Special Report

Content consumption is constantly changing. But that change can sometimes mean going back to basics. In this report, Prensario analyzes the new consumer trend: FAST channels, what they are and what new opportunities they bring to the industry.

Free Ad Supported TV (FAST) channels are, on the one hand, free streaming services with advertising, but on the other, they extend the traditional linear TV service to connected devices such as mobile phones, tablets or connected televisions.

Unlike traditional linear channels, FAST allows you to offer dynamic ad insertion, giving you the opportunity to establish specific audience targets for brands, and a more assertive analysis of results, with relevant advertising for each user.

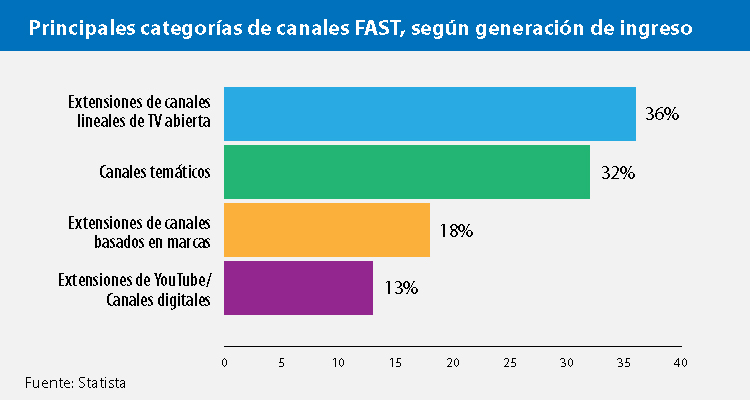

The models for creating a FAST channel are split into two: an existing channel can be taken, both Free TV and Pay TV, or an independent content catalog can be taken and turned into a channel. The second becomes a very useful tool, especially for those producers and distributors who have a niche offer, a significant volume of titles, or who perhaps cannot have a strong penetration in services where the purchase and sale of rights can have a value, established or at least a GM if the model were low revenue share.

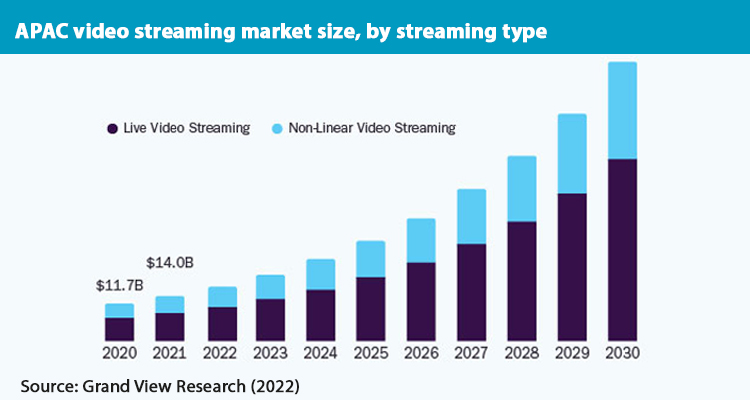

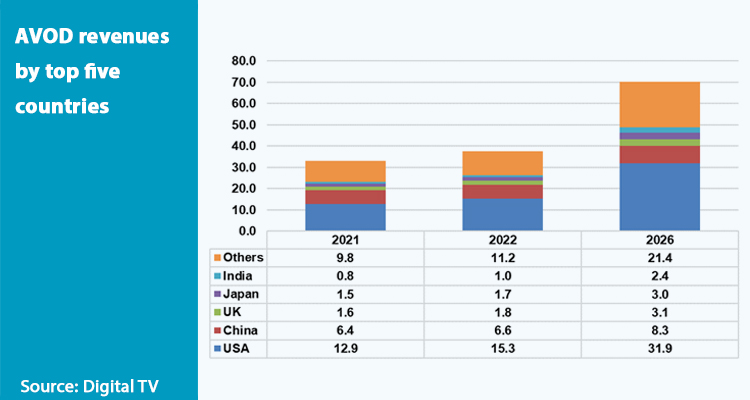

This trend is in line with the loss of subscribers at the hands of cord cutters, and the increase in connected televisions per household, which according to data from the Leichtman Research Group today exceeds 80%. Today consumers are programmers at the same time, assembling their grids with bundles of platforms of their interest. But the high costs of having more than three services, and the so-called «fatigue», leads to complementing said proposal with AVOD and FAST services such as Xumo, Tubi or Pluto TV, respectively.

«FAST is an exciting new way for consumers to watch and discover premium content in an environment that mimics linear television,» said James Rooke, president of Comcast Advertising. ‘And because FAST services are easy and free to access without registration, it is becoming a valuable way for advertisers to reach audiences, especially cord cutters. While FAST is not a replacement for linear television or other broadcast advertising, it certainly acts as a valuable supplement; the strongest media plans combine FAST and streaming with traditional TV to maximize reach and efficiency.”

Among the giants that have already managed to make a strong foothold in this business model are Pluto TV and Rakuten, which launched 21 new channels in 2021 and aims to have a total of 90 pan-European channels. The good results led other technology companies to bet on the same path. As is the case of Samsung, which had its own stand at the last edition of MIPCOM Cannes, presenting its Samsung TV+ service.

According to Laura Tapias, VP America & Spain, Applicaster, although the costs of putting together the infrastructure to launch a FAST platform require a significant investment, «once launched, adding brand channels is much simpler than in traditional television.» ‘Streamers can launch as many channels as they want on whatever content they like. FAST also avoids the complexity of dealing with cable payments or authentication, so these TV channels can be distributed to as many platforms as they want, as setting up a channel is no more than a click on their back end,’ he emphasizes. .

But once again, is there room for everyone? According to Tapias, those committed programmers will force their channels to grow, investing heavily in programming and promoting television channels, and the smaller ones will probably disappear. The upside is that streaming provides many new tools to grow and sustain, such as personalization through AI placed on top of user consumption and behavioral analytics. In short, the experience becomes 360° and not only depends on what content is programmed.

A TVision study notes that, by the end of 2021, nearly 30% of US households had more than 10 apps installed on their SmartTV, with a growing number dedicated to generic AVOD and FAST services. While from Dataxis they emphasized a significant increase in engagement in all types of AVOD content and a greater potential in regards to the insertion of advertising in smart connected devices and CTVs. Additionally, a recent joint study by DeepIntent and LG ads indicated that 64% of US CTV viewers would rather watch ads than pay more for content, highlighting the significant gap observed between growing demand for content and limitations. of household budgets.

The AVOD model is expected to surpass the traditional one by the end of 2025, thus representing a chance to re-linearize online content through FAST channels, with higher ad revenue. In less than a year, Scripps Networks multiplied by 5 the CTV distribution of its FAST channels (Newsy, Ion, Court TV among the main ones), ensuring their availability through a wide number of devices and platforms.