The European FAST TV market is experiencing rapid growth and significant evolution, mirroring trends seen earlier in the United States. Last year whitepaper from the FAST4EU Consortium highlights this expansion, detailing market characteristics, growth drivers, and emerging challenges for content owners and platforms.

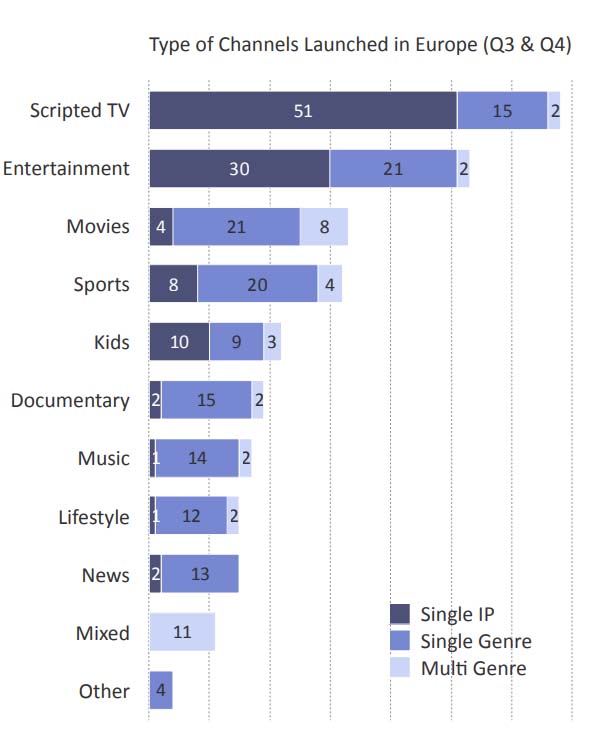

FAST, defined as linear, ad-supported streaming TV delivered over internet-connected devices, has become a central topic in industry discussions in CEE region. While early FAST channels typically relied on library content with lower ad loads, this is evolving as more players enter the market. The three main types of FAST channels include single-source IP, single-genre, and multi-genre offerings. Platform operators vary from Original Equipment Manufacturers (OEMs) like Samsung and Vizio, offering embedded services on their devices, to specialists accessible via apps and browsers, and increasingly, traditional broadcasters extending their digital presence.

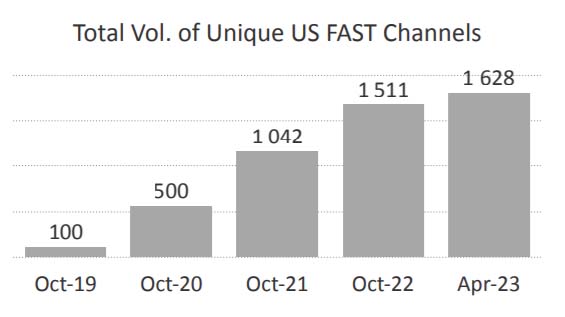

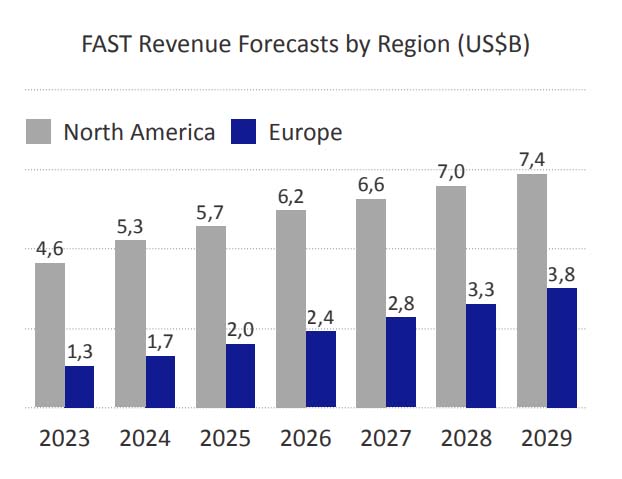

The European market is following the trajectory of the US, which has seen explosive growth. The US market identified 100 unique FAST channels in 2019, growing to over 1,600 in 2023. Global FAST revenues are forecasted to reach $17 billion in 2029, a substantial increase from $8 billion in 2023. North America currently accounts for over 50% of these revenues, though this share is expected to decrease as other regions catch up. Europe is expanding quickly, holding 17% of the global market share currently, with projections to reach 22% by 2029.

Despite a more developed advertising industry in the US, Europe’s growth is distinct. While US channel volume growth has begun to slow (only 6% over the first nine months of 2023), European channel volumes continue to increase, with Germany showing 32% growth in the same period. This growth is accompanied by an improvement in channel quality as major players and premium content owners enter the market, moving beyond the early days of non-premium, unbranded programming. For instance, 60% of recent channel launches in Europe in 2023 were from Tier 1 Content Owners, including major studios, broadcasters, and leading independent distributors.

Across the five top European markets (UK, France, Germany, Italy, Spain), all major FAST platforms experienced channel volume growth in 2023. The top five European markets launched an average of over 40 channels per month during the last six months of 2023. The largest growth category during this period was Single IP Scripted TV channels, often featuring well-established brands. This category now averages 27% of channels across most markets. The increase in scripted content overall, both TV and movies, points to a higher level of investment in the European FAST market.

Local content is increasingly a priority for platforms, with recognition that home-grown content is often the most popular. Platforms are working with local channel providers and developing their own channels through local partnerships to build offerings that resonate more with viewers. For example, Samsung TV Plus grows its owned-and-operated channels by licensing content in some areas and partnering in others, including collaborations with local players like ZDF Studios in Germany. Rakuten TV, available in 43 European territories and reaching over 140 million households, offers an extensive lineup of over 500 unique FAST channels, including 100 Owned & Operated (O&O) channels that are fully localized for key markets.

As the market matures, platforms are becoming more discerning about channel lineups, leading to the removal of under-performing channels in favor of higher-quality additions. On average across the top five European markets, 22% of channels were dropped from at least one platform between April and December 2023. This indicates a shift towards optimizing channel offerings and implementing minimum quality standards for new and existing channels.