The gaming segment continues to see good results after the Coronavirus pandemic in 2020. After two years of growth driven by confinement, the global market for this industry in 2022 was ‘corrective’ according to Newzoon: ‘Revenues in 2020 and 2021 were much higher than anticipated at the time, and in 2022, the sector accounted for $184.4 billion, fueled by around 3 billion players worldwide.

The consultancy also ensures that this industry could reach 200 billion dollars, and until 2024 the market could grow with a compound annual growth rate of 8.7%, reaching 218.7 billion dollars.

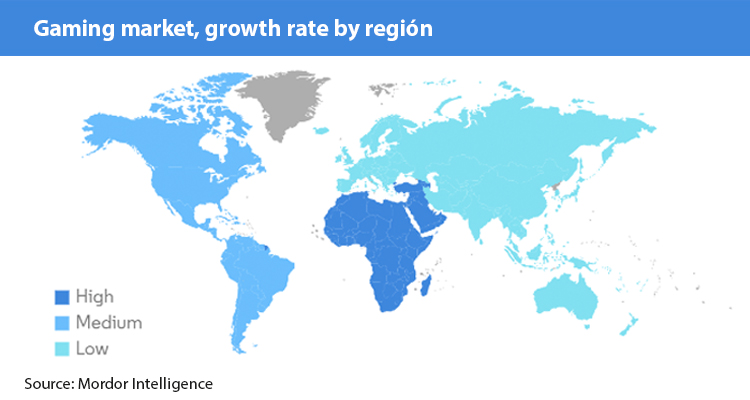

In addition to Newzoo, Mordor Intelligence believes that the number of global players will continue to grow around the world. The firm dedicated to the video game industry says that the market will register a CAGR of 8.94% during the current period and 2028.

Thanks to the expansion of technology, new tools, the considerable increase in the quality of content, the professionalization of e-Sports, streaming services and niche platforms, it also estimates that by 2027, the global industry of gaming could reach 340,000 million dollars.

For this year specifically, more growth is expected as publishers invest in quality that can compete with premium console and PC games. Also, as cloud gaming develops, cross-platform releases are expected to reach more audiences and retention will increase. But cloud gaming will continue to grow as more mobile games offer multiplayer options and cross-platform compatibility.

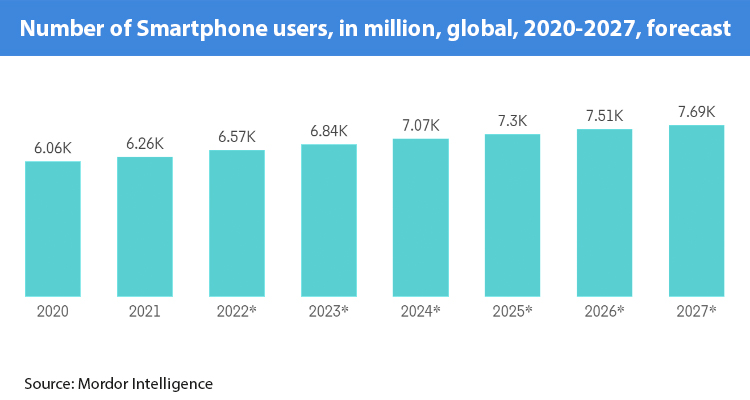

One of the accelerators of this trend are smartphones which are already powerful and capable enough to run more demanding mobile games, and their features are helping to increase this trend. Handheld console makers like Nintendo and Steam could consider adding 5G capability to their devices to enable ubiquitous access and compete with iPhone or Android. For their part, operators and service providers can build on the popularity of mobile gaming by looking at gaming-specific data plans and investing in cloud gaming infrastructure.

US market

According to eMarketer, this 2023 could be an exceptional year for the gaming industry in the US market, with the advancement of technology boosting the sales of gaming products. Advertising investment in mobile games in this market will grow this year by 10% to 6,280 million dollars, and will continue to grow between 8% and 10% in the coming years. While e-Sports ad revenue will continue to grow at the same rate and is expected to rake in around $250 million by the end of this year.

However, executives from major gaming and e-Sports companies highlighted their readiness for the next recession and their confidence in the gaming industry’s ability to resist. In addition, the combination of artificial intelligence and virtual reality innovations continue to significantly improve the gaming experience: the use of artificial intelligence is leading to enhanced artistic qualities and photorealistic animation. For gaming to drive adoption, companies should also invest in 5G infrastructure.

Netflix is one of the streamers that also began to invest in this segment. In addition to licensing popular game IPs like League of Legends for original series, in 2022 the company began offering games directly within its platform and just added two more games: «Kentucky Route Zero» and «Twelve Minutes». In total, the platform already has 48 free games available on its service.

South East Asia market

The market in Asia will register a CAGR of 16.2%, due to the growing popularity and interest in various sports and increased investments in Internet infrastructure. In recent years, the region’s telecom providers such as Ooredoo, CK Hutchinson, True Corp and DTAC announced merger deals worth $30 billion worth of 5G technology.

All-Correct Games claims that Southeast Asia has more than 250 million mobile gamers, with Malaysia, Thailand, Vietnam, Indonesia, Singapore and the Philippines being the largest contributors. This sector is mainly driven by revenue streams like in-app purchases, pay per download, subscription services, ads, etc.

For its part, the e-sports market is growing exponentially in the region as traditional games are being replaced by digital games.

Streaming giants like Amazon and Google have invested millions in online gaming, so this is expected to further fuel the growth of the market.

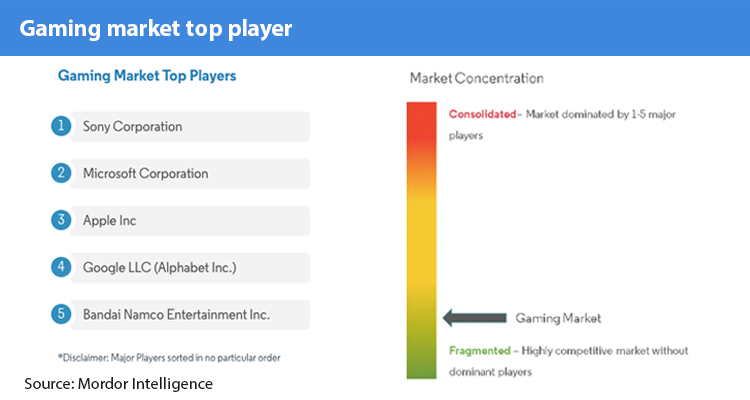

Among the main players that stand out are: Sony, Asiasoft, IGG Inc, com2uS Corporation, Nintendo Co Ltd, Tencent Holdings Ltd, Netmarble Corporation, BANDAI NAMCO Entertainment Asia, Sherman3D and Garena SEA Group.

European market

Finally, for the European market, the gaming industry will grow in turnover by 8% per year in the next five years, and among the main drivers are the increase in users, digital adoption, corporate investment and an ecosystem of developers. competitive against other markets.

In recent years, the number of e-Sports viewers on this continent has maintained a growing trend, reaching over 90 million. The sector presents boom rates, despite the fact that it is not yet as popular as in the United States or the Asian continent.

It is expected that in the future, e-Sports will continue to grow here, and this trend may be possible thanks to the overcoming of the age barrier, as shown by the proportion of fans above 30% in all time slots. France is currently the European country with the highest profits in the sector, although in terms of consumption Spain and Italy occupy the leadership.