https://digitalcontent.prensariozone.com/hbo-max-in-61-territories-and-counting/),Peacock and Paramount+ have all expanded rapidly and together through their original content strategies contributed more than USD 8 billion to content spending in 2021.

Regarding TV advertising, the company reported that the results of the last quarter of 2021 confirmed Ampere’s forecasts for the full year 2021, where TV advertising revenues in the main European markets averaged 6% below the revenues generated in 2019. The consulting firm said that while a seasonal rebound is expected in 2022, a return to pre-pandemic levels remains out of the question.

On the other hand, streaming ads rebounded in 2021, and consultants such as Conviva assured that it will be investment material this year. In Q4 2021, global ad impressions increased 16% quarter over quarter, as did ad attempts. It also highlighted that lost ad opportunities fell 2% quarter over quarter and bit rate improved 4%.

Sports-viewing

Regarding the audience in the sports segment, Dataxis reported that in Western Europe, during 2021, the number of subscribers to Premium sports channels has almost returned to its pre-Covid levels. The consultant reported that with the return of live programs and confirmed tournaments, the sports segment is recovering. Some networks like Sky allowed their customers to freeze their subscriptions for free (in the UK) or compensated them with additional free content (entertainment in Germany, for example). Second, the likes of Canal+ in France benefited from its mainstream model, by offering a wide variety of content, not just sports, to its subscribers.

In this regard, European sports on social media have bounced back very well since the start of the pandemic. Specifically for European sports videos on social platforms, total posts were up 1% and videos were up 4%, while interactions were down 2% overall.