In the ever-evolving landscape of streaming services, free-ad-supported TV networks, or FASTs, are seizing the spotlight once again. More and more people are establishing themselves in this TV model, either because of its access, because of its content, but also because it recovered something that had been lost with streaming: traditional TV viewing, even family viewing was recovered.

Consumer sentiments shift towards Ad-Supported content

Traditionally, viewers have harbored mixed feelings about watching TV advertisements. However, attitudes towards ad-supported content are undergoing a positive transformation. According to Vevo and a Publicis Media survey, an overwhelming 89% of respondents perceive FASTs as delivering exceptional value. Furthermore, a mere 7% of FAST viewers admit to skipping advertisements, signifying a significant shift in consumer behavior.

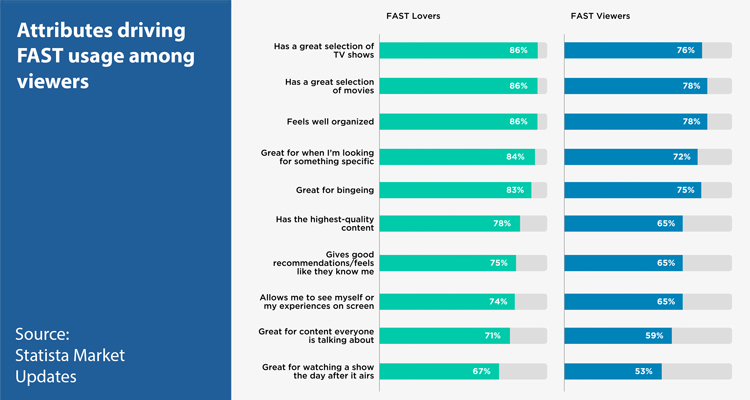

The survey delved deeper into the motivations behind choosing FAST channels, revealing that viewers are drawn by a trifecta of factors: a diverse selection of TV shows, an extensive array of movies, and well-organized content libraries.

As cord-cutting becomes increasingly prevalent, consumers are gravitating towards FAST networks to fulfill a desire akin to the content surfing experience offered by traditional linear television. The survey highlights that 60% of viewers engage in browsing or scrolling until they discover content that captures their interest.

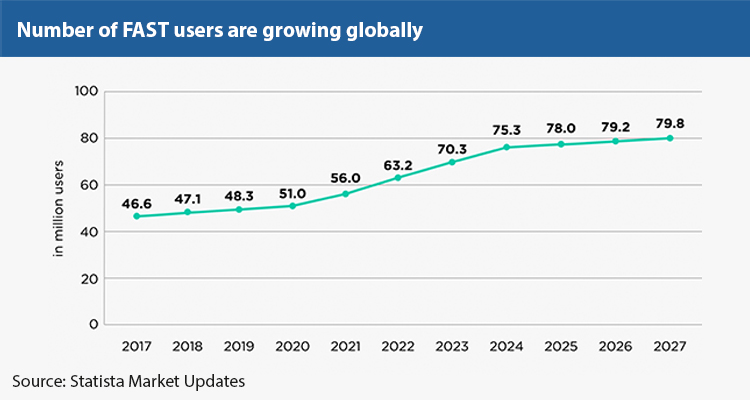

Steady Growth in FAST Usage and challenges for SVOD services

Mirroring the satisfaction expressed by FAST users, viewership numbers are witnessing a steady ascent. According to eMarketer, 57% of TV consumers are already tuning into FAST networks. These figures translate to millions of viewers, with consultancy firms such as Statista, reporting a surge to 70.3 million FAST users as of October 2023, up from 63.2 million in 2022 and 56 million in 2021. Should this trend persist, viewership is projected to reach nearly 80 million by 2027.

This has awakened classic subscription-based services. As these platform prices continue to escalate, consumers may increasingly opt for ad-supported networks over other streaming platforms. Major players like Disney, Warner Bros. Discovery, and Apple TV+ have implemented price hikes, prompting consumers to reconsider the value proposition of ad-free streaming.

Addressing content discovery

Content discovery remains a crucial issue in the SVOD vs. FAST debate. With the abundance of content and sources, consumers often struggle to find something to watch on streaming services. FAST networks, with their curated content libraries and viewer-friendly organization, present a compelling solution to this challenge.

Advertising opportunities on FAST Networks

The growing satisfaction and viewership of FAST networks present lucrative opportunities for advertisers. Brands can effectively reach engaged audiences on these platforms by employing precision audience targeting strategies. With nearly 40% of consumers expressing willingness to watch personalized ads, advertisers have a prime opportunity to connect with their target demographics on these networks.