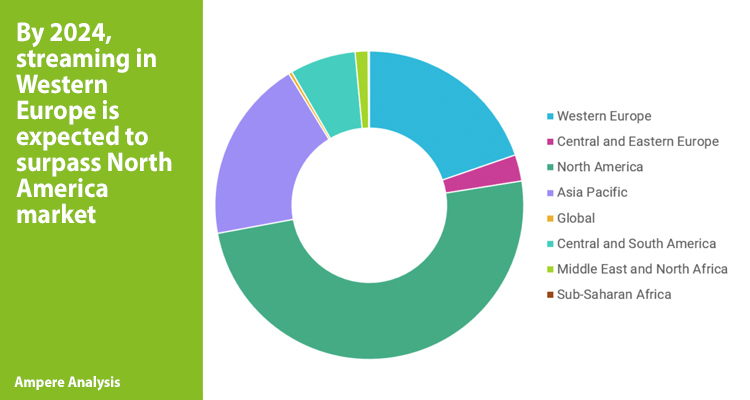

The dynamics of streaming consumption continue to evolve as local players establish themselves in Europe. According to recent data from Ampere Analysis, the number of households subscribing to at least one OTT service in Western Europe, so this market is projected to surpass North America (comprising the US and Canada) in 2024, driven by the UK and Germany.

This means that the countries within this market (Norway, Denmark, Germany, Sweden, United Kingdom, Netherlands, Finland, Italy, France, Spain, Ireland), Austria, Switzerland, Belgium, Luxembourg, Portugal, Iceland, Malta, Greece, and Cyprus) are open to a variety of streaming services, both local and foreign. As a result, North America will become the world’s third-largest geographic region for streaming households, following Asia and Western Europe.

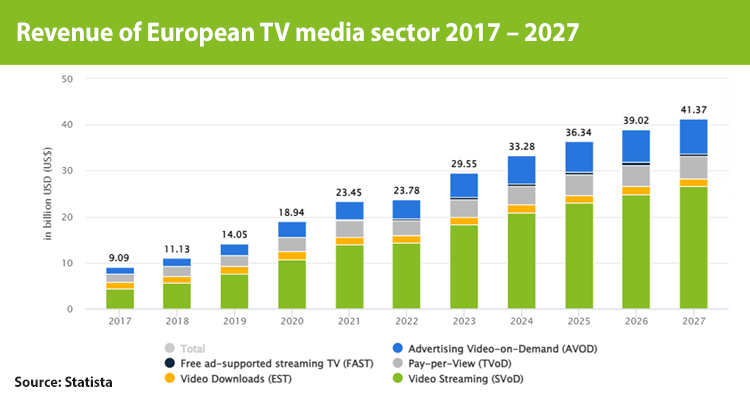

In particular, the growth of countries outside North America will propel the expansion of streaming. As a result, the region will no longer represent the majority of streaming revenue, falling below 50% of global revenue by 2024, as noted by the consultant.

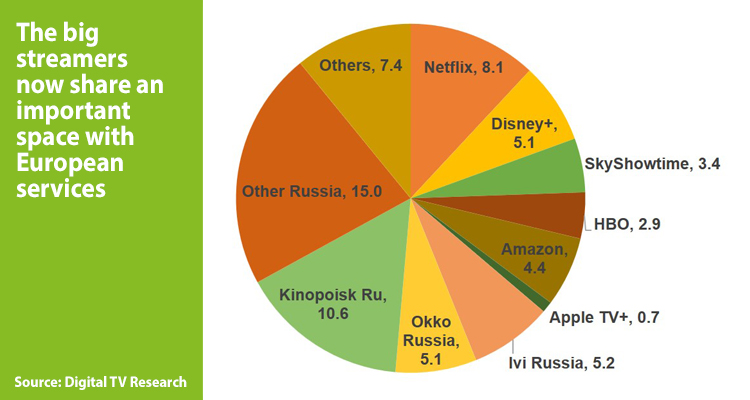

Meanwhile, Eastern Europe is expected to have 68 million SVoD subscriptions by 2029, an increase of 27 million from 2023, according to a recent report from Digital TV Research. The report also estimates that the top platform by subscribers in the region will not be US-based, but rather Kinopoisk, which is exclusively available in Russia. Russia is projected to account for 53% of the total SVoD subscriptions in 2029.

Opportunities for Local Content Producers

Following last year’s data, which Ampere also presented, indicating a 10% decrease in the commissioning of new programs in the USA by the end of last year, but a 9% increase in Europe, it has shifted the streaming strategies of local players. This is especially true for public broadcasters, followed by commercial TV operators and Pay-TV brands, all eager to claim a share of the segment’s pie.

European public television stations led the market with the highest volume of commissioned titles at the end of 2022, marking a 22% increase compared to 2021. As a result, the consulting firm anticipates that spending on original content in Europe will surpass that in the USA. This is due to market saturation in the USA, and more recently, the strikes in recent months.

Networks such as ZDF, France Televisions, RTVE, RAI, and RTVE remain very active in terms of original productions. They aim to remain relevant and meet the demand for content resulting from the slowdown of American productions.

An example of this is the alliance of PSBs (Public Service Broadcasters) to identify intellectual property and promote co-production alliances between peers. This capitalizes on content between public channels and pan-regional VOD platforms. In 2022, all these networks together invested close to 5 billion euros in original content, accounting for 63% of the total TV commissions in Europe’s major market. This compares to the 2.8 billion euros invested by global streamers in 2021.

Furthermore, the OTT field has paved the way for the emergence of new services in Europe. Among them are LigaT, the El Gourmet platform, Filmbox+, GB Basketball, Real Madrid’s platform RM Play, and 1+1 Media Group‘s service 1+1 video, among others.

Commenting on these new insights, Guy Bisson, CEO of Ampere Analysis, said: ‘Streaming saturation in North America is the main driver of reduced growth. Other regions of the world still have room for new customers, both in terms of completely new streaming customers and the number of services contracted in each home. North America losing its position as the largest revenue-generating region will only accelerate the existing trend of focusing content investment on key growth markets, which will have long-term implications for US manufacturing sectors and for domestic investment in Asia and Europe’.