After the recent announcement of BBC that it plans to serve ads on some of its podcasts in the U.K. has sparked controversy. This move has angered commercial broadcasters, who argue that the use of public license fees to generate ad-funded content could distort the market. While this shift may seem limited to podcasts, it reflects a much larger transformation happening across the European TV industry as broadcasters race to reinvent themselves to stay competitive in the streaming era.

With the rise of American streaming giants like Netflix, YouTube, Disney+, and Prime Video, European broadcasters are feeling the pressure to innóvate, specially the public ones. These platforms have cemented their dominance in almost every European market, forcing local broadcasters to rethink their content, ad offerings, and revenue models. The competition is especially fierce as these streamers have expanded into ad-supported content, including live sports—an area traditionally dominated by European broadcasters.

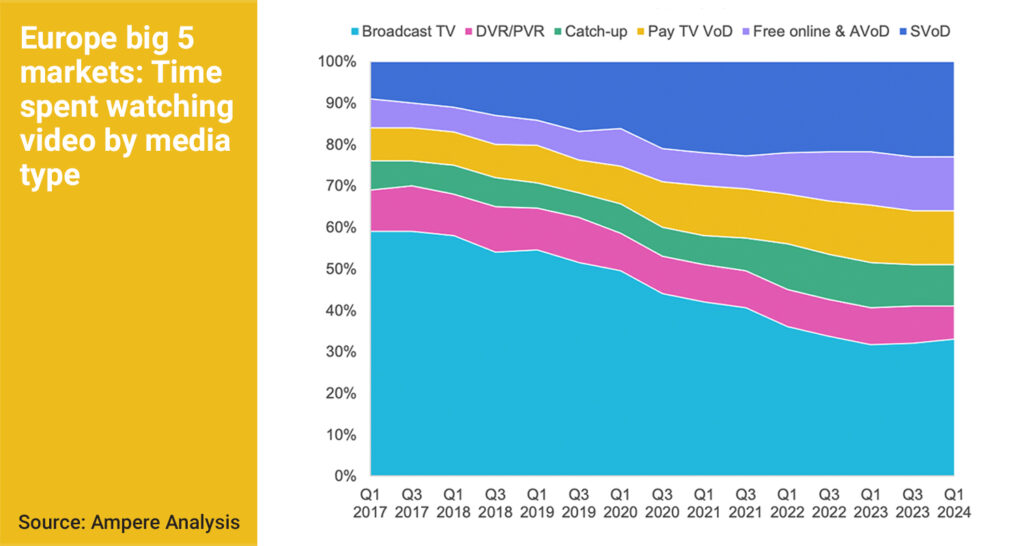

The urgency for reinvention is clear. Linear TV advertising revenue in Europe’s top five markets—U.K., Germany, France, Spain, and Italy—has dropped by nearly €900 million over the past decade. At the same time, connected TV (CTV) ad views have surged by 24% year on year in the second half of 2023, signaling a major shift in how audiences engage with content.

European broadcasters fight to stay relevant

For European broadcasters, adapting to the new streaming landscape is about more than just revenue. Public broadcasters, in particular, have long served as key players in delivering culturally significant, locally produced content that reflects national identities. However, with global streamers prioritizing profit over public interest, there is a growing concern that local storytelling could be overshadowed by more commercial, homogeneous content.

The challenge for broadcasters is not just to maintain their position in the market but also to continue reaching local audiences with compelling, culturally relevant programming in an increasingly digital world. As Ophélie Boucaud, principal analyst at Dataxis, points out: ‘What is at stake is European broadcasters’ very position in the media industry and, more than that, their ability to keep reaching local audiences with local narratives in a new, unfamiliar space’.

To compete, many European broadcasters have launched their own ad-supported streaming platforms, offering a mix of free and subscription-based content. ITVX in the U.K. and Joyn in Germany are just two examples of how broadcasters are embracing digital platforms to capture a larger share of the streaming market.

Despite challenges, there have been efforts to consolidate and streamline operations. France’s TF1, M6, and France Télévisions collaborated on the now-defunct streaming service Salto, while Spain’s Lovestv brings together local broadcasters on one platform, albeit with separate ad inventories. The launch of Freely, a free ad-supported streaming service developed by the BBC, ITV, Channel 4, and Channel 5, is seen as a major opportunity to reclaim ad budgets and boost competitiveness in the crowded streaming market.

As broadcasters increasingly embrace ad-supported content, they are also investing in new technologies to make ad buying and placement more seamless for advertisers. U.K. broadcasters like ITV and Sky have led the charge with digital addressable TV advertising solutions like Planet V and AdSmart, which enable advertisers to target specific audiences with precision.

On the continent, Germany’s RTL and ProSiebenSat.1 have combined their ad tech stacks to make programmatic linear TV and CTV ad buying easier for advertisers. Similarly, France’s TF1 and M6 are supporting European Unified ID to help advertisers navigate cookie-free CTV environments. These innovations are expected to appeal to digital-savvy advertisers and help broadcasters compete with global tech giants like Meta and Alphabet.

For European broadcasters to remain competitive, focusing on advertising opportunities seems to be a more viable strategy than directly competing with streaming giants on premium subscription services. Ad-supported streaming services, combined with innovations in ad tech, offer a path forward. But broadcasters are also keen to differentiate themselves through local content production. Original programming, especially in local languages, remains a key asset for European broadcasters.

Examples like Babylon Berlin from Sky Germany and Medici from Italy’s RAI demonstrate the potential of European broadcasters to create standout, culturally resonant programming. Partnering with global platforms also offers a way to expand revenue streams, as seen with the BBC’s decision to license global rights to Doctor Who to Disney+ while retaining U.K. rights.

Some recents milestones of these strategies involves precisely RAI and BBC. The first one is the ad-supported platform RaiPlay, Launched in 2016, the service offers a wide array of television programs, films, documentaries, news, and original productions, marking pubcaster’s strong entry into the digital media space.

BBC iPlayer had a recent relaunch, including a new content strategy, which has made it one of the fastest growing services in Europe. The truly distinctive British service continues to break records – up over 20% this year so far. BBC service’s viewing growth is twice that of Netflix, three times that of ITVX and four times that of Channel 4. This is underlined by the record levels of people using the service last summer, which has grown 10% at the same time last year. Its summer of live events generated over 350 million requests.