Content consumption is constantly changing. But that change can sometimes mean back to basics. In this report, Prensario analyzes the trends to take into account in the FAST channel segment, and what’s the new opportunities that bring to the industry.

A very simple definition of FAST platforms or channels is that on the one hand, they offer free streaming services with advertising (AVOD), but on the other one, they extend the traditional linear TV service to connected devices such as mobile phones, tablets or connected TVs.

Unlike traditional linear channels, FAST allows you to offer dynamic ad insertion, giving you the opportunity to establish specific audience targets for brands, and a more assertive analysis of results, with relevant advertising for each user.

The models for creating a FAST channel are split into two: an existing channel can be taken, both Free TV and Pay TV, or an independent content catalog can be taken and turned into a channel. The second becomes a very useful tool, especially for those producers and distributors who have a niche offer, a significant volume of titles, or who perhaps cannot have a strong penetration in services where the purchase and sale of rights can have a value established or at least a guaranteed minimum if the model were low revenue share.

This trend is in line with the loss of subscribers and the growth of cordcutters, also the increase in connected televisions per household, something that according to data from the Leichtman Research Group today exceeds 80%. Today consumers are programmers at the same time, assembling their grids with bundles of platforms of their interest. But the high costs of having more than three services, and the so-called «fatigue», leads to complementing said proposal with AVOD and FAST services such as Xumo, Tubi or Pluto TV, respectively.

Among the key data that shows the preponderance and growth of FAST in the industry, is the one recently presented by Ampere Analysis, which ensures that AVOD platforms are offering more top content than before. Since the beginning of 2022, Pluto TV, Freevee and Tubi have established important alliances with prominent providers. Freevee recently signed an alliance with Interscope Records to broadcast exclusively Ellie Goulding’s concert special, “Monumental”. This has meant that only in the United States, since the third quarter of 2021, there has been a 39% increase in internet users using an AVOD platform.

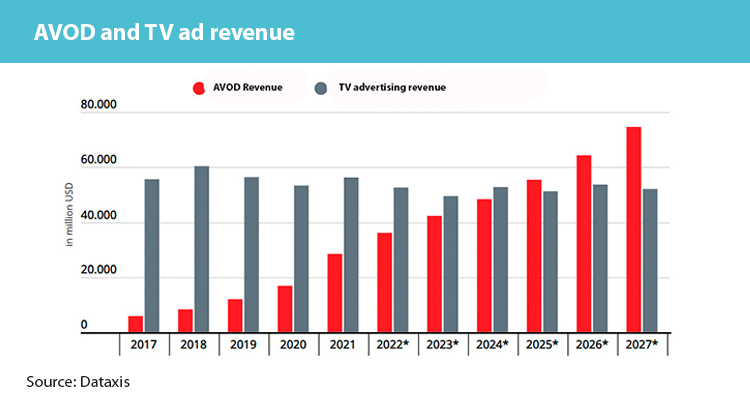

This has presented great opportunities for advertisers, as for the first time ever, online video ad revenues overtook TV ad revenues in 2021. Online video advertising has grown as a share of total global ad revenues from 10% in 2017 to 22% in 2022, according to the same report from Ampere: Globally 196 billion were received for online advertising concepts, USA accounts for 49%.

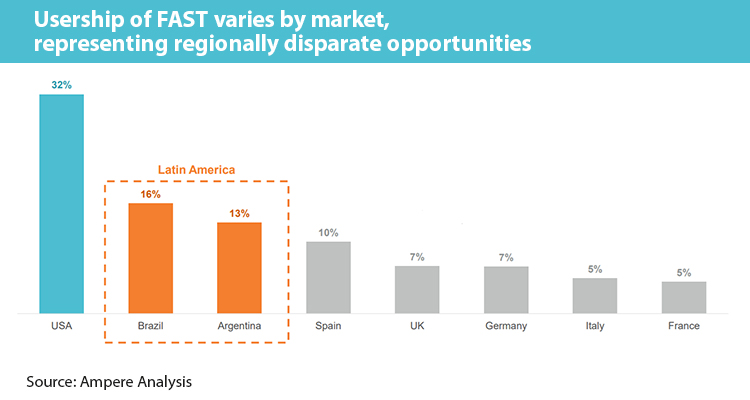

Regarding usership, Ampere observed that it varies between markets, and although the USA has one of the highest adoptions in the world, with 32%, Brazil and Argentina stood out especially with 16 and 13% respectively in terms of usership. While the uptake of FAST-offering AVOD services has been slower in major European markets due to the longstanding position and strength of local BVoD (broadcaster-led video-on-demand) platforms like All4, ZDF Mediathek and MyTF1.

The largest FAST providers offers hundreds of channels. For example, in the USA there’s 122 Channels on average per package, with Roku and Pluto TV on the top of platforms. In general, the offer of channel themes leans towards non-scripted content, in up to more than 80% of the offered catalogue, as in the case of Peacock.

‘FAST is an exciting new way for consumers to watch and discover premium content in an environment that mimics linear television’, said James Rooke, president of Comcast Advertising. ‘And because FAST services are easy and free to access without registration, it is becoming a valuable way for advertisers to reach audiences, especially cordcutters. While FAST is not a replacement for linear television or other broadcast advertising, it certainly acts as a valuable supplement; the strongest media plans combine FAST and streaming with traditional TV to maximize reach and efficiency’.

Among the giants that have already managed to make a strong foothold in this business model are Pluto TV and Rakuten, which launched 21 new channels in 2021 and aims to have a total of 90 pan-European channels. Or Samsung TV Plus, which continues to grow by leaps and bounds, and has already crossed the 100-channel border in a short time.