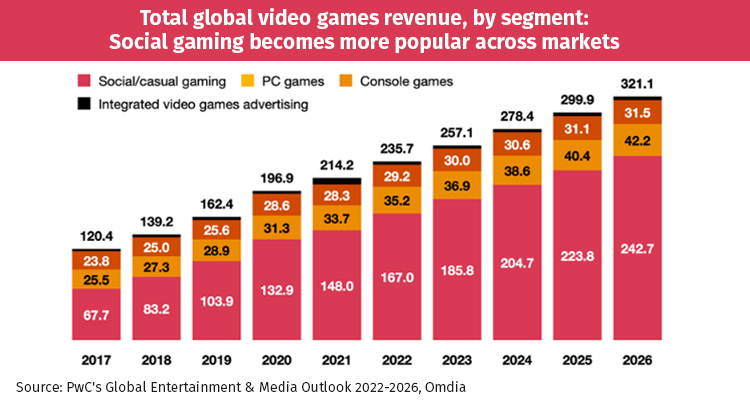

The entertainment market focused on gaming is booming. The sector is expected to expand and have a value of 321,000 million dollars by 2026, according to the latest Global Entertainment and Media Outlook report by PwC.

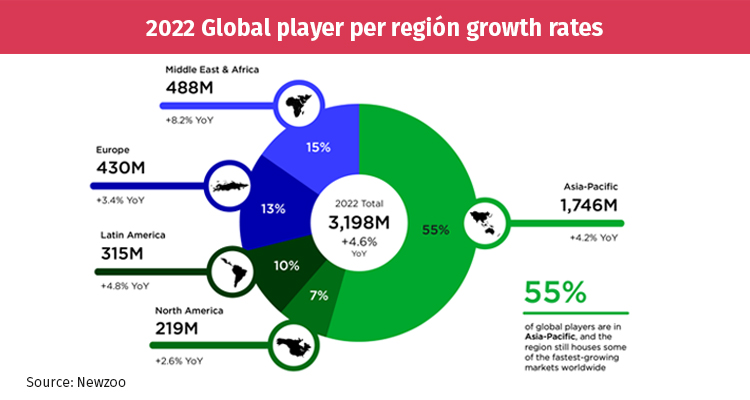

These figures are driven by social and casual gamers, which were added following health restrictions following the COVID-19 outbreak. According to Newzoo, at July 2022 there were more than 3,198 million gamers worldwide. Likewise, the consultant estimates that there are more than 300,000 million dollars in direct and indirect value in the gaming industry.

The truth is that this industry has already surpassed cinema and music, becoming popular in all countries, languages, of all ages and in all genres; with big implications for many of the companies involved within the ecosystem, such as developers, distributors, content creators and gaming platforms.

Market drivers

There is no doubt that the pandemic boosted the adoption of terminals for the use of video games. Several consultants say that the widespread adoption of smartphones has added a large number of players around the world. According to data compiled by Google, 20% of the global gaming market in 2020 consisted of new or returning players, while 80% consisted of veteran players who were already playing prior to 2020. Even said on its report, that by the end of 2021, almost three billion spent a combined $175.8 billion on games.

Representing 53% of the market, mobile games have already generated $103.5 billion this year, up 5.1% from last year, according to Newzoo. This is followed by 52.9 billion revenue from console games, 27%; $38.1 billion from boxed PC games, a modest 19%; and finally a slight 1% from browser PC games, or 2.3 billion.

Another index that attests to this growth is that this widespread adoption has placed the female gender at 46% of all gamers, according to Accenture. Below 52% with respect to the male gender; meanwhile, they have also identified a slight 2% who identify as non-binary. Meanwhile, Accenture also reported that 21% of gamers have only been playing for four years or fewer, where the point it these are the hundreds of millions of new gamers who are helping to drive the industry’s growth, especially in mobile.

Based on these trends, the segment industries are moving more and more to free-to-play games from any console, but above all to the monetization of subscribers, even through advertising-based platforms.

Global markets

Latin America has become one of the fastest-growing markets for the video game industry. The region is transitioning to mobile gaming, due to the costs of high-end consoles and PCs, and as internet connections improve. In 2021, 289.3 million LATAM players spent a combined $7.2 billion on games, of which 48% will be spent on mobile, 27% on console, and 25% on PC, according to Google data.

Several consultants predict that this increase in players and digital consumption habits in LatAm also opened the region to the world of eSports, as a result, the audience for live-streamed content is expected to rise to 122.4 million people by 2024, by which point the number of esports enthusiasts will have grown to 25.3 million people.

Meanwhile, the North American market continues to have a stable trend towards video game consoles, a market segment that has a 46% share, generating some 19.6 billion yoy; while mobile accounts for 38%, generating some 16.1 billion yoy.

In this market, games have been incorporating social media like- elements to actually becoming social media platforms themselves. Even gaming has become the second most popular form of social digitalization in 2020, only behind social networks. Meanwhile, the number of players meeting in-game or via game-related platforms equaled or surpassed the number of people using videoconferencing apps.

As for EMEA, the region is home to four of the 10 largest gaming markets (Germany, UK, France and Italy), while also encompassing promising Middle Eats markets, which are growing as countries open to higher internet speeds and 5G technology. In 2021, EMEA’s 842.9 million players spent a combined $37.8 billion on games. Console gaming represented the largest segment as of 2021 (45%), but mobile was the fastest growing (35%, up 4% from last year).

Finally, APAC, as one of the largest regions in the gaming market, is placing a strong emphasis on multiplayer games, while companies in the segment continue to integrate more social uses into video games.

The market is home to 55% of all global players and three of the top four markets by consumer spending (mainland China, Japan, and South Korea), according to Google. Virtually all of APAC’s 1.62 billion players play on mobile. The $57.9 billion being spent on mobile games in 2021 represents two-thirds of all consumer spending in the region.

This market is more developed in terms of sociability through gaming, even it’s more ready than other regions to adopt proto-metaverses and similar innovations.

Future

One of the advantages that companies entering the gaming world are finding is that it is a «recession-proof» industry, according to Brazil-based consultancy Newzoo.

Some of the factors that the firm finds for those who invest in the segment are: Solid monetization, with players willing to acquire Premium content at full price, subscriptions, or free titles, or all these models combined. Likewise, the good reception of free-to-play, such as mobile titles with advertising or games in the cloud. And finally, everyone agrees that the social elements will continue to rise since all users are eager to share their expertise, make live broadcasts and play in a community way.